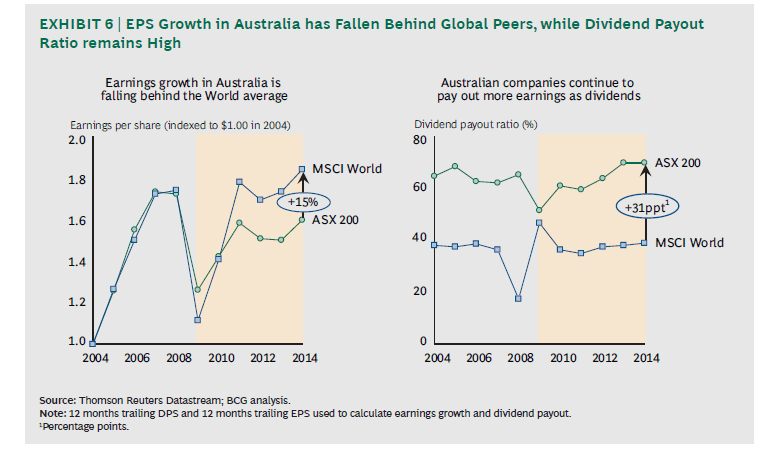

On Monday we looked at some of the reasons for investing in Australian dividend stocks. High payout ratio is one of the main advantages of Australian stocks.However a report published by the Boston Consulting Group questioned if Australian firms are missing out on potential growth opportunities as they are focused too much on satisfying investors’ hunger for yields. According to the authors of the report, this issue is especially important since the earnings growth of Australian firms are falling behind the world average but they continue to maintain the high dividend payout ratios as the chart shows below:

Click to enlarge

Source: The 2014 Australian Value Creators Report, The Challenge of Growth, Boston Consulting Group

The payout ratio of Australian companies 20 to 30 percentage points higher than the world average.While the authors do not offer an answer to the title question of this post they do note however that “Growth has become increasingly challenging as the market lost some of its competitive prowess.”

Related ETF:

- iShares MSCI Australia Index (EWA)

Disclosure: No Positions