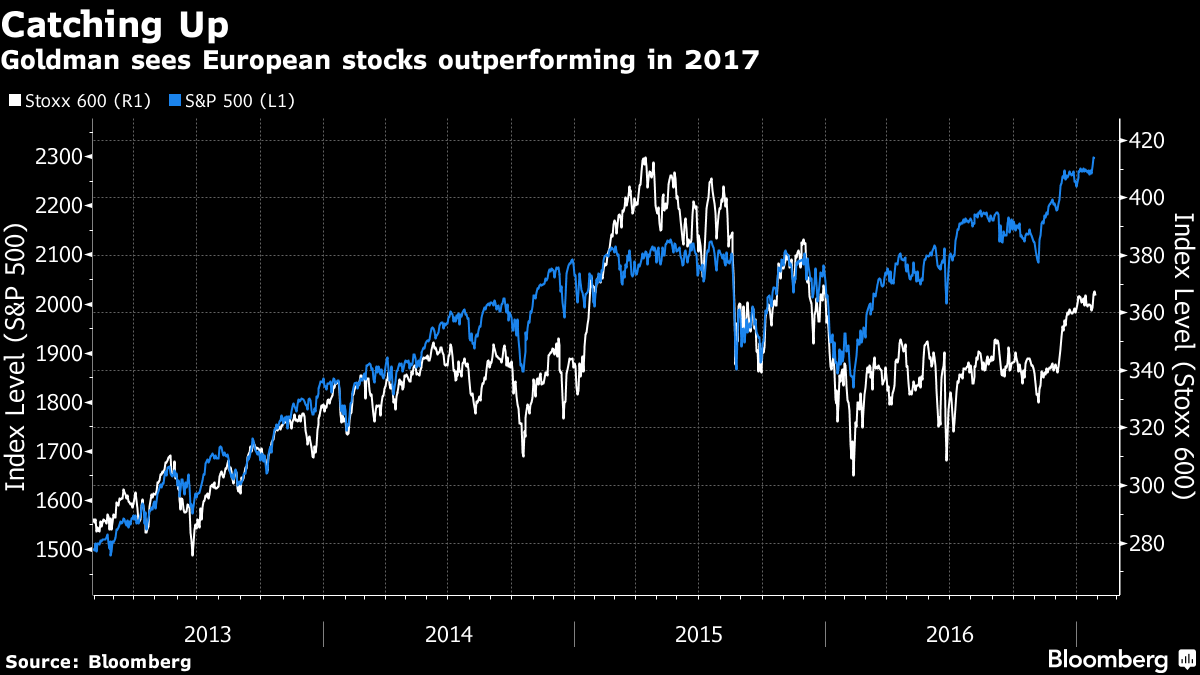

European stocks are projected to beat US stocks this year, according to an article in Bloomberg yesterday quoting Goldman Sachs. From the article:

European equities will catch up to their U.S. peers once the uncertainty surrounding near-term elections is lifted, according to Goldman Sachs Group Inc.

The Stoxx Europe 600 Index will return 8 percent including dividends by end-2017, boosted by a weak euro, strong global growth and recovered oil prices, according to Christian Mueller-Glissmann, managing director of portfolio strategy and asset allocation at Goldman Sachs in London. The S&P 500 Index will return 4 percent, Goldman predicts, as optimism about economic growth in the U.S. fades and mutes the stock rally. The return forecasts are in local currencies.

“U.S. equities will net still be up, but less than Europe, which is catching up,” Mueller-Glissmann said in an interview at Goldman’s offices in London. “What is generating optimism in the U.S. right now are the tax cuts and fiscal spending, and both of those might be watered down over the course of the year. We have a pretty good set-up for Europe to do well.

