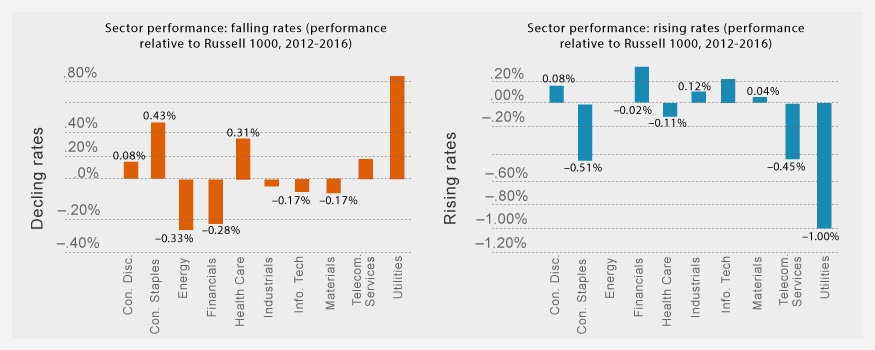

Some sectors of the equity market perform when interest rates rise and vice versa. Based on an analysis of historical data, a report by Fidelity Investments notes that high-yielding sectors like utilities and consumer staples under-perform when rates rise. On the other hand, financials outperform the overall market when rates increase.

Click to enlarge

Source: A new era for dividend stocks, Fidelity

It should be noted that other factors like valuation, dividend payout ratio, dividend paid or not, etc. have to considered in addition to interest rates before making investment decisions.