In most developed countries interest rates offered by banks on savings accounts these days are pretty much next to nothing. Germany is no exception. Not only is the interest rate zero some German banks have started charging depositors with high cash balances in their accounts. Most savers around the world including Germans would agree paying a bank to save money defines logic and does not make sense.

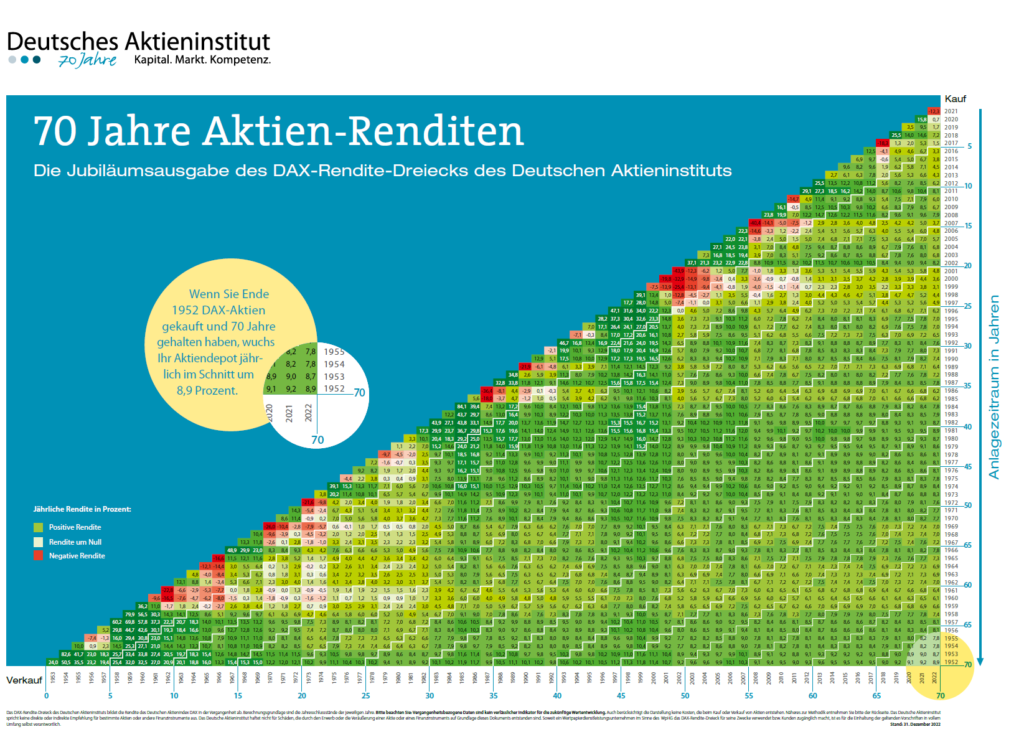

Germans are big savers and not big spenders like Americans for example. Germany’s export-based economy as opposed to a consumption-driven economy is proof of this. Traditionally Germans save most of their savings in banks, life insurance policies, etc and not invest in stocks. I have written a few articles before on Germans’ low participation in the stock market and savings which you can find here, here, here and here.

Unlike Americans and others Germans are not big believers in the convenience of credit cards. Most prefer cash to cards. Hence stock ownership and credit card penetration rates are low in Germany.

A recent journal article discussed that more and more Germans are stashing their cash at home in safes and negative interest rates has turned the world of savers upside down.

