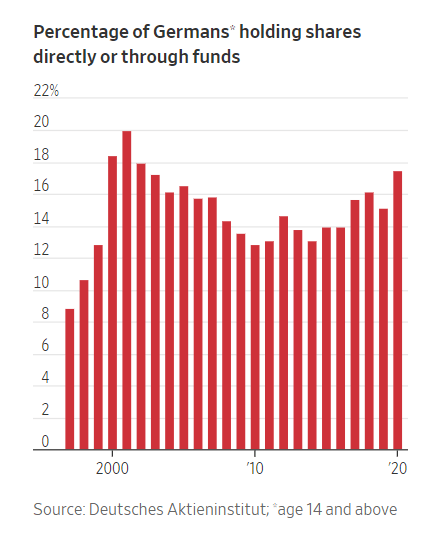

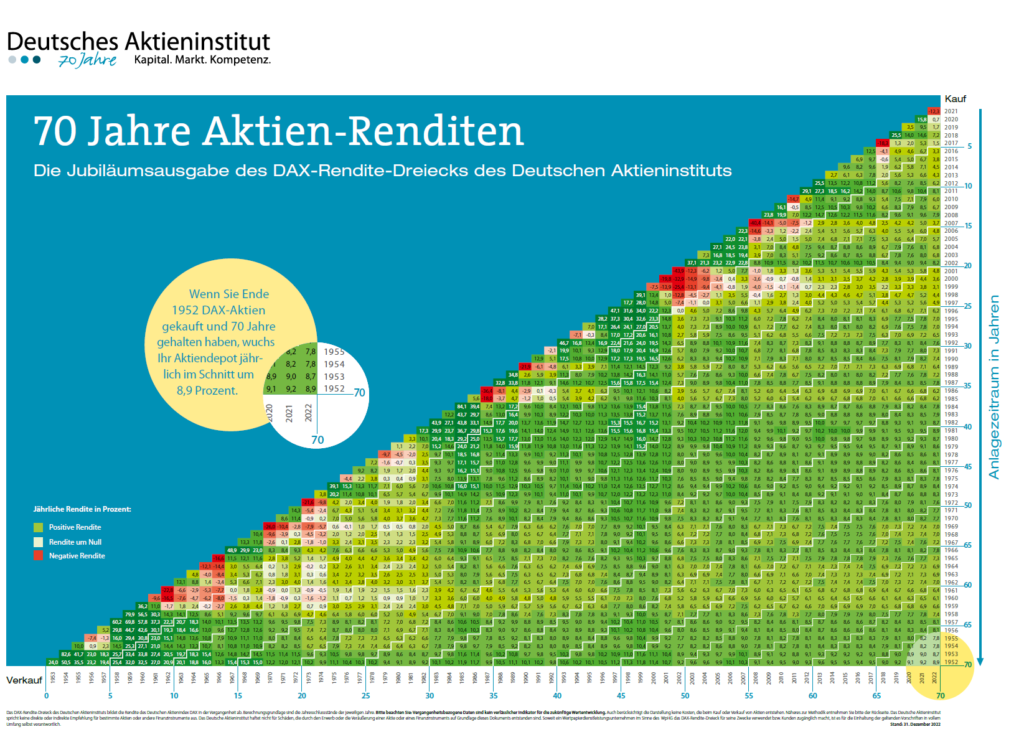

The German economy is the largest in Europe and the DAX Index is one of the top performing indices in the world over the long term. However despite the excellent returns of German stocks over many years, Germans are highly conservative and their participation in the equity market is very low relative to other developed countries. According to an article I wrote back in 2013, Germany’s stock market participation rate was about 9%.

A recent article in the Journal noted that Germans are becoming less risk averse as they seek higher returns due to ultra-low interest rates offered by banks. From the article:

FRANKFURT—Europe’s long experiment with ultralow interest rates is prompting unexpected changes in Germany’s deeply entrenched culture of saving.

For decades, Germans have faithfully parked much of their personal wealth in old-fashioned savings institutions while shunning home buying and its associated debt. Those habits were cemented by the shock of hyperinflation in the 1920s and supported by a strong postwar economy and an inflation-averse central bank that kept returns predictable.

But since the financial crisis hit and the European Central Bank sliced interest rates for countries sharing the euro to about zero, Germany’s saving formula has collapsed—and savers are reacting by taking on more risk.

“Permanent low interest rates changed my wife and me from savers into investors,” saidThomas Krauss, a 55-year-old marketing expert from Düsseldorf who used to contribute to a retirement-savings plan.

Old-style pension plans “yielded almost zero,” so during the financial crisis, Mr. Krauss opted to invest in index funds. His wife of 30 years “felt uneasy about changing from the familiar investment mix of insurance and saving deposits,” but they switched about six years ago and have since outperformed traditional savings returns, he said. The recent downturn in the stock markets doesn’t make Mr. Krauss nervous. “The shift was a strategic decision and independent of short-term developments,” he said.

