Politics plays an integral part of our lives everyday.However when it comes to investing, we are better off ignoring politics in making our investment decisions. Though politics is a necessary evil in all countries, markets are much bigger than politics and generally markets can overcome political shocks and surprises. Political events may create short-term volatility in the markets as investors make knee-jerk reactions in panic mode.But eventually markets stabilize and continue their upward or downward trend based on other factors that are more important. This year proved why investors should ignore all the political noises to be successful.

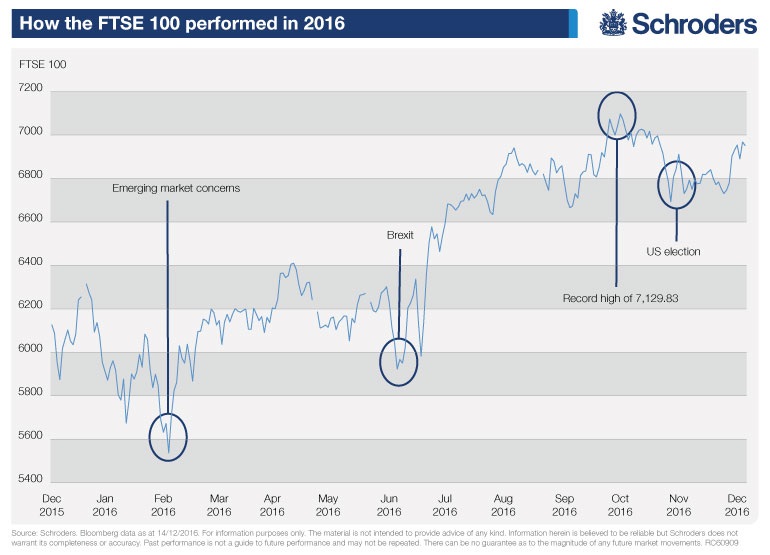

Two major political events that shaped year 2016 were the UK Brexit vote in June and the election of President-elect Trump in the US elections in November. Equity markets worldwide fell following Brexit but then recovered strongly. Fears of major collapse in European markets especially in the British market were proven false.

Similar to the Brexit drama in Europe, the US elections was another shocker. Almost all the US media, political pundits and experts were sure that the democratic candidate was a sure winner to the Whitehouse. Then the American voters delivered a shock vote that surprised even the Republicans. Again predictions of market meltdown were quickly erased and markets soared to record highs surprising experts for another time.

The performance of equity markets due to the Brexit decision and the surprise outcome of the US elections shows that investors should focus on the long-term and ignore politics. Whether it is the US, EU or UK, political drama is good for entertainment but not for investments.