Click to enlarge

Source: Goldman: Europe’s Stocks to Return Double U.S. Equities in 2017, Bloomberg, Jan 29, 2017

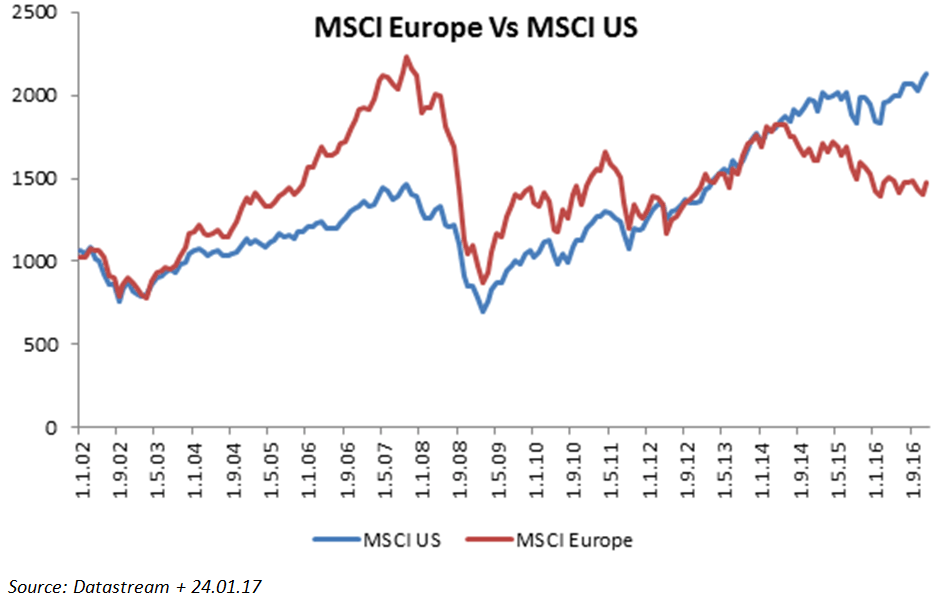

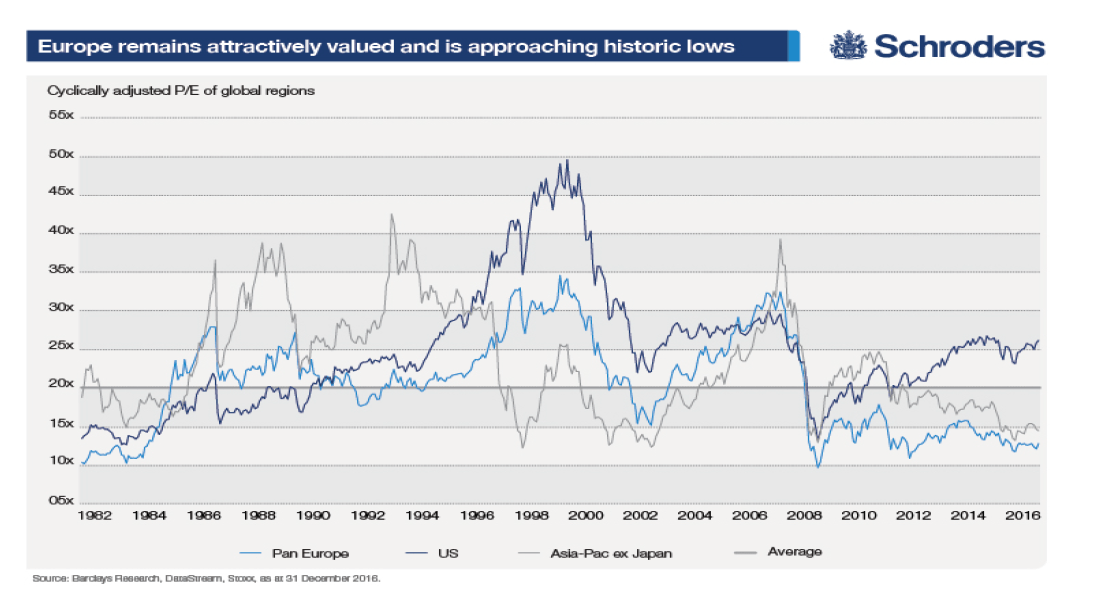

After years of lagging their American peers, firms in Europe are in a better shape now and have better potential to deliver higher returns. Recently I posted the following chart from Schroder’s:

Click to enlarge

Investors looking to diversify and gain exposure to European equities may want to consider adding high-quality stocks from the continent.In addition, the Callan Periodic Table of Investment Returns shows that no one country is the top performer consistently.

Update:

Source: Europe best placed for cyclical upswing, Money Observer