Pension systems around in the around are going through tremendous changes. In more and more countries, employers are moving towards Defined Contribution (DC) plans from Defined Benefit (DB) plans. DC plans are advantageous to employers are it transfers more risk in payments to employees. For example, in DC plans employees save a portion of their wages in employer run retirement accounts and invest it in the equity market. So if the stock markets tank employees have to take the losses. In DB plans, companies pay their workers a defined amount in retirement such as a $1,000 per month. This amount is fixed and the employer is on the hook to pay this amount until the employee dies. In this scenario, the employer is liable for the payment regardless of what happens to the company like whether it earns a profit, its stock collapses, etc.

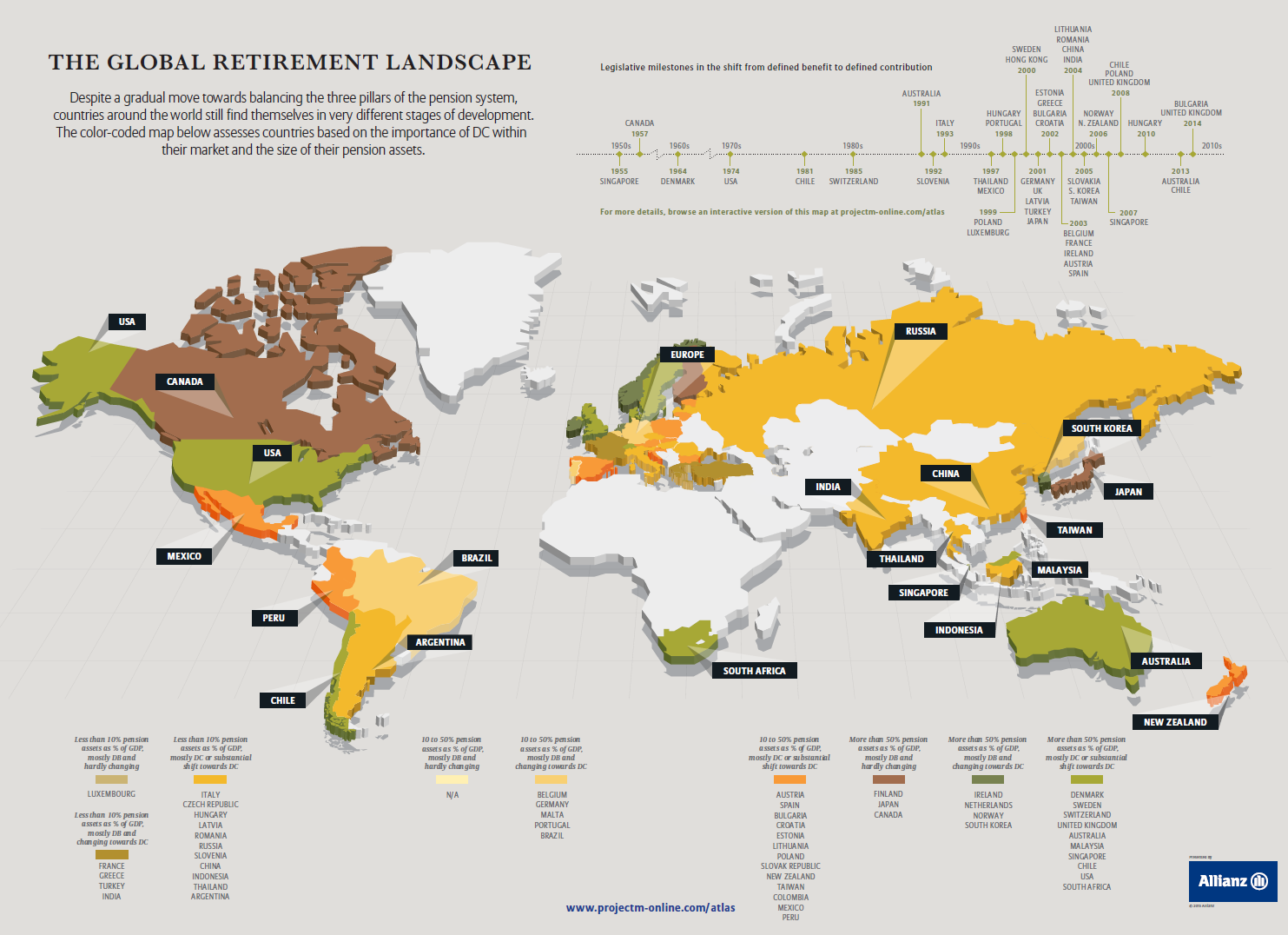

A new tool from Allianz called the Global Pension Atlas shows the various pension systems globally and helps readers compare and contrast countries and time periods:

Click to enlarge

Source: An interactive journey around the world of pension systems, Allianz

The above chart shows that countries France, Greece mostly have DB pension plans while DC plans are more prelevant in countries like the US, Chile, etc.

Download: The Global Retirement Landscape 2015 chart (in pdf)