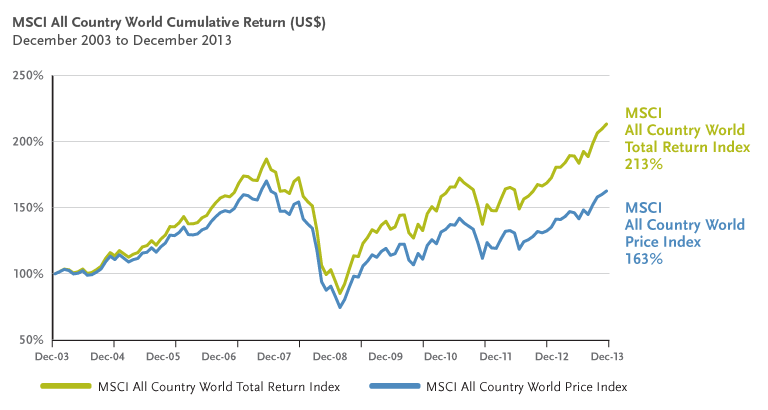

Dividend stocks can generate higher returns from an equity investment compared to non-dividend stocks. The total return from dividend stocks can get a significant boost from dividend reinvestment especially over the long-term. The following chart shows the difference in returns between total returns and only price returns using the MSCI All Country World Index:

Click to enlarge

Source: AGF Management Limited

For the period shown above, the total return was 50% higher than the price return.

U.S. investors looking to add dividend stocks can find plenty of opportunities abroad. I recently came across an article in The Financial Post in which Ramona Persaud, portfolio manger at Fidelity Investments discussed her views on investing in foreign dividend stocks. From the article:

Companies that make the grade can be found anywhere in the world. South Africa, for example, has a lot of companies paying very strong dividends due to efforts since the end of Apartheid to bolster the economy, but a lot of investors won’t touch them because the rand can be very volatile.

“They’re actually very good dividend payers and I’ve found so many great management teams there,” Ms. Persaud said. “Believe it or not, for such a poorly run country, the corporate sector is fairly well run.”

She also highlighted a similar opportunity in both the U.K. and Chile, where pension funds have large equity positions. Since these funds have to service their liabilities, companies became beholden to them to pay fat dividends.

In Australia and New Zealand, meanwhile, investors benefit from a tax shield on dividends, so companies are incentivized to have high payout ratios.

Source: How going global for dividends can generate strong returns, Dec 23, 2014, The Financial Post

The countries that Ms.Persaud points out are excellent choices to hunt for dividend payers.Nine stocks from the countries mentioned above and Sweden’s Svenska Handelsbanken are listed below for further research. Svenska Handelsbanken is one of the top Swedish banks that investors can consider adding for both dividend and steady growth.

1.Company: Nedbank Group Limited (NDBKY)

Current Dividend Yield: 4.22%

Sector: Banking

Country: South Africa

2.Company: Standard Bank Group Limited (SGBLY)

Current Dividend Yield: 4.21%

Sector: Banking

Country: South Africa

3.Company:Banco Santander- Chile (BSAC)

Current Dividend Yield:

Sector: Banking

Country: Chile

4.Company: Banco de Chile (BCH)

Current Dividend Yield: 5.31%

Sector:Banking

Country: Chile

5.Company:Empresa Nacional de Electricidad SA (EOC)

Current Dividend Yield: 2.62%

Sector:Electric Utilities

Country: Chile

6.Company: Westpac Banking Corp (WBK)

Current Dividend Yield: 6.20%

Sector:Banking

Country: Australia

7.Company: Australia and New Zealand Banking Group Ltd (ANZBY)

Current Dividend Yield: 6.05%

Sector:Banking

Country: Australia

8.Company: Telstra Corp Ltd (TLSYY)

Current Dividend Yield: 5.49%

Sector:Telecom

Country: Australia

9.Company: National Grid PLC (NGG)

Current Dividend Yield: 4.90%

Sector: Multi-Utilities

Country: UK

10.Company:Svenska Handelsbanken AB (SVNLY)

Current Dividend Yield: 5.38%

Sector:Banking

Country: Sweden

Note: Dividend yields noted above are as of Dec 23, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long BCH