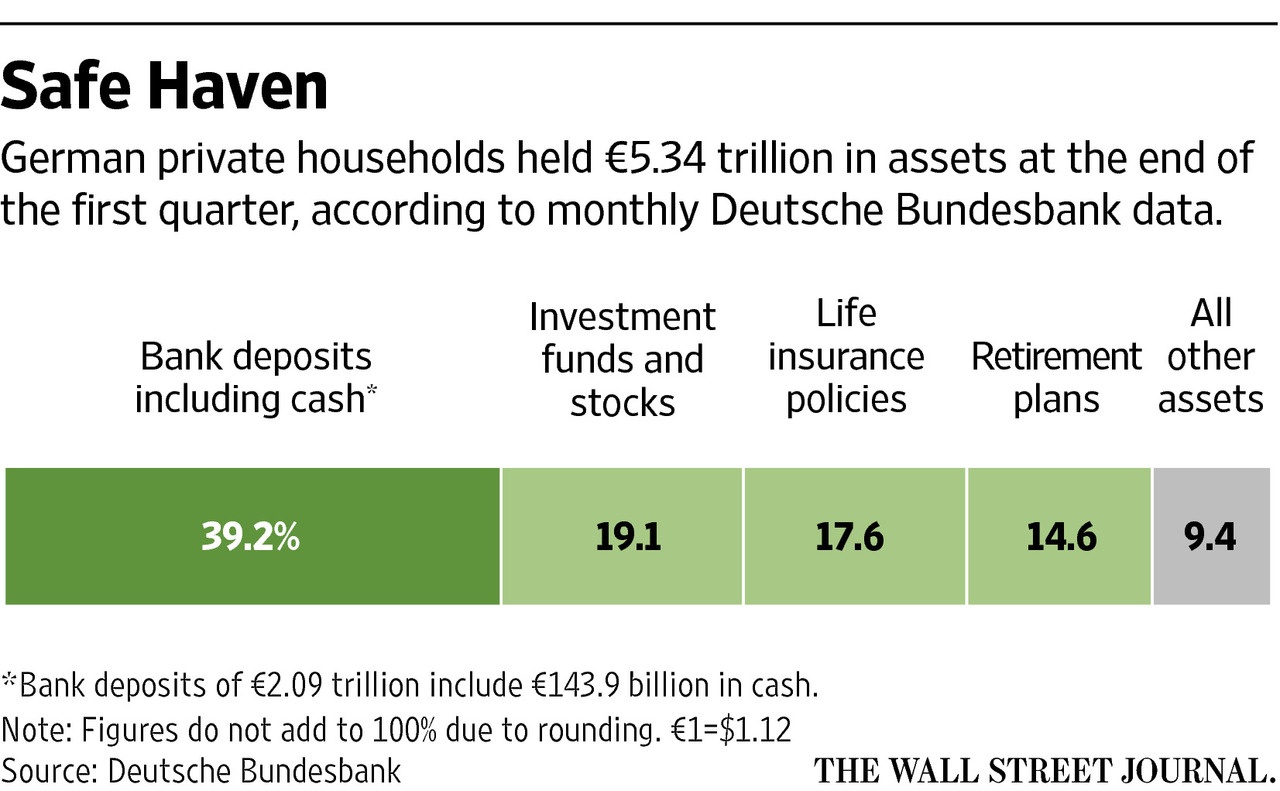

The Composition of Assets of German Households from the article:

Click to enlarge

Here is an excerpt from the piece:

In a country where few people buy stocks, the possibility of having to pay fees on deposits has turned savers’ world—and their piggy banks—upside down.

“The moment the bank tells me I have to pay interest on my deposit I’ll take my €50,000 or whatever it is and put it under my pillow, or buy a safe and stick the money inside,” saidDagmar Metzger, a 53-year-old entrepreneur in Munich.

Ms. Metzger, a game hunter, said she would also consider squirreling cash away in her gun cabinet, which has solid locks.

Paying to save is “preposterous,” said Marlene Marek, 58, owner of a Frankfurt bistro. “I would rather withdraw my money and stash it at home, or keep it in a safe-deposit box at a bank.”

Many Germans have a similar idea, creating waiting lists for safe-deposit boxes in some big cities. So a growing number of Germans prefer self-sufficiency.

“When you put money in a safe-deposit box, everyone notices, and you’re paying fees,” said Mr. Wiese, the Hamburg retiree, who said his new safe is roughly twice the size of a hotel safe.

Source: German Savers Lose Faith in Banks, Stash Cash at Home, WSJ, Sept 2, 2016