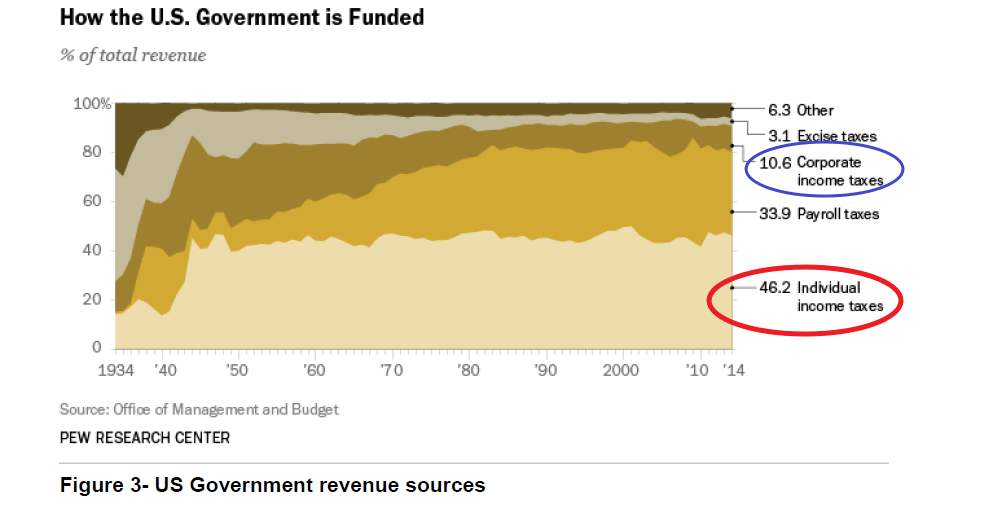

Tax avoidance by large US firms is a major issue that gets very little attention in the media. Heavy lobbying (lobbying is legal, bribing is illegal) by these firms ensures that the regulators and politicians perpetually turns a blind eye to the issue. Every year billions of dollars in taxes owed never reach the state’s coffers as corporations use all legally available options to avoid them. Since billions are unpaid the state collects these amounts from individuals to compensate for the loss. Hence individuals pay a much higher rate in taxes to the government than corporations. Some of the tax evasion strategies that are perfectly legal have funny names like Double Irish, Dutch Sandwich, etc.

Here are three interesting charts and key points from a report titled “Broken at the Top ” by Oxfam America:

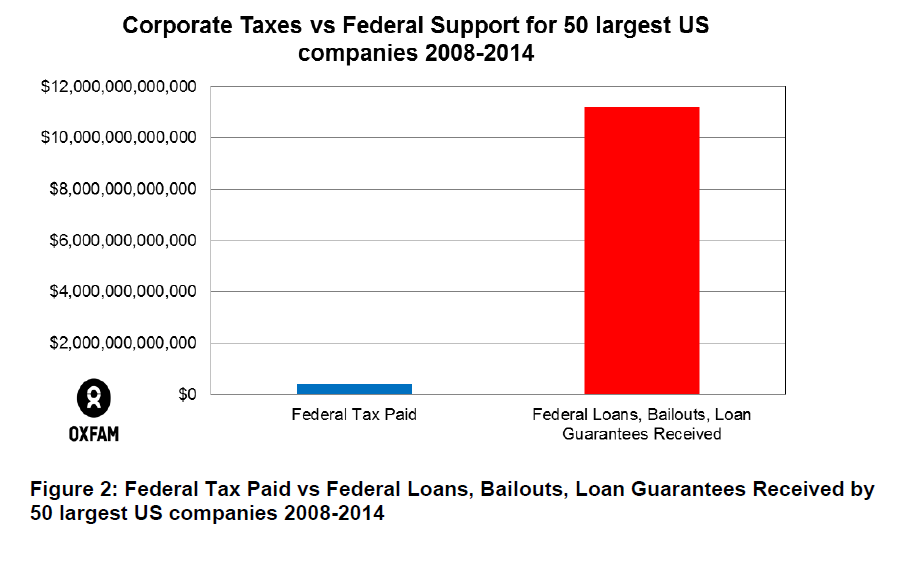

From 2008 – 2014 the 50 largest US companies collectively received $27 in federal loans, loan guarantees and bailouts for every $1 they paid in federal taxes.

From 2008 – 2014 these 50 companies spent approximately$2.6 billion on lobbying while receiving nearly $11.2 trillion in federal loans, loan guarantees and bailouts.7

Even as these 50 companies earned nearly $4 trillion in profits globally from 2008 –2014, they used offshore tax havens to lower their effective overall tax rate to just 26.5%8, well below the statutory rate of 35% and even below average levels paid in other developed countries. Only 5 of 50 companies paid the full 35% corporate tax rate.

These companies relied on an opaque and secretive network of more than 1600 disclosed subsidiaries in tax havens to stash about $1.4 trillion offshore. In addition to the 1600 known subsidiaries, the companies may have failed to disclose thousands of additional subsidiaries to the Securities and Exchange Commission because of weak reporting requirements.

Their lobbying appears to have offered an incredible return on investment. For every $1 spent on lobbying, these 50 companies collectively received $130 in tax breaks and more than $4,000 in federal loans, loan guarantees and bailouts.

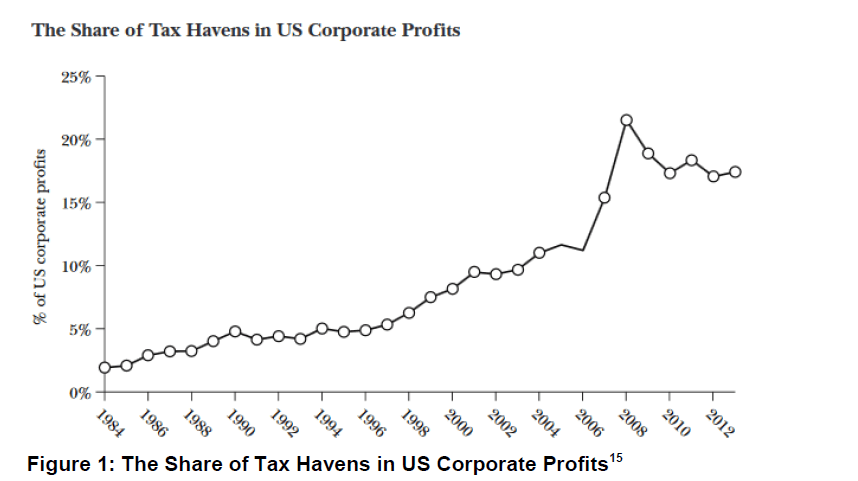

a) Share of tax Haven in US Corporate Profits:

Click to enlarge

b) Corporate taxes vs Federal Support:

c) Sources of Revenue for US government:

Source: Broken at the Top – How America’s dysfunctional tax system costs billions in corporate tax dodging, Oxfam America