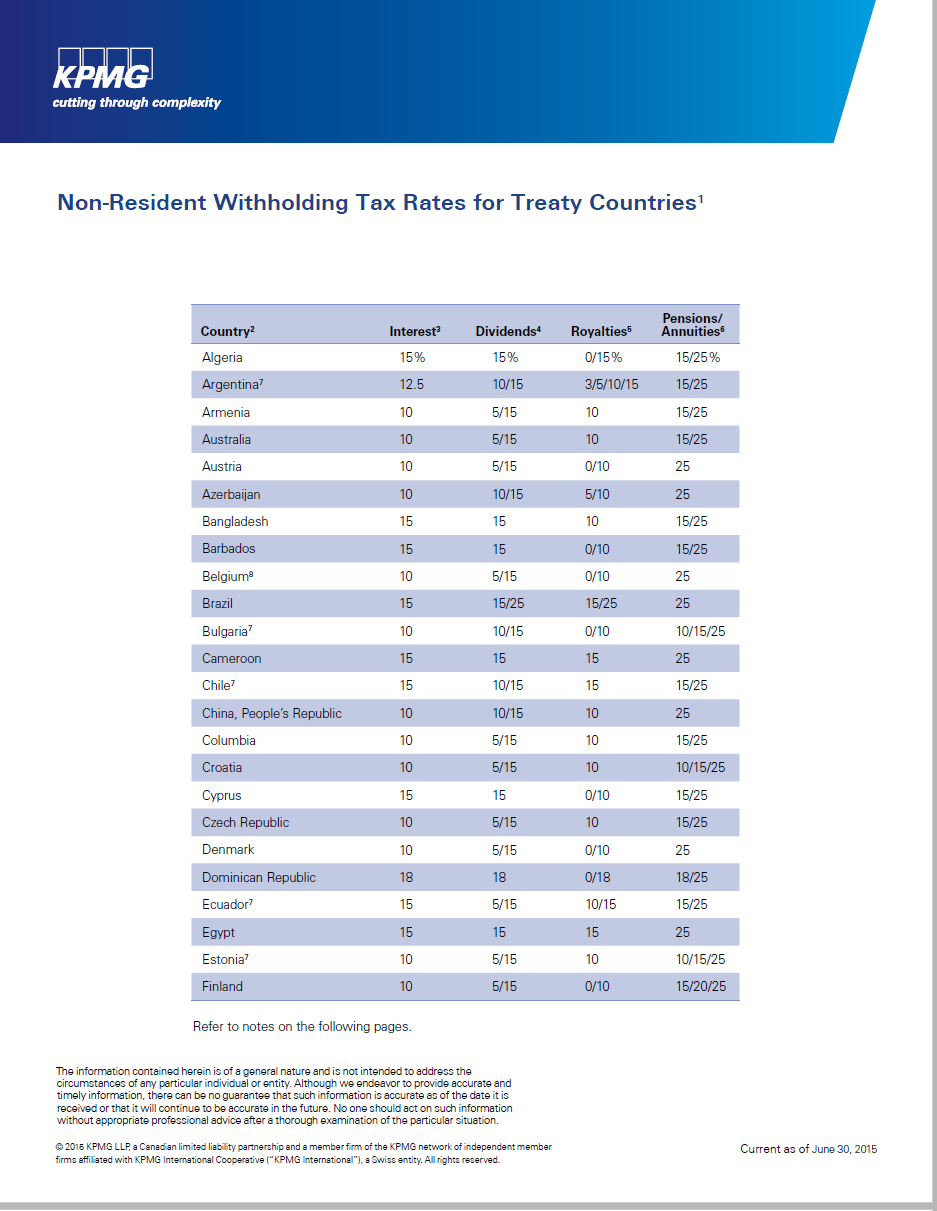

Countries have tax treaties with one another for offering preferential tax rates for investors and companies. Canada also has such tax treaties with many countries. For example, US investors get plenty of benefits for investing in Canada. For example, withholding taxes are NOT charged for interest paid out to US residents by Canadian banks and also on dividends paid out by Canadian companies (excluding REITs) to US qualified retirement accounts.

What are the withholding tax rates for countries with which Canada has tax treaties?

The following tables shows the latest tax rates for Non-Residents of Treaty Countries:

Click to enlarge

Canada-Non-Resident-Withholding-Tax-Rates-for-Treaty-Countries

Click on the above image to view the rates for the rest of the countries or download the pdf document below.

Source: KPMG Canada

Download: