Investing in individual stocks is the most common way for investors to build a portfolio. However individual stocks are inherently risky to hold for a variety of reasons. Some of the risks with holding stocks include:

- There is no guarantee that a would an investors would go up. It is perfectly possible for any stock to go down or an investor to hold that stock for many years with flat or even negative returns.

- Dividends paid by a firm on its common stock can be suspended or cut any time for any reason. Dividends are completely discretionary and a company can decide to eliminate it for whatever reason. Since ordinary investors do not have a say in how companies are run they are at the mercy of the CEO and the board running the firm on a daily basis.

- Investors do not have all the information of a company’s inner workings. For example, despite quarterly reports and other reports filed by firms, not all the information is widely and publicly shared. So if a massive fraud is going on with accounting inside a company investors will be in dark until it unravels publicly. Only a handful of people in the firm would have knowledge about such things.

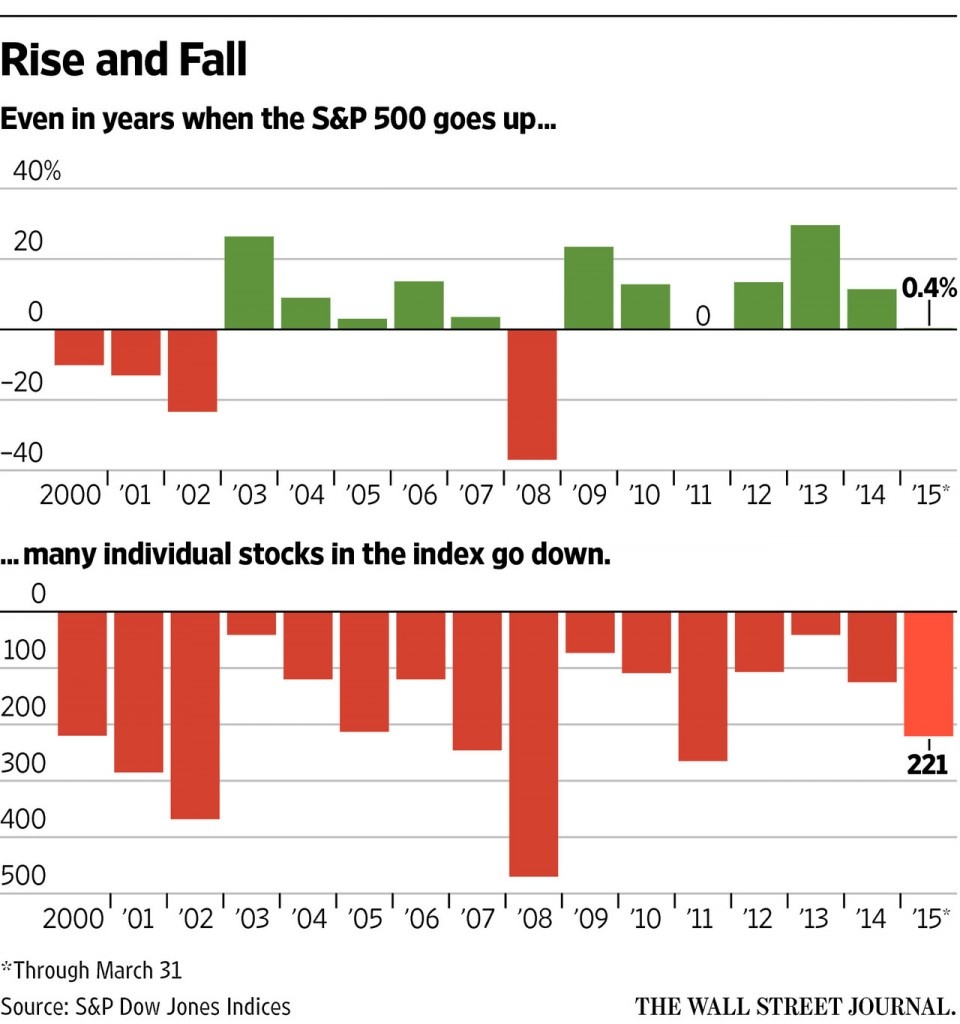

- Another reason individual stocks are risky is that though the whole market may go up the stock one holds may not necessarily go up. So one holds a portfolio of such stocks they will be out of luck.

The following chart from a recent journal article shows this phenomenon:

Click to enlarge

Source: The Trap of Trying to Pick Individual Stocks, by Liam Pleven, Apr 3, 2015, WSJ

From the WSJ article:

Investors could be easily dazzled by the current stars of the stock market and tempted to ditch boring index funds for a piece of the action.

Twitter shares have gained 41% this year through Thursday. Apple is up 14%, after rising for six years in a row. Shares of Kraft Foods Group have shot up 45% since March 24, the day before a proposed merger with H.J. Heinz was announced.

Not bad in a year when the S&P 500 is up less than 1%.

But consider this sobering fact: Even when the market is up, many stocks drop. Last year, when the S&P was up 11%, 125 stocks in the index fell, says S&P Dow Jones Indices.

As the example shows above, diversification is very important when building a portfolio of equities. The following is another example that shows the importance of diversification.

The S&P 500 fell by 37% in 2008 during the global financial crisis of 2008-2009. But even during that time there were some stocks that actually went up while many stock plunged with some falling over 90% or disappearing altogether.

Click to enlarge

Source: The aristocratic investor (and Downton Abbey spoilers) by Andy Clarke, Vanguard Blog

In summary, the key to successful investing in equities is to select and build a portfolio of high-quality stocks and hold them for the long-term.It is never a wise idea to put all the eggs in one basket.

Disclosure: No Positions