Chinese stocks are red hot this year. Among the BRICs, China is far ahead year-to-date. While the S&P 500 is up 2.36%, the benchmark indices of the BRICs are up higher as shown below:

- China’s Shanghai Composite: 42.6%

- India’s Bombay Sensex: 1.2%

- Brzail’s Sao Paulo Bovespa: 5.5%

- Russia’s RTS Index: 22.5%

Source: WSJ

Some Investors may be wondering if now is the time to jump into Chinese stocks. In his weekend article, Jason Zweig of The Wall Street cautions investors against invest in China.From the article:

If this past week’s stumble in Chinese stocks has you thinking about buying, think twice.

On Thursday, the Shanghai Composite Index fell 6.5%, the Shenzhen Stock Exchange Composite Index lost 5.5% and the Hang Seng Index of Hong Kong-listed stocks dropped 2.2%. They changed little on Friday.

Speculative frenzies don’t become safe just because there’s a momentary pause in the proceedings. U.S. investors should shop carefully in China—if at all.

Even after the selloff, the Shanghai index is up 42.6% in 2015 and Shenzhen 97.4%; neither figure includes dividends.

Stocks in Shenzhen are trading at an average of 61.4 times earnings, according to the exchange—nearly twice their level at the end of 2014 and almost 25% higher than where they stood on April 30. By price/earnings ratio, the Shenzhen market is more than three times as expensive as the MSCI EAFE index of international stocks; the U.S. is at about 22 times earnings.

The Shanghai and Shenzhen markets for so-called A shares are dominated by local amateur traders, using borrowed money, who have whipped up prices.

Source: Stocks in China: Still Too Hot to Handle?, WSJ, May 29, 2015

He also notes that the stock turnover rate in Shanghai reached 600% by the end of April. Basically this means very few are holding stocks for the long-term and most of them are just traders flipping stocks in less than two months. Clearly this is not a sign of a healthy market.

However Chi Lo, senior economist for Greater China at BNP Paribas Investment Partners is bullish on China. In an article, he notes that financial reforms undertaken by the state have not been taken into consideration by the China bears.

From Reform is what the China ‘bubble’ advocates have missed:

The view that the rapid run-up in Chinese stock prices since mid-2014 has been mostly driven by liquidity and hype ignores the importance of a strong stock market in advancing Beijing’s financial reform.

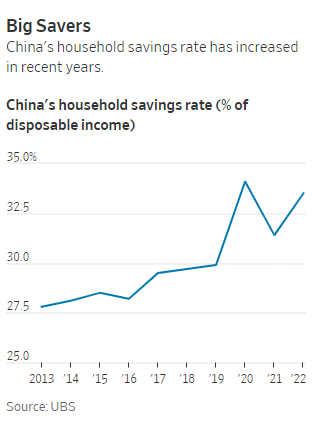

In particular by channeling more household savings into equities and, hence, reducing the reliance of corporate funding on banks and shifting it to the equity market. A success transformation could lead to a fundamental re-rating of Chinese equities in the long-term.

Encouraging robust market sentiment helps Beijing to achieve a number of policy objectives, including:

- local government debt restructuring

- state-sector reform

- capital market liberalisation

- renminbi internationalisation

- economic rebalancing towards consumption-led growth

- lowering the cost of funding (via equity financing) for the private sector

EXAGGERATED BUBBLE CONCERNS

Worries about a stock market bubble propelled by margin-financing have been exaggerated. Despite the exponential rise in the A-share market, its market capitalisation is still only about 70 per cent of the country’s GDP. This degree of equitisation of the economy is far below the 90 per cent in South Korea and 150 per cent in the US, for example.

Further, despite recent concerns about margin trading, it only accounted for less than 20 per cent of China’s monthly equity market turnover in the first quarter of this year. This is much lower than the 31 per cent recorded in South Korea and almost 40 per cent in Taiwan.

And the Chinese authorities are not allowing margin trading to expand out of control; they have tightened up margin trading rules twice in the last five months, and will not hesitate to tighten them again if needed.

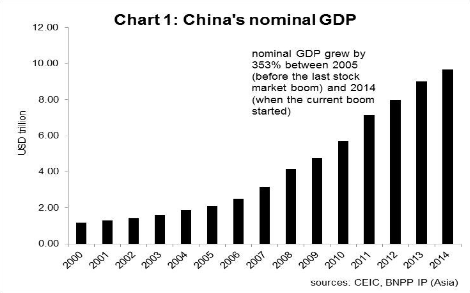

As argued recently, the sharp rise in A-share prices also reflects the rapid growth of China’s nominal GDP, which has expanded by more than 350 per cent since 2005 (see chart 1 above, click to enlarge), before the onset of the last A-share rally.

Mr.Lo also noted that households in China hold only 5% of their total assets in stocks.

Source: Reform is what the China ‘bubble’ advocates have missed, Money Observer, May 29, 2015

Despite Mr.Lo’s arguments I would be cautious on investing in Chinese stocks especially after the strong run up already. As many Chinese are poor and are becoming part of the middle class, the temptation to get rich quickly is very high. And equities provide one avenue where retail investors are able to speculate easily.

For US-based investors still interested in gaining exposure to China, currently 107 China ADRs trade on the organized exchanges and more than 195 trade on the OTC markets. Investors can avoid internet and other start-up companies like Alibaba Group Holding Ltd(BABA) and focus on established firms like China Telecom(CHA), PetroChina(PTR), CNOO (COO), Sinopec(SNP), etc. Another option is go with ETFs such as iShares China Large-Cap ETF (FXI), iShares MSCI China ETF (MCHI), SPDR S&P China ETF (GXC), etc.

Disclosure: No Positions