Investors looking for dividend stocks should consider companies from New Zealand. Some of the reasons why New Zealand dividend equities are attractive for income are listed below:

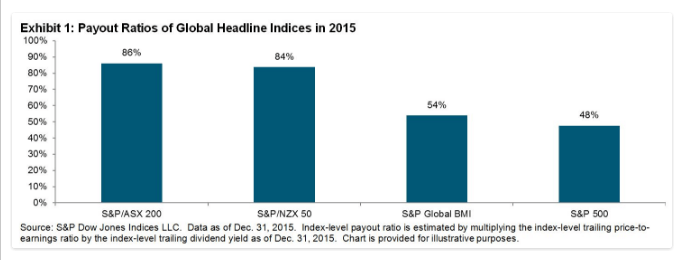

New Zealand firms have one of the highest dividend payout ratios in the world. For example, in 2015 the payout ratio was 84% of earnings. This vastly exceeds the 48% payout ratio in the US and 54% globally.

Click to enlarge

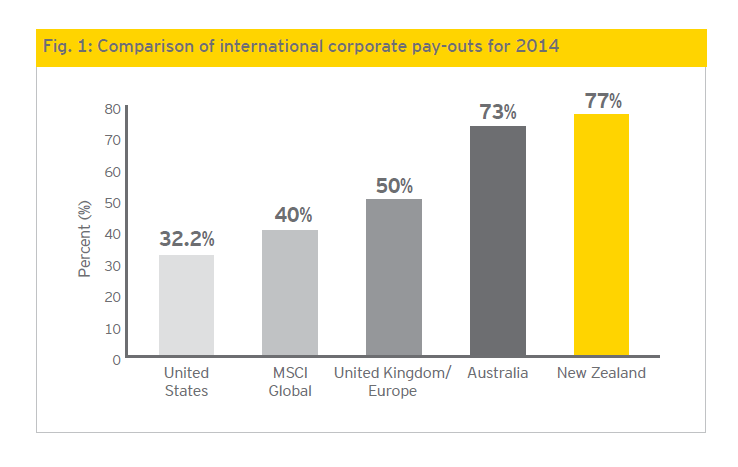

New Zealand tops in the payout ratio across markets for 2014 shown below:

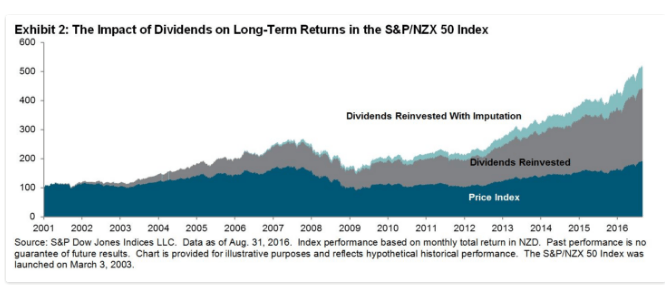

One of the main reasons for the high payout ratio is due to a unique tax policy called the dividend imputation. This simply means it prevents double taxation of dividends – once at the company-level and next at the individual level – by giving tax credits to investors on dividends received.

The total long-term return of stocks (which included price appreciation and dividend reinvestment) is boosted greatly due to the investor-friendly dividend policy as shown in the chart below:

Click to enlarge

Because New Zealand is a small country with opportunities for growth limited for companies, many prefer to distribute their profits to investors. Because investors benefit from the favorable tax regime they are satisfied with companies distributing their earnings as opposed to wasting them on some wasteful projects.

How to invest in New Zealand stocks?

It is a shame that none of the major Kiwi firms trade on the US exchanges. However over 35 stocks trading on the OTC markets some options for US investors to invest directly.

So the simplest and easiest way to gain access to New Zealand is via the iShares MSCI New Zealand Capped ETF (ENZL). It holds 27 companies and the distribution yield is 2.72%.

Sources:

- Gaining Insight Into New Zealand’s Dividends, S&P Indexology

- Imputation and the New Zealand Dividend Psyche, Sept 2015, E&Y

Disclosure: No Positions