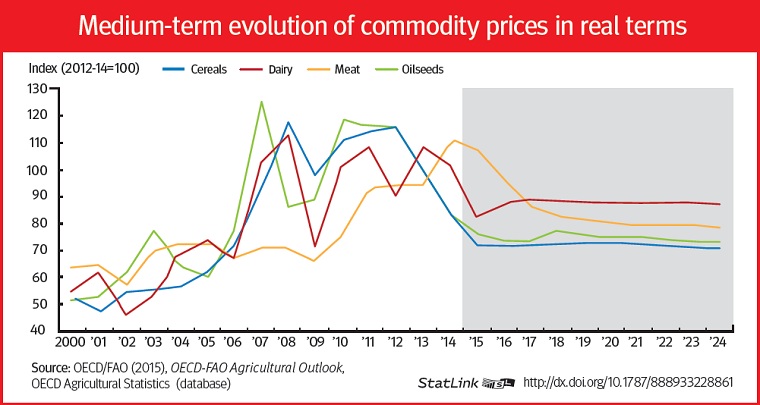

Global food prices are impacted by a multitude of factors including the price of crude oil. The following chart from an article I wrote in 2011 shows the factors that influence food prices:

Click to enlarge

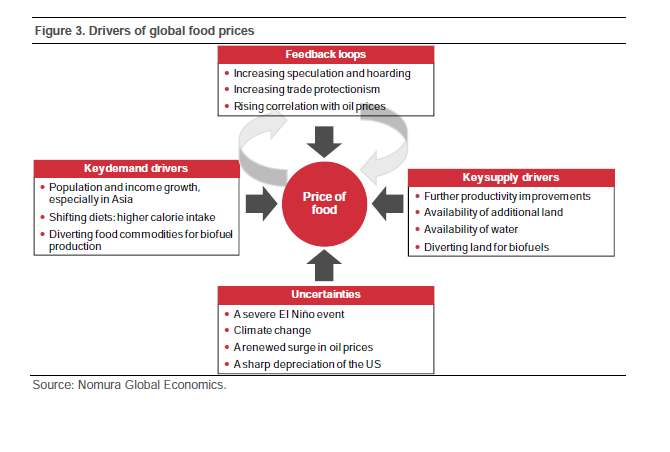

A new OECD report published recently notes that food prices are on a downward trend and are projected to stay stable in the next few years. From an article in the OECD Observer:

Click to enlarge

Just like many other commodities, food prices have fallen in the last couple of years. Over the next 10 years, prices for all agricultural products are projected to stabilise without dropping above their pre-2007 levels, according to the 2015 OECD-FAO Agricultural Outlook.

How times have changed since 2008 when real food prices had increased sharply, sparking widespread criticism about speculation. But in this magazine, Loek Boonekamp wrote that this spike was “neither unique nor the biggest one to occur” in the previous three decades. Indeed, many factors triggered the rise in food prices, including the weak dollar, surging demand for food and biofuels, and the emergence of new traders in commodity markets.

OECD work shows that the period of low prices in the early 2000s was followed by a period of high and volatile prices starting in 2007. Prices began to moderate in 2013: among crops, two years of strong harvests put further pressure on prices of cereals and oilseeds in 2014, while tighter supplies–due to herd rebuilding and disease outbreaks, among others– supported high meat prices. The prices of dairy products dropped steeply.

Source: Food prices on a declining trend, OECD Observer

The OECD-FAO Agricultural Outlook 2015-2024 report notes that lower crude oil prices has only a limited impact on food prices. From the report:

Lower crude oil prices to have limited impacts on commodity prices

Crude oil prices affect the prices of agricultural products and biofuels through different channels. In the case of agricultural products, lower crude oil prices lead to reduced energy and fertiliser costs. This effect is muted as energy input costs are only part of the total cost of production. For example, it is estimated that in the United States energy and fertiliser costs account for 10% and 20.8% respectively of expenditures to produce coarse grains. These shares are considerably lower in developing countries where production systems are less intensive and less mechanised and where there is low price transmission between energy and crop prices. The demand response to changing prices is less pronounced than the supply response as consumers’ demand for agricultural products is rather inelastic.

The situation is different for biofuels. The demand for biofuels remains strongly driven by policies and hence minimum levels of demand are maintained irrespective of relative biofuels and crude oil prices. In fact, as policies regulate biofuel demand, the link between biofuels and crude oil prices is relatively limited. However the development of biofuels behind mandate levels depends on the comparative price ratio between biofuels and crude oil. When the price of crude oil falls, biofuels become less competitive which leads to lower market-driven demand and lower investments in the sector which can be compensated at least partially by increasing policy-related biofuel demand due to stronger transportation fuels use.

From an investment opportunities in the food sector standpoint, it is important to remember that crude oil prices is just one factor that determine the prices of agricultural commodities and food prices. So just because oil is at $40 or lower does not mean the profits of food companies would soar.

Related: