The return on an equity investment can be grouped into two parts: dividend return and price return. Dividend return is based on dividend yield and dividend growth. While dividend yield is important dividend growth is even more important especially for investments held over many years since returns are boosted due to the effect of compounding. One way stock prices increase is via multiple expansions. The P/E ratio of an equity will rise higher as investors are willing to pay more per share for the same amount of earnings. Dividend yields and dividend growth can be considered as somewhat stable and predictable compared to multiple expansions which tend to expand or contract based on the overall market or investor attraction towards a particular sector. For example, during bull markets stock multiples can go sky-high as investors get caught in the frenzy of rising stock prices and focus less on fundamentals. Hence multiple expansions are at the whim of the market. It would be unwise to invest in stocks purely betting on price appreciation which may or may not occur.

Of course, dividends are also not guaranteed as they can be reduced, suspended or even eliminated for any number of reasons. But generally high-quality established firms tend to not only pay stable dividends but also raise them on a consistent basis. There are companies that have increased dividends every year for many years.

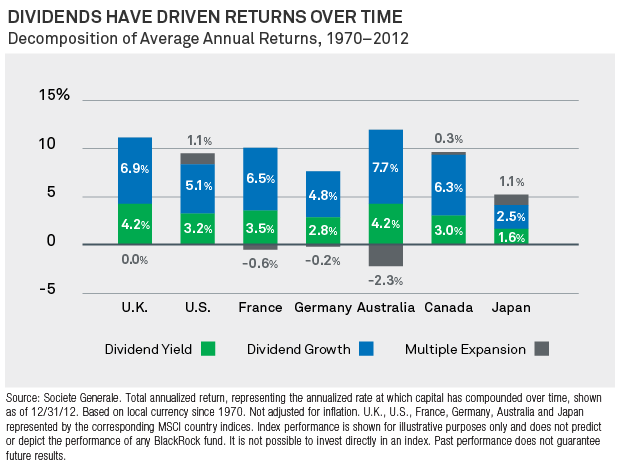

For investors wondering whether dividends or multiple expansions drive long-term returns, research by GMO has found that dividends indeed drive long-term returns. From an article by Stuart Reeve, Andrew Wheatley-Hubbard & James Bristow of Blackrock:

Dividend yield and dividend growth have accounted for approximately 90% of long-term stock returns,much more than multiple expansion and valuation moves.

Click to enlarge

Source: Why Dividends? Why Global? , Why Now? Why Always?, BlackRock

Over the four decades noted, multiple expansion accounted for just 1.1% of the average annual returns for U.S. equities. Dividends generated most of the average annual returns with dividend growth accounting for more than dividend yield. Australian equities’ multiples actually declined but the dividend yield and dividend growth was substantial enough to push annual returns to about 12%. In UK, France and Germany multiple expansion was basically flat or went negative, but still all the three markets had decent positive returns because of dividends. Similarly the multiples of Canadian stocks barely moved. However average annual returns was good for Canadian stocks also.

Ten large-cap high-quality stocks are listed below to consider for long-term investment:

1.Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.30%

Sector: Food Products

Country: Switzerland

2.Company: Unilever PLC (UL)

Current Dividend Yield: 3.62%

Sector: Food Products

Country: UK

3.Company:Colgate-Palmolive Co (CL)

Current Dividend Yield: 2.27%

Sector: Household Products

Country: USA

4.Company:Procter & Gamble Co (PG)

Current Dividend Yield: 3.09%

Sector: Household Products

Country: USA

5.Company: The Coca-Cola Co (KO)

Current Dividend Yield: 3.17%

Sector:Beverages

Country: USA

6.Company: Henkel AG & Co KGaA (HENKY)

Current Dividend Yield: 1.72%

Sector: Household Products

Country: Germany

7.Company: National Australia Bank Ltd (NABZY)

Current Dividend Yield: 5.49%

Sector:Banking

Country: Australia

8.Company: Royal Bank of Canada (RY)

Current Dividend Yield: 3.93%

Sector: Banking

Country: Canada

9.Company: Abbott Laboratories(ABT)

Current Dividend Yield: 2.29%

Sector: Pharmaceuticals

Country: USA

10.Company:Air Liquide (AIQUY)

Current Dividend Yield: 2.42%

Sector: Chemicals

Country: France

Note: Dividend yields noted above are as of Mar 21, 2014. Data is known to be accurate from sources used.Please use your own due diligence before making any investment decisions.

Disclosure: No HENKY, RY