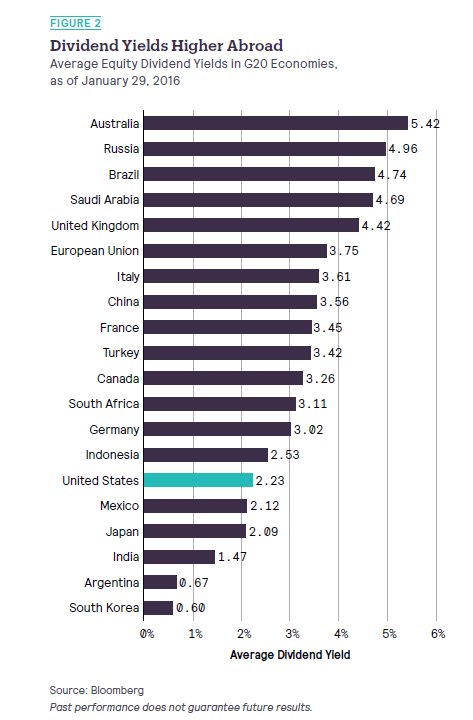

Dividend yields are generally higher overseas relative to the U.S. market. In the U.S. investors and management tend to prefer high share prices while in other developed economies investors prefer both moderate price appreciation and high dividend payments.

The following chart shows the Average Stock Dividend Yields in G-20 countries:

Click to enlarge

Source: The Dividend Signal Uncovering Global Growth Opportunities, Salient Partners

Here a few points to remember when investing in foreign stocks for dividends:

- Other developed countries such as France, Germany, UK, etc. have higher average dividend yields than the U.S.

- Even just venturing Canada one can earn more than 3% dividends compared to the average of around 2% to US stocks.

- South Korea, India and Japan are low dividend countries and hence income investors can avoid dividend stocks in those countries.

- Investing in foreign stocks for dividend involves dividend withholding taxes.So investors should be mindful of the effects of this tax and try to avoid it if possible.