“I cannot forecast to you the action of Russia. It is a riddle, wrapped in a mystery, inside an enigma; but perhaps there is a key. That key is Russian national interest.” – Winston Churchil

Global investors in Chinese equities might agree with the above quote if Russia is replaced by China especially with its meddling in the functions of the stock market. Chinese stocks plunged dramatically a few weeks ago and now seems to have stabilized. However nobody knows how long this state-created stabilization will last. The Shanghai Composite Index stopped falling after a series of interventions by the government. Despite the substantial decline, the index is still one of the best performing indices in the world with a year-to-date gain of over 18%. However in general, investing in Chinese stocks is not for the faint-hearted. The government is a big investor in investor in many listed firms and creates rules and regulates as it seems fit at any time. Basically the state is the perma cheerleader for the masses to invest in stocks and when the market crashes it intervenes to prevent the decline.

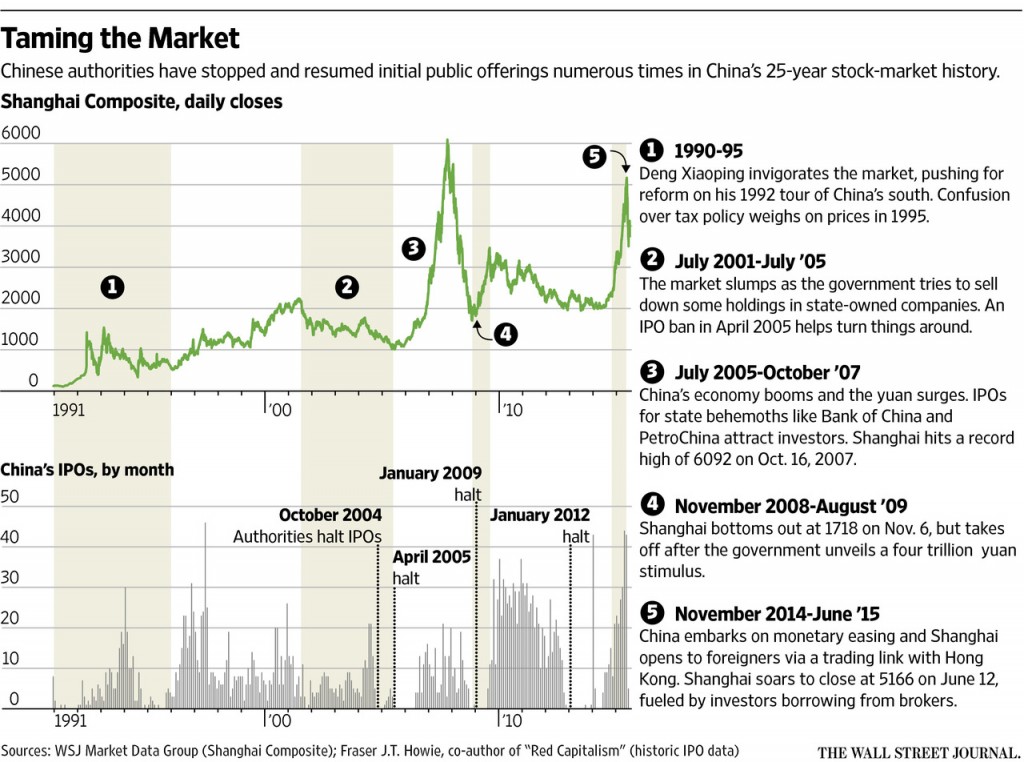

As a communist country with a capitalist economic system, China presents a unique problem for global investors in addition to being an emerging country. Unlike Brazil or India for instance, China controls the operation of equity “markets” on a constant basis. The following chart shows the wild ride of China’s equity markets in the past 25 years:

Click to enlarge

Source: China’s Stock Markets: Nearly 25 Years of Wild Swings, WSJ, July 31, 2015

From the above article:

In the two years after China opened its stock markets, shares soared 1200% and twice fell by half. Investors seeking IPO shares rioted, overturning cars and smashing windows, leading police to use tear gas and fire their guns in the air to quell the disturbance.

