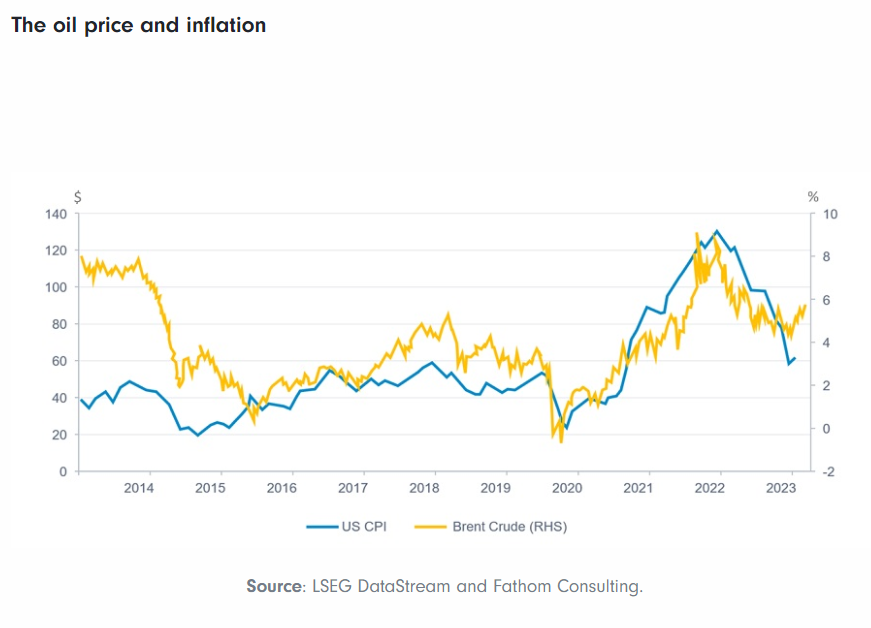

Crude prices plunged dramatically in the past few month from over $100 a barrel to about $60 a barrel for Brent crude. The decline in oil prices also led to the collapse in stock prices of drillers, oil-sector service providers, MLPs, etc. However in the past few weeks oil prices have stabilized and may slowly recover although they may not reach previous levels anytime soon.

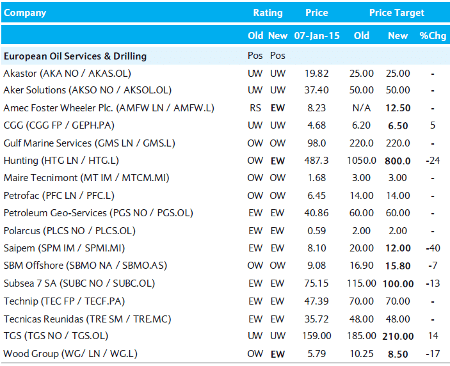

According to a report by Barclays published in January and quoted in a news report, at some point investors may want to consider the European drillers and service providers. From the news story:

Of course, things will not remain this bad forever. Indeed, Barclays can already see light at the end of the tunnel.

“Day by day the picture becomes clearer and we see reasons not to be overly pessimistic – capital discipline in oil is not a new concept, backlogs in [oilfield services] are robust, US$ strength should help, and input prices for projects are falling,” it says.

“More importantly, our analysis shows that relative valuations already factor in scenarios as worrying as 1999 and 2009, but as history indicates, the apocalyptic forecasts at the start of a new oil price period tend to be extreme, and, as oil prices recover, so do earnings estimates. Assuming a more robust 2H15F oil price environment, we see light at the end of the tunnel and remain Positive on a one year view. Today may not be the time to buy the European OFS sector, but as oil prices find a new equilibrium and negative earnings revisions abate, it should soon be time for investors to do their homework.”

Source: Barclays

Favouring companies with backlog-driven visibility, Barclays is particularly fond of companies with strong Middle East exposure and existing order book. Picking from the polar market caps, they favour SBM Offshore,Petrofac (PFC), GMS and Maire Tecnimont.

Source: When to buy the oil services sector, Interactive Investor

Investors willing to hold for five years or more can consider nibbling some of these firms at current levels.

Some of the above firms trading on the US markets include Petroleum Geo-Services ASA (PGSVY), CGG (CGG), Technip (TKPPY) and Subsea 7 SA (SUBCY).

Late last year France-based CGG soared after rival Technip made an offer for acquisition. However the deal fell apart and Technip withdrew the offer.

Disclosure: Long TKPPY