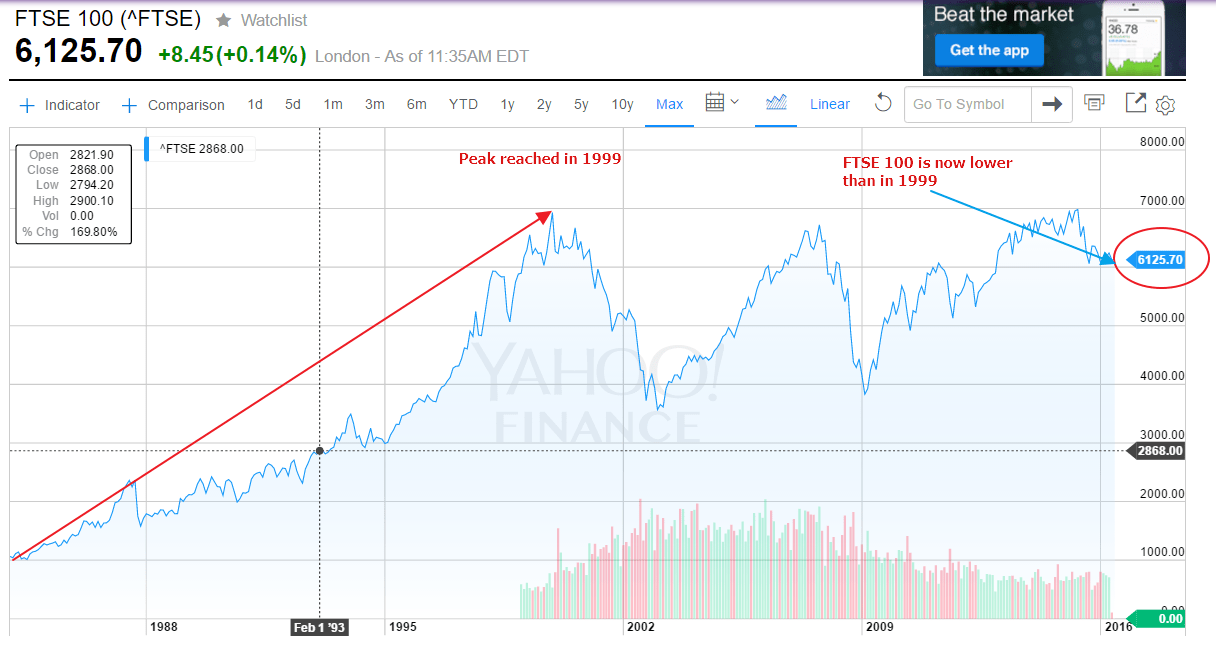

FTSE 100, the benchmark index of the UK equity market peaked at 6,930 in December, 1999. After 17 years, the index closed at 6,125 yesterday, which is lower than where it was in 1999 – when the dot con mania was at the highest level. Does that mean the index has gone nowhere since 1999? Or put another way does this mean investors in UK stocks lost money over such a long period of time?

Well. The FTSE 100 being lower now than in 1999 is true as the chart shows below:

Click to enlarge

Source: Yahoo Finance

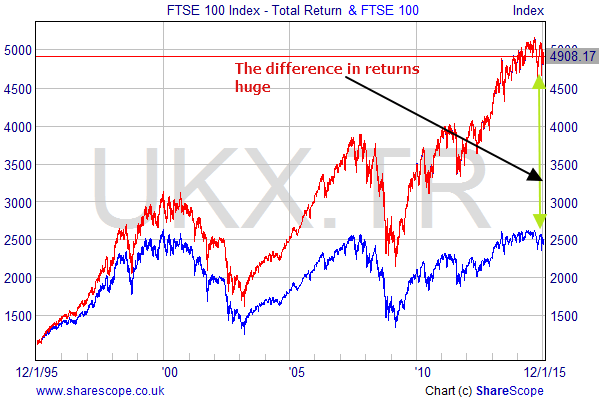

However this does not tell the whole story in terms of investor returns. This is because the FTSE is a price index and measures only the price appreciation of the components. The return of the FTSE 100 does NOT include dividends. So if dividends are included in the index, similar to the DAX index, then the return is much higher and the index now is far higher than where it is now based on price alone. So statements like “The FTSE 1oo has gone nowhere since 1999” are misleading to investors.

The correct way to measure the performance of the FTSE 100 over long periods is to use the FTSE 100 Total Return Index which includes dividends reinvested. Using this index, we can see investors did not lose money since 1999. The chart shows the difference in returns between the FTSE 100 and the FTSE 100 Total Return Index:

Click to enlarge

Source: Sharescope

Since UK firms especially those in the FTSE 100 pay dividends it just makes sense to include those in the return calculation. Moreover dividends are an integral part of total returns. Including dividend return is more important in countries like the UK where dividend yields are much higher at around 3.98% which is nearly double that of the US market.

In summary, investors have to dig deeper and understand what an index is comprised of and how the return is measured before coming to any conclusions. Simply looking at the headlines that media report or not including dividends in performance calculations is not a wise strategy.

Related ETF:

- iShares MSCI United Kingdom ETF (EWU)

Disclosure: No Positions

First!