On May 31, 2013 I wrote an article on National bank of Greece when it implemented a second reverse split and suggested that investors avoid Greek stocks. From the article:

National Bank of Greece (NBG) has implemented a reverse split for the 2nd time in less than two years. In November, 2011 when the reverse split went into effect in the ratio 1:5 I noted that investors may want to avoid the stock. On May 30th, the bank reverse split the ADR again. This time they seem to be trying to keep the share

price above $1.00 for some time and gave shareholders 1 ADR for each 10 held. After closing at $1.22 on May 29th, the stock opened at $5.70 yesterday and end the day at $7.07. From the reverse split made in November, 2011 to the current split, the stock fell by over 50%.

This is an update to that article.

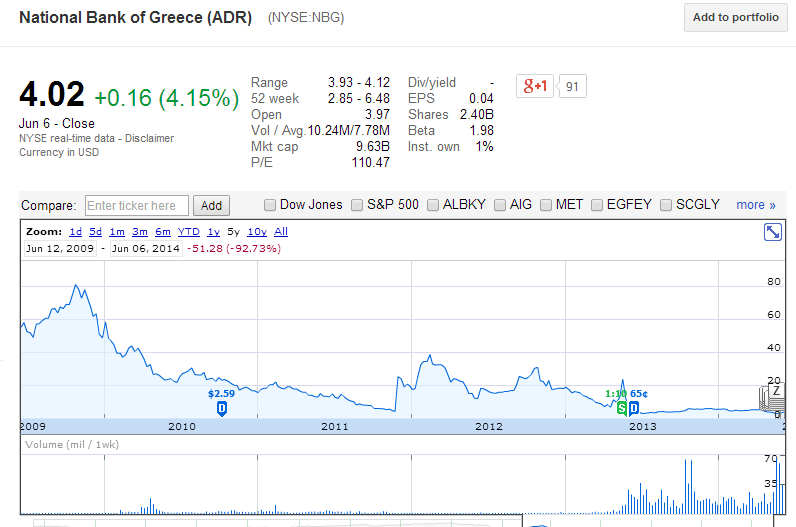

On May 31, 2013 my screenshot of NBG showed a price of $7.22. On June 6, 2014 the stock price closed at $4.02. In fact, National Bank of Greece is the worst performing foreign exchnage-listed ADT year-to-date with a loss of over 28%.

The 5-year performance chart of the bank is shown below:

Click to enlarge

Source: Google Finance

In the past 5 years the stock is down about 93%.

Related ETF:

- Global X FTSE Greece 20 ETF (GREK)

Disclosure: No Positions