China will celebrate the 25th anniversary of the opening of its stock markets later this year, and not much has changed since their founding. They vacillate between big government-driven rallies and equally dramatic selloffs that leave once-euphoric investors disillusioned and angry.

“China’s stock markets have developed quickly and their accomplishments are great, but they are very irregular,” Zhu Rongji, China’s premier at the time, said in 2000. “If they are to receive the people’s trust, the investors’ trust, then they have a lot of work to do.”

Stocks are down by 29% from their peak in June, and investors have continued to sell shares despite the strongest efforts ever by Beijing to prop up prices. The current bear market—defined as a fall of 20% or more from a peak—is the 27th that investors have suffered in the past 25 years. It is the 21st worst in terms of losses.

Shares have lost half their value three times, and plummeted by two-thirds once, in 1993-1994, when the Shanghai Composite Index fell by 67% from its peak to its low point.

The 27 bull markets have been equally dramatic, though none has come close to the initial 1200% gain. The market has gained more than 100% on eight occasions. The most recent bull market, which began in December 2012 and stretched until June, making it the longest in China’s history, clocked in at 164%.

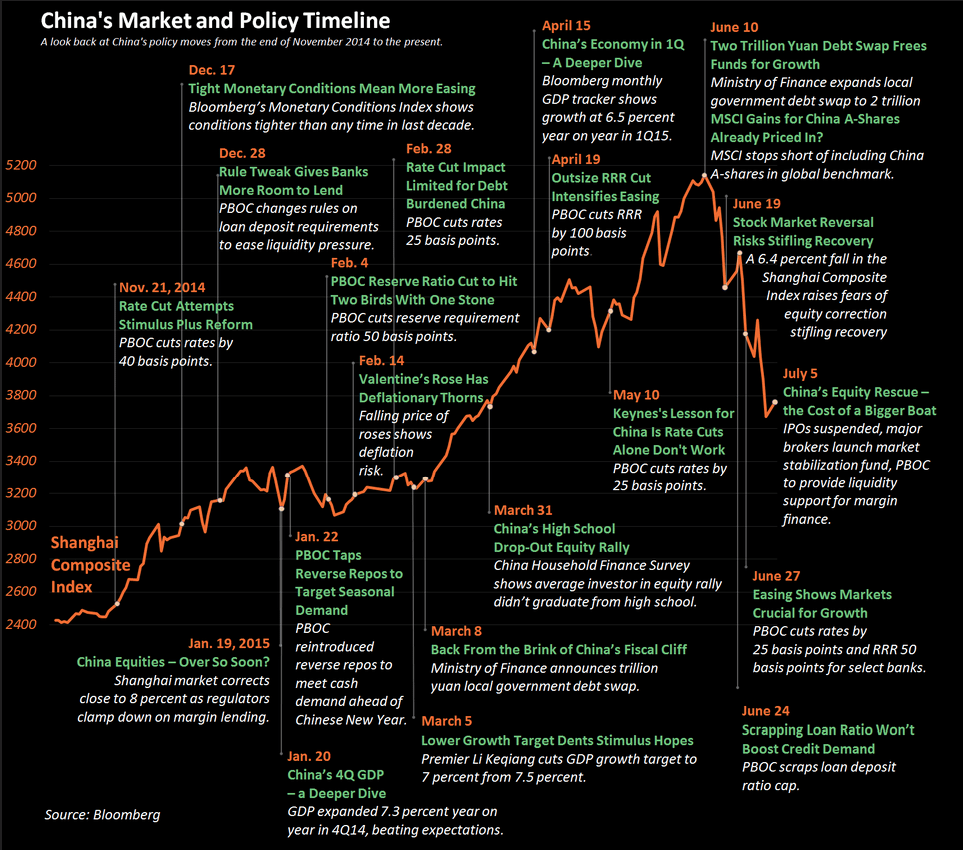

Here is another chart of Chinse regulators in response to the recent crash:

Source: Lessons in distorting your own market from China’s “national team”, FT Alphaville

The following chart from Bloomberg is another take on this topic:

Via The Big Picture

In conclusion, before venturing into the Chinese stock market, investors should be very cautious and be prepared to deal with unforeseen actions by the state. While boom and bust cycles are common in emerging markets, in China it is amplified because of the government’s involvement in markets.