Investing in emerging markets involves more risk than developed markets. Among the major emerging markets, the Chinese equity market is considered by some investors as one huge casino. This year the Shanghai Composite Composite Index is down about 19% year-to-date. Last year Chinese stocks had a tumultuous year to say the least.

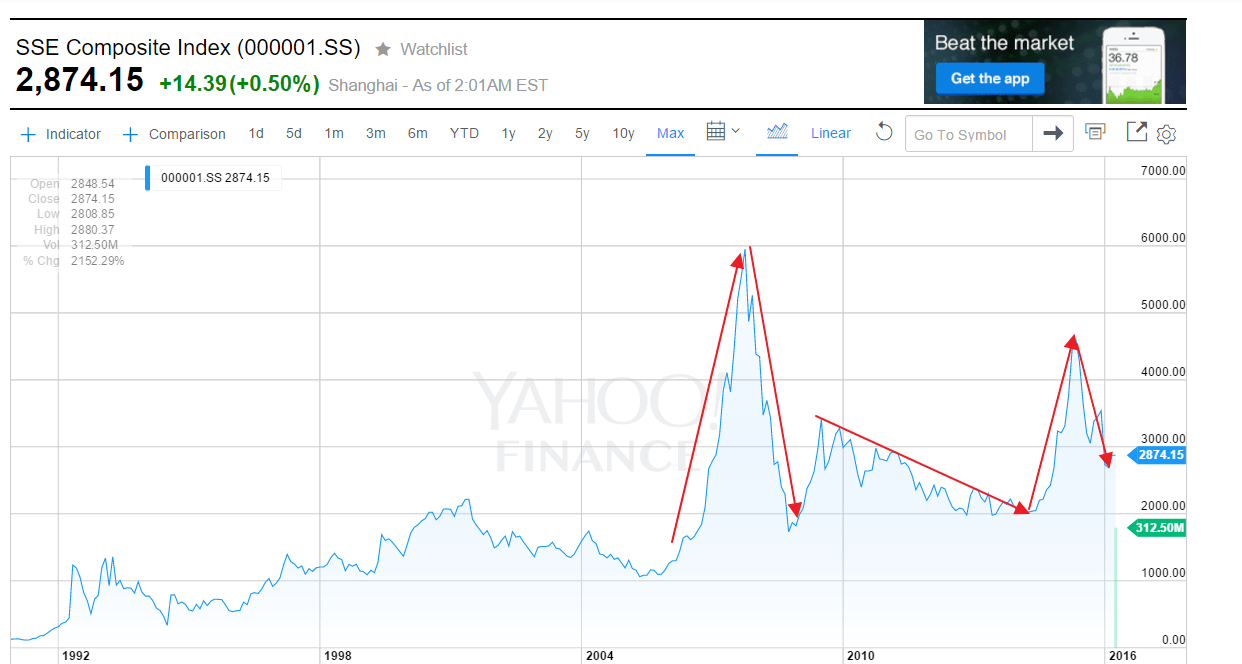

The following chart shows the long-term return of the Shanghai Composite Composite Index with all the ups and downs over the years:

Source: Yahoo Finance

Though volatility in emerging markets is expected, the China equity market is a class of its own. Unlike other emerging markets, the Chinese market is dominated by retail investors who seem to be extremely impatient to get wealthy. Here is an interesting cartoon depicting the Chinese investors and the stock market:

Click to enlarge

Credit: Nichols Cartoons

In China, people spend their past time watching the stock market. Brokerage offices have giant monitors with theater like settings so that investors can sit and watch the market. Senior citizens especially seem to spend their past time even their whole day in these places.

An excerpt from a recent BBC article:

Making friends and money

Last year I went to a brokerage house in Shanghai, the sort of stock exchange shop floor. All around me were people of a certain age, all busily trying to fill the family coffers.

They arrive in the mornings with their flasks of green tea and spend the entire day watching the red and green flashing lights and making bold decisions about their future. It’s also a venue for socialising: people are making friends and, of course, passing on tips of the trade.

This isn’t just an interesting phenomenon – it does have implications on the market.

Large numbers of small traders can move in unpredictable ways, which can add to the swings we’ve seen in the last week. Experts call it “herd behaviour”.

Source: China’s stock market and the rise of the ‘pyjama traders’, The BBC

Some photos of retail investors in China:

Note: In China, red means stocks are up and green means they are down.

Sources: Time, BBC

I do not know the answer to my title question. But one thing is clear. Investing in China is not the for the faint of heart. In addition to high state invention in the functioning of markets, extremely high retail participation makes volatility even higher since retail investors are the usually the first to bail out when markets decline and tend to pile on to equities when markets keep rising.