In the U.S., the social security check received each month is the most reliable and top source of income for senior citizens in retirement. Despite all the attacks on the social security system, majority of the retired Americans depend on Uncle Sam for their survival. Other sources of income for retired persons include pension from their employer and income from their own private investments.

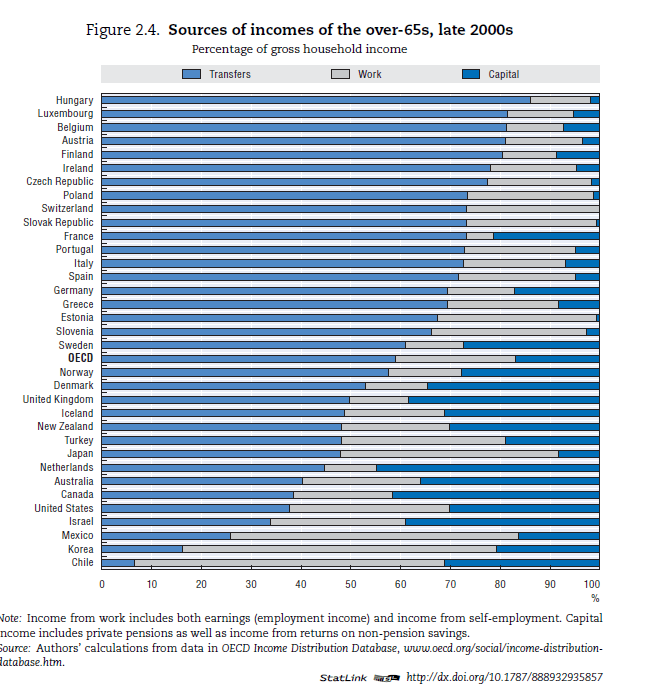

In general, what are the sources of income for senior citizens in OCED countries? The following chart provides the answer:

Click to enlarge

Source: Pensions at a Glance 2013, OECD

“Transfer” in the chart denotes pensions provided by the state, “Work” means income derived from their former employer and “Capital” simply means an individual’s own private sources of income.

Countries such as Finland, Austria and Belgium have high public pensions.Senior citizens in the U.S. receive lower public pension (i.e. social security) than the average for OECD nations. The difference in the sources of income between Senior citizens in the U.S. and France are interesting. From the OECD report:

Alternatively, later retirement ages may be the main factor. In 2010, for example, the share of income from work was relatively high in the United States where the normal pension age is over 65. In France, by contrast, where workers who had contributed for 41 years could still retire at the age of 60 in 2010, income from work accounted for less than 10% of old people’s incomes.