European and US equity markets are very volatile this year.While the S&P 500 had a solid double digit growth last year,the index is having a rocky ride this year.

The year-to-date price returns of some of the major developed and emerging benchmark indices are listed below:

- S&P 500 Index: 0.9%

- UK’s FTSE 100: -1.8%

- France’s CAC 40: 3.2%

- Germany’s DAX Index: -1.5%

- Spain’s IBEX 35 Index:3.8%

- China’s Shanghai Composite: -0.9%

- India’s Bombay Sensex: 6.9%

- Brzail’s Sao Paulo Bovespa: 1.2%

- Chile’s Santiago IPSA: 4.3%

- Mexico’s IPC All-Share: -4.3%

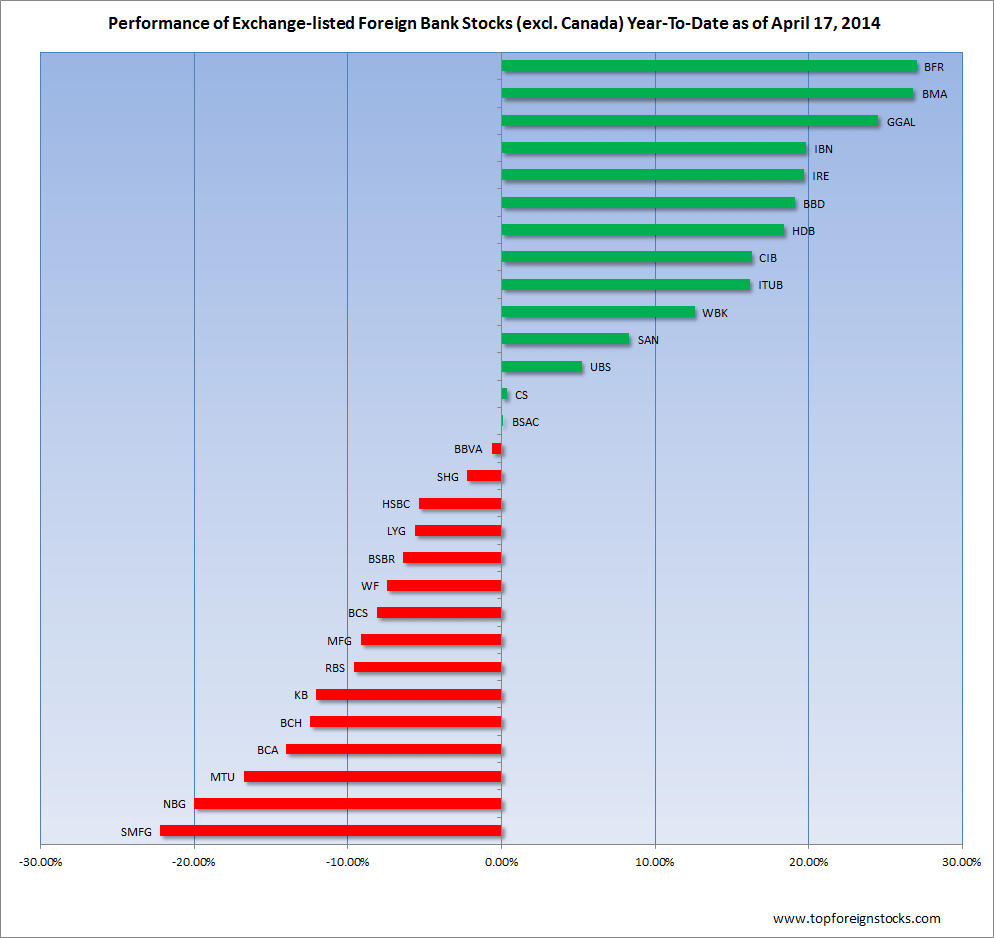

The chart below shows the year-to-date price returns of exchange-listed foreign bank stocks (excluding Canada):

Click to enlarge

Data Source: BNY Mellon

A few observations:

- Elections in Brazil and India are having a postive impact on stocks. As a result banks such as HDFC Bank(HDB) of India and Itau Unibanco (ITUB) of Brazil are up by over 15% so far.

- Depsite the greek economic recovery National Bank of Greece (NBG) is off by 20% since it plans to raise capital which may include issuing new shares.

- Investors are betting on a strong surge in European banking sector leading to the mostly positive performance of Spanish bank Banco Santander (SAN), Bank of Ireland(IRE), etc.

Disclosure: Long BMA.BCA,BSAC,BCH,BBVA,SAN,LYG, BBD and ITUB