The U.S. economy is the world’s largest economy with an GDP of over $16.0 Trillion. However much of the U.S. economy output is derived from the service sector not manufacturing of goods. Service sectors includes everything from flipping burgers at a fast food store to preparing taxes for a customer to creating and shuffling paperwork around like derivatives on Wall Street and everything in between that does not involve producing any actual product. We can also consider the U.S. economy as a consumption-based economy since the U.S. is the largest consumer of goods in the world. But the majority of goods consumed especially consumer goods are produced overseas by other countries.

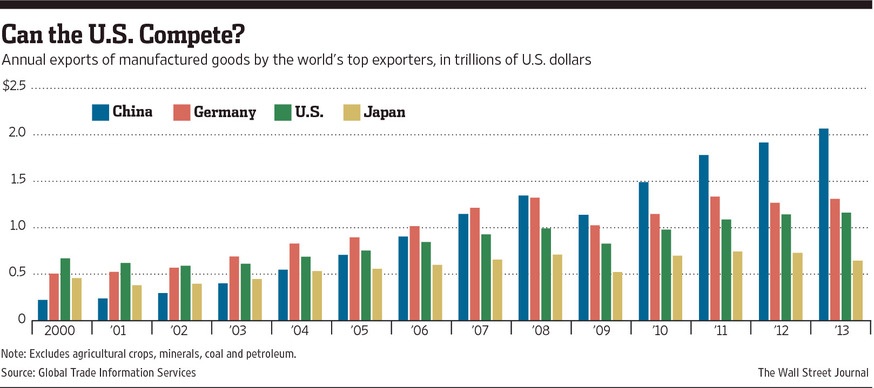

The following chart from an article on U.S. manufacturing in The Wall Street Journal shows the annual exports of manufactured goods by the world’s top exporters:

Click to enlarge

Source: Why U.S. Manufacturing Is Poised for a Comeback (Maybe), The Wall Street Journal, June 1, 2014

Here are two interesting stats from the article:

In 2013, the U.S. had $470 billion deficit in trade of manufacturing goods while Germany had a surplus of $437 billion. China’s surplus stood at an astonishing $866 billion.

The manufacturing industry accounts for just 8.8% of the total employment in the U.S. at the end of last year.

Some of the positive factors that support a revival of manufacturing in the U.S. are:

- Availability of cheap energy such as electricity and natural gas.

- Vast pool of world-class top quality talent in every field from biotechnology to engineering.

- Almost unlimited amount of funding available for research and investment from government and the private sector.

- Huge amounts of land and other resources such as water available for building factories.

- Good transportation infrastructure.

- Cheap labor costs compared to other developed countries as the majority of U.S. labor is non-union.

Some of the negative factors that prevents a revival of manufacturing in the U.S. are:

- Complicated and unfavorable tax codes include the highest tax rate for corporations.

- Excessive and burdensome government regulations.

- All types of infrastructure needs a badly needed upgraded. This include the electricity grid, road, railroads, airports, internet, cell phone network, etc. For example, U.S. airports and internet connectivity speeds are pathetic compared to even some third-world countries.

- Labor costs are high relative to emerging countries due to excess supply of labor in those countries. Despite millions of Americans unemployed now and thousands of illegals pouring into the country, labor costs will always be higher here than in China, Brazil, South Africa, etc.

In summary, the U.S. can compete and become the world’s biggest exporter of manufactured goods provided policies are reformed to encourage manufacturers to stay home as opposed to fleeing to abroad. Otherwise despite the hype about the growth of U.S. oil and natural gas industry growth due to fracking, cheap electricity and other factors, the U.S will continue to be a service-based economy and will never retain the title of world’s top goods exporter.

A related note:

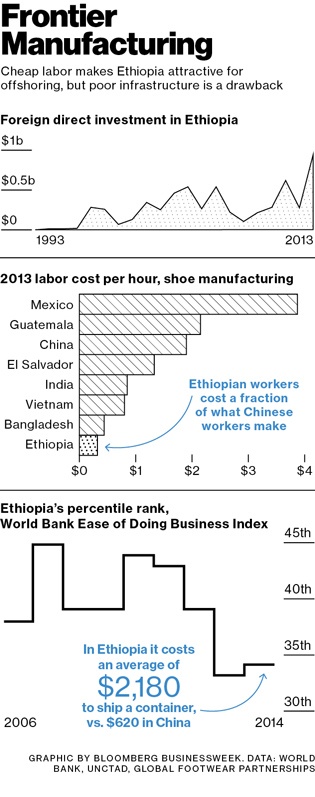

A interesting Bloomberg BusinessWeek article recently discussed China’s manufacturing investments in Africa. China’s Huajian Shoes company operates a factory outside Addis Ababa in Ethiopia. Huajian is a supplier of top brand names like Nine West and Guess.Compared to employing a Chinese worker in China the company finds Ethiopian workers much cheaper. While Chinese workers make about $400 per month stitching shoes whereas an Ethiopian workers does the same job for just $40 a month. As business grows Huajian plans to increase its workforce in the factory to about 50,000 in eight years.

From the BusinessWeek article:

Huajian’s 3,500 Ethiopian workers produced 2 million pairs of shoes last year. Located in one of the country’s first industrial zones—which offer better infrastructure and tax exemptions—the factory began operating in January 2012. It became profitable its first year and now makes $100,000 to $200,000 a month, Zhang says—an insufficient return that he claims will rise as workers become better trained. Beneath bright fluorescent lights and amid the drone of machines, workers cut, glue, stitch, and sew Marc Fisher leather boots destined for the U.S. market. Supervisors monitor quotas on whiteboards, giving small cash rewards to winning teams and criticizing those who fall short.

Source: Turning Ethiopia Into China’s China,Bloomberg BusinessWeek, July 14, 2014