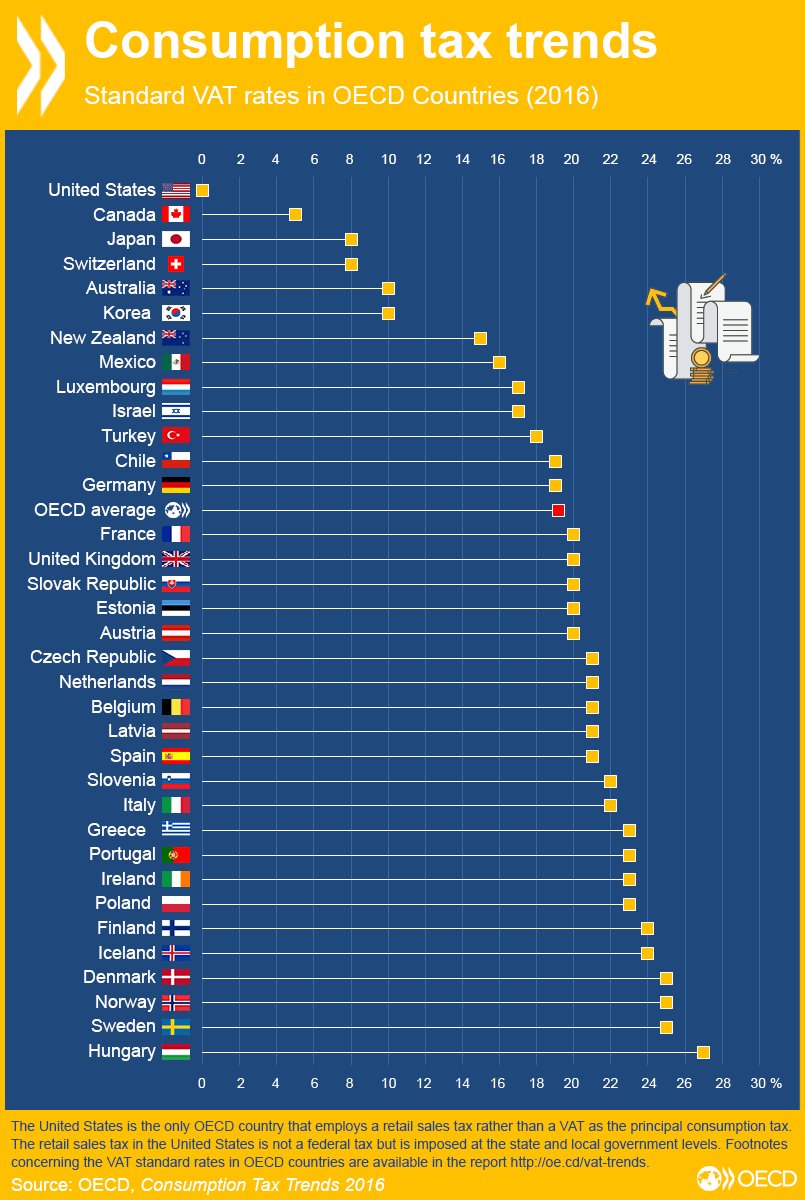

Consumption tax rate, called as Value-Added tax(VAT) or Sales Tax, varies across OECD member countries. The average rate .among all OECD countries is 19.2%. The average rate for OECD countries that are members of the EU is even higher at 21.7%.

The chart below shows the consumption tax rates between OCED countries:

Click to enlarge

Source: OECD

The consumption tax rate is the lowest in the US and highest in Hungary.Scandinavian countries have the highest rates among Western Europe.