Most European equity markets performed very well last year. The performance has varied widely so far this year with a handful of markets such as Portugal, Denmark and Italy up by double digit percentages. While a few years ago investors abandoned stocks in the PIIGS countries now they are returning to these countries in the hope that the worst is over.

The year-to-date return of some of the European indices are listed below:

- UK’s FTSE 100: -2.0%

- France’s CAC 40: 2.7%

- Germany’s DAX: 0.40%

- Italy’s MIB: 13.3%

- Portugal’s PSI 20: 15.5%

- Spain’s IBEX 35: 4.2%

- Denmark’s OMX Copenhagen: 12.6%

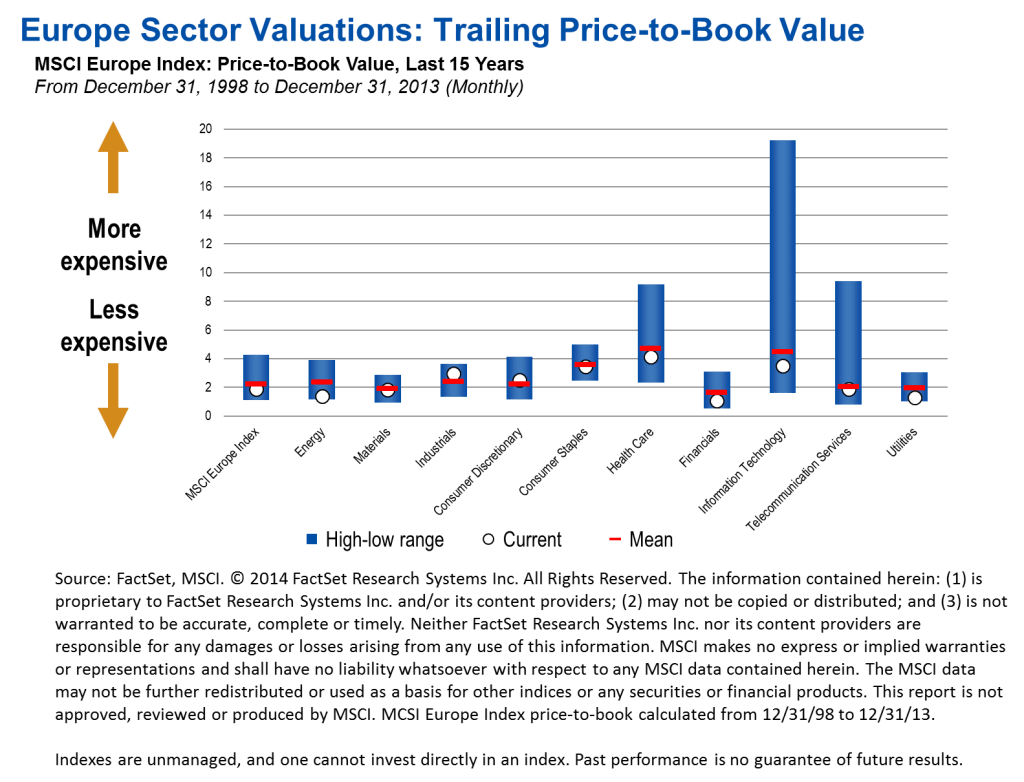

Though European stocks have had a strong run last year and have risen again this year, they have still room to run and valutions are attractive in many sectors from a historical Price-to-Book standpoint according to Lisa Myers of Templeton Global Equity Group. In an article titled “Pockets of Opportunity in Europe, Emerging Markets” she noted that companies in the pharmaceutical,biotechnology, healthcare equipment, oil services, IT and financials have further potential for growth.

The following chart shows the sector valuation based on the MSCI Europe Index for the past 15 years:

Click to enlarge

Source: Pockets of Opportunity in Europe, Emerging Markets, Lisa Myers, Templeton Global Equity Group, Mar 18, 2014

Investors looking to add some European stocks can consider some of the companies listed below:

1.Company: Nordea Bank AB (NRBAY)

Current Dividend Yield: 3.23%

Sector: Banking

Country: Sweden

2.Company: Electricite de France SA (ECIFY)

Current Dividend Yield: 4.25%

Sector: Electric Utilities

Country: France

3.Company: HSBC Holdings plc (HSBC)

Current Dividend Yield: 4.82%

Sector: Banking

Country: UK

4.Company: Fresenius Medical Care AG & Co. KGAA (FMS)

Current Dividend Yield: 0.98%

Sector: Health Care Providers & Services

Country: Germany

5.Company: Telenor ASA (TELNY)

Current Dividend Yield: 4.63%

Sector: Telecom

Country: Norway

6.Company: BNP Paribas SA (BNPQY)

Current Dividend Yield: 2.52%

Sector: Banking

Country: France

7.Company: Roche Holding AG (RHHBY)

Current Dividend Yield: 2.59%

Sector: Pharmaceuticals

Country: Switzerland

8.Company: Technip SA (TKPPY)

Current Dividend Yield: 2.12%

Sector: Energy Equipment & Services

Country: France

9.Company: Novartis AG (NVS)

Current Dividend Yield: 2.17%

Sector: Drugs

Country: Switzerland

10.Company: GlaxoSmithKline plc (GSK)

Current Dividend Yield: 4.58%

Sector: Pharmaceuticals

Country: UK

Note: Dividend yields noted above are as of Mar 28, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: Long TKPPY