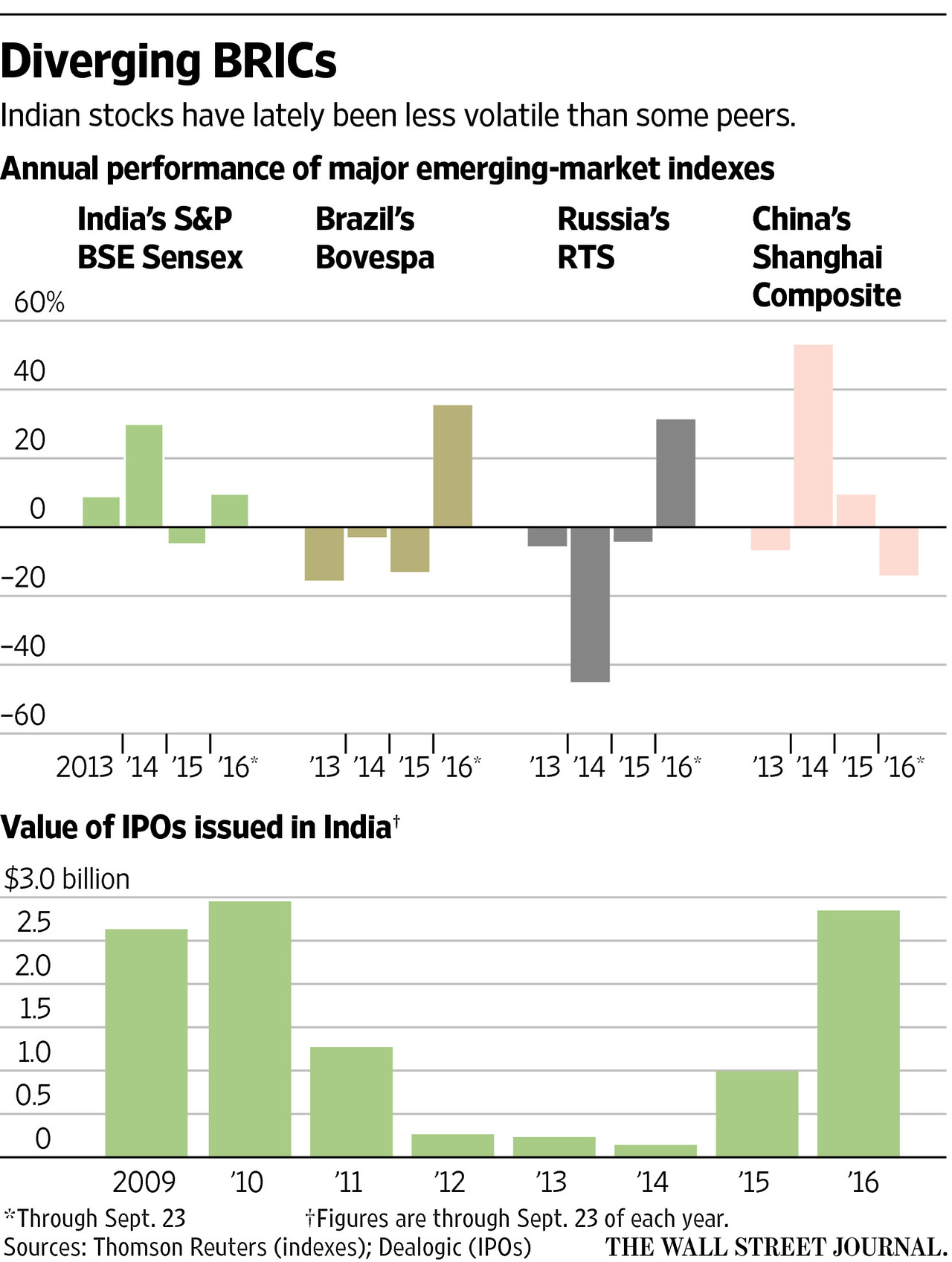

Indian stocks have outperformed so far this year relative to Brazil, Russia and China. The benchmark S&P BSE Sensex is up by 8.3% this year as of Sept 25th. From a journal article on Indian stocks today:

Click to enlarge

Once lumped in with a block of emerging markets termed the BRICs—Brazil, Russia, India and China—India has lately diverged from the group, in part thanks to its heavy weighting toward domestic consumption. By contrast, Brazil and Russia have been hit by the slump in global commodity prices, while China’s exports have suffered from a slowdown in world trade.

Over the past three years, Indian shares have gained a cumulative 44%, beating the 37.5% rise in China’s Shanghai Composite, and well ahead of the 8% rise in Brazilian shares and the 31% drop in Russia.

India’s inflation has eased, its trade deficit has narrowed thanks to lower oil prices, and the rupee has been relatively stable against the U.S. dollar this year. Recent good monsoon rains could help boost agricultural productivity, and thus consumer demand from rural India.

Source: Indian Stocks Stand Out From the Crowd, WSJ, 9/26/16

Here are few facts about India and Indian stocks:

- Over 5,500 companies trade on the Bombay Stock Exchange. However of the major 200 firms only 100 are freely traded and the rest are largely owned by founders.

- The Sensex P/E ratio is 18.5 compared to long-run average P/E of 15.5. So Indian stocks are not cheap.

- With a projected GDP of $10.0 Trillion, India is poised to become the third-largest economy by 2030.

- India’s Forex reserves are at a record $356 billion.

- The number smartphones in the country has doubled in recent years to over 81 million units.

- Due to high number of listings on the BSE, India is an excellent hunting ground for stock pickers.

Source: Above WSJ article and Aberdeen

India ADRs:

The complete list of Indian ADRs trading on the US markets can be found here.

ETFS: The Complete List of India ETFs and ETNs Trading on the US Markets