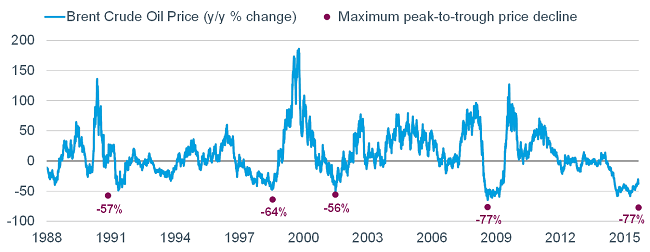

Crude oil prices have declined dramatically in the past year or so. Brent crude closed at $28.49 today.

According to an article by Liz Ann Sonders of Charles Schwab, crude oil declines have reached historical extremes. Oil prices have plunged by 77% from the recent peak.

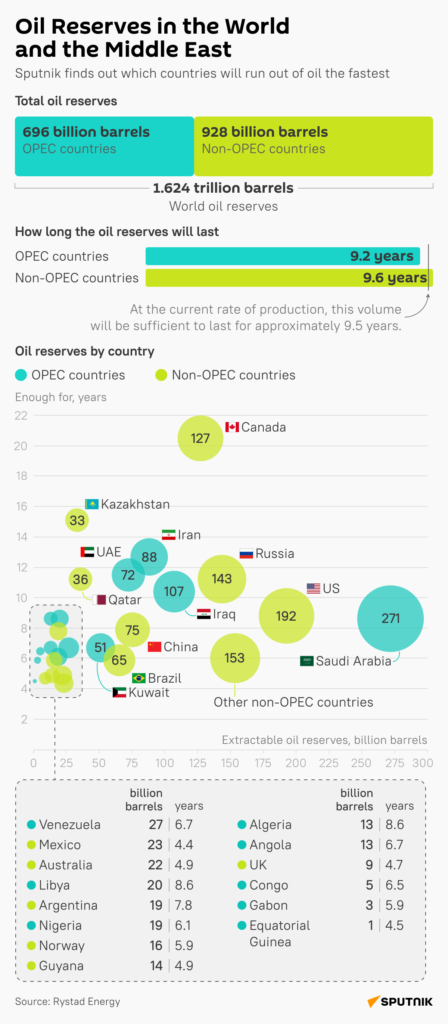

Click to enlarge

From the article:

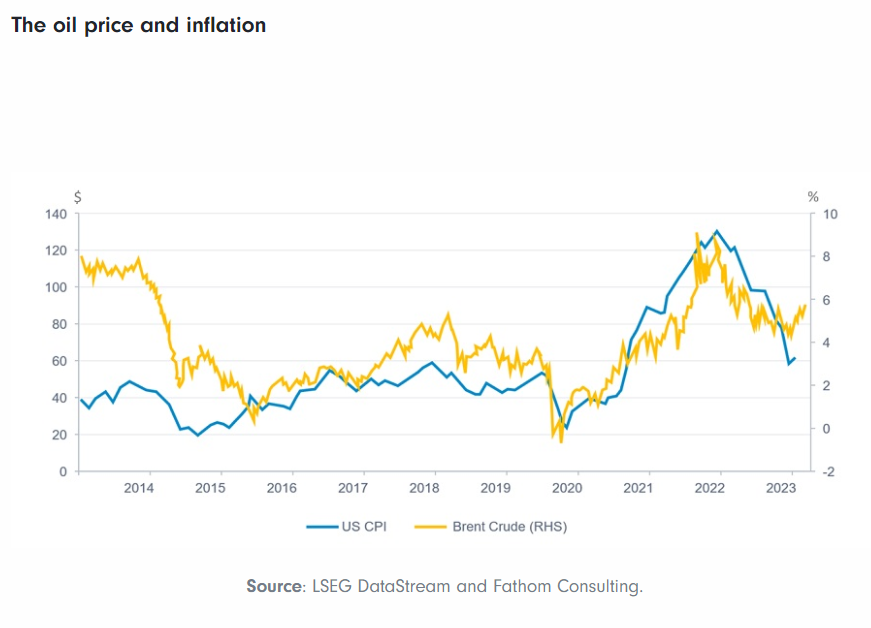

Oil effect

If a recession is coming, it would also be the first time in history it was preceded by a crash in oil prices—more often than not, it’s a surge in oil prices which helps trigger a recession. As a consumption-oriented economy, US growth is ostensibly helped by lower energy prices. The rub of course, is that there are segments of the economy which are severely damaged; i.e., the energy and basic materials sectors. What we’re facing now is an environment where the headwinds associated with weak oil have a higher miles-per-hour than the tailwinds, which have yet to pick up.

Oil prices likely have to stabilize for the market to do the same. I won’t attempt to forecast when/where that may be, but the chart below does show we have reached historical extremes—not only in year-over-year terms for global oil prices, but also maximum peak-to-trough declines.

Source: Changes: Turn and Face the Strange (Market), Charles Schwab

Related:

- United States Oil (USO)

Disclosure: No Positions