Germans have among the world’s highest household rates of saving, according to the Organization for Economic Cooperation and Development. Only 14% of Germans invest in equities, compared with 56% in the U.S. and 23% in Britain, according to finance-industry association Deutsches Aktieninstitut. (emphasis added)

Source: Germany’s Cautious Savers Find New Taste for Risk, WSJ, Jan 25, 2016

Unlike Germans, Americans are big risk takers as evidenced by the participation rate in equity markets. One of the reason for the high participation rate in the US is many of the retirement products and savings for retirement are channeled towards equities as opposed to other avenues. In addition, similar to Germany, by keeping interest rates at ultra low levels, the Fed and the state is also indirectly nudging people towards risky investments. Another factor is that tax policies favor equity investments over banks and other risk-free investments. For instance, interest earned on bank deposits is taxed at the higher ordinary income rates while qualified dividends and long-term capital gains are taxed at lower rates. So indirectly Americans are encouraged to put their hard-earned money into equities.

Here is a excerpt from a 2010 article in Bloomberg BusinessWeek:

In Düsseldorf, 44-year-old Reinhard Strueven feels the same way. His retirement plan consists of a pension, a bank account, an investment apartment—and no equities. Max Ruehle, 30, a furniture store owner in Wiesbaden who lost €30,000 ($38,424) on stocks from 2001 to 2005, also stashes his cash in the bank. “If I want to play with money, then I go to a casino,” he says.

When it comes to investing, many Germans are uncomfortable taking risks. Only 6percent directly owned stocks in the first half of 2010, according to Deutsches Aktieninstitut (DAI), a shareholder lobby association, whereas stock ownership for the French is 15percent and 10 percent for the Britons. Only 9.4 percent of the German population owned shares of mutual funds in the first half of 2010, vs. 44percent of households in the U.S. in 2009. At the end of 2009 stock investments represented 3.9percent of the financial assets of German households, the lowest level since at least 1991. Instead of stocks, Germans have 28percent of their assets invested in life insurance products, 18percent in cash and short-term deposits, and 20percent in bank deposits.

Some of Germans’ reluctance to sink their money into equities is a result of the structure of the retail banking system, which is dominated by locally owned savings banks and cooperative lenders. As a result, investment advice tends to be more conservative than in other Western economies. But it’s the 2003 implosion of the Neuer Markt—a technology-focused exchange that had launched four years before—that truly frightened people away from the stock market. There was also a series of money-losing IPOs: In 1996 the Kohl government privatized Deutsche Telekom, and shares surged from €14.57 in the 1996 public offering to €102.9 in March 2000, before the dot-com bust shattered the price—and Germany’s fragile investing confidence along with it. Today, Deutsche Telekom still trades below its IPO value. Shares of Deutsche Post, Europe’s biggest mail carrier, followed a similar pattern, selling for €21 each in a 2000 IPO. They’re now worth little more than half that.

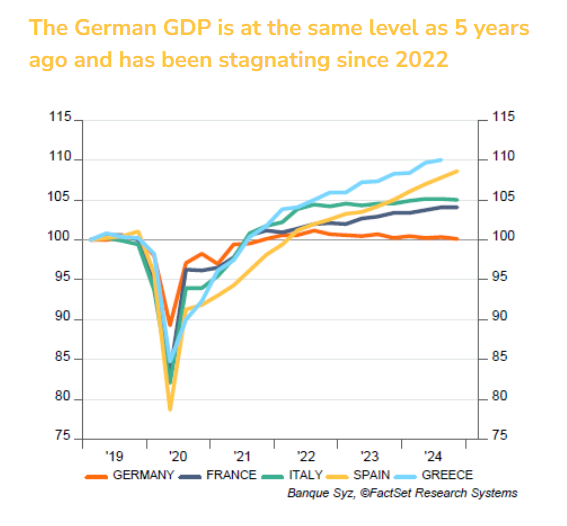

Since German reunification in October 1990, the DAX has more than quadrupled in value, confounding skeptics who said the costs of subsidizing East Germany’s crippled economy would cause years of stagnation. So far this year, German stocks have performed better than those in most developed nations. Still, the Germans aren’t going for it. “The thinking of the broad population,” says DAI director Franz-Josef Leven, “is that shares are here to lose money.”

Source: Why Don’t Germans Invest in Stocks?, Sept 2010, 2010, Bloomberg BusinessWeek

So as the DAX acts like an emerging market index these days, ordinary Germans probably are not affected by it. However that is not the case in the U.S.A Dow plunge of 500 points creates worry and fear among even ordinary retail investors as a high percentage of their assets including funds saved for retirement, funds saved for kids college tuition, money saved for future medical expenses in some cases, etc. are all invested in the stock market. So a regular correction of 5% of 10% in the markets creates panic and is widely discussed about by investors and the media alike.

Update (5/6/21):

Click to enlarge

Percentage of Germans owning stocks either directly or through funds 2021:

Source: Negative Rates Push Cautious Germans Into the Stock Market, WSJ, May 4, 2021

Also see:

Related:

- German – ‘Thriftiness is sexy’: exhibition examines Germans’ mania for saving, The Guardian

- East Germans still invest very less in the stock market, Research Paper at University of California, Berkeley