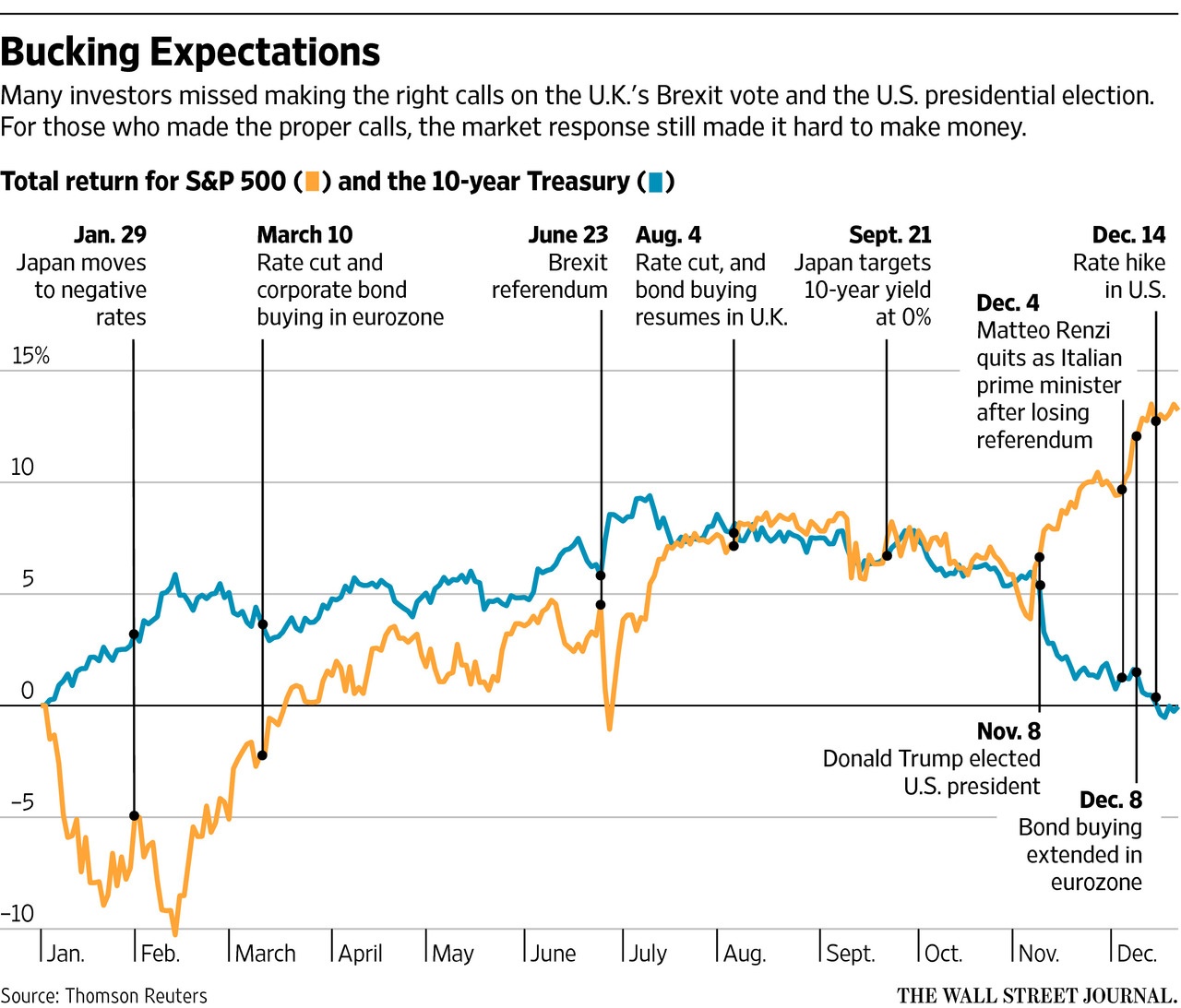

From a recent journal article by James Mackintosh:

There were just two problems with trading politics in 2016: the politics and the trading.

The year brought two of the biggest political upsets in decades with the surprise votes for Brexit and Donald Trump, but investors mostly missed both. Worse, those who did call the votes right might still have lost money because of the surprising market response.

Even an investor with advance knowledge of the electoral outcomes would have struggled, said Mark Haefele, global chief investment officer of UBS Wealth Management. “If you had said during 2016 the U.K.’s going to leave the European Union and Donald Trump’s going to be elected president and the stock market’s going to love it, I think few people would have expected that,” he said.

“Brexit and Trump were seen as two very similar outcomes,” said Mr. Lyon. “If you had tried to position for Trump to be like Brexit, you would have been carried out; the Trump [market] reaction was the exact mirror image.”

Source: Skull and Crossbones Alert: Don’t Mix Politics and Trading, WSJ, Dec 22, 2016

The chart below shows how the FTSE 100 performed in 2016:

Source: What next for the FTSE 100?, Schroders

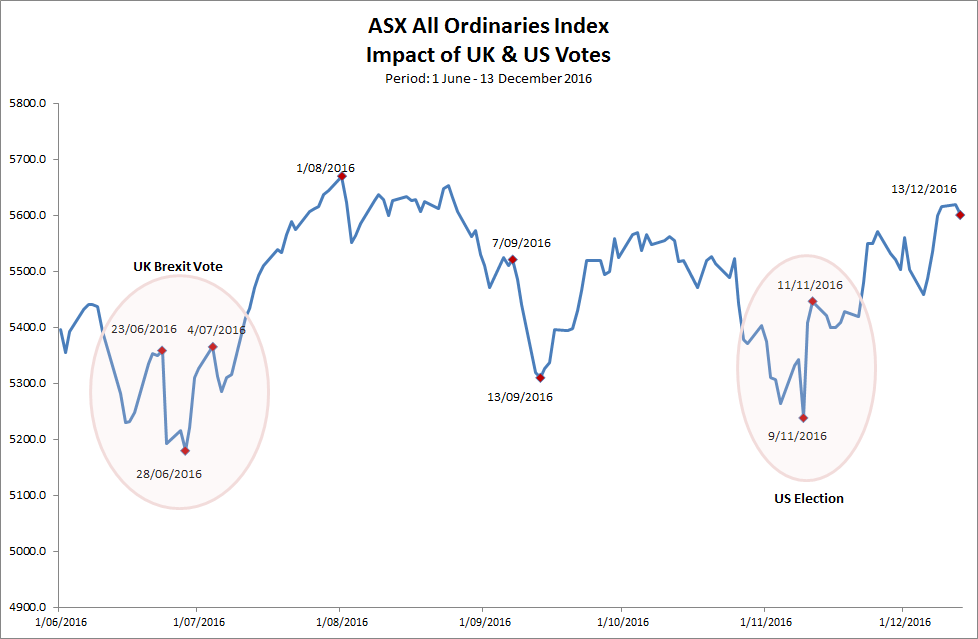

In the third example below, the Australian benchmark index also performed well despite the two major political events in 2016:

Click to enlarge

Source: APW Insight – A Year in Review 2016, APW Partners

An excerpt from the APW article:

To both these significant events, we can undoubtedly borrow the mentality of Chinese premier Zhou Enlai in 1972 in saying the impact of the French Revolution was ‘too early to say’. The ultimate market impact of both these events will take years, if not decades or longer to be truly understood.

To summarize, investors must focus on their long-term investment goal than other factors such as politics, predictions by so-called experts, media, etc.

Also checkout:

- Why politics and investing don’t mix, Barry Ritholtz’s The Big Picture

- Your Money: Don’t mix politics and investing, The Irish Times

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- iShares MSCI Australia Index Fund (EWA)

- iShares MSCI United Kingdom Index (EWU)

Disclosure: No Positions