The U.S. dollar will stay the reserve currency in 2014 and beyond according to a research report by Barclays. This is because there is no serious competitor despite the U.S running persistent current account deficits. poor fiscal position, loss of AAA credit rating and the ongoing QE program run by the Federal Reserve.

In addition to the above factors, three other factors that matter for the reserve currency status are: liquidity, depth of local capital markets and investor faith. In each of these categories the U.S. beats other major developed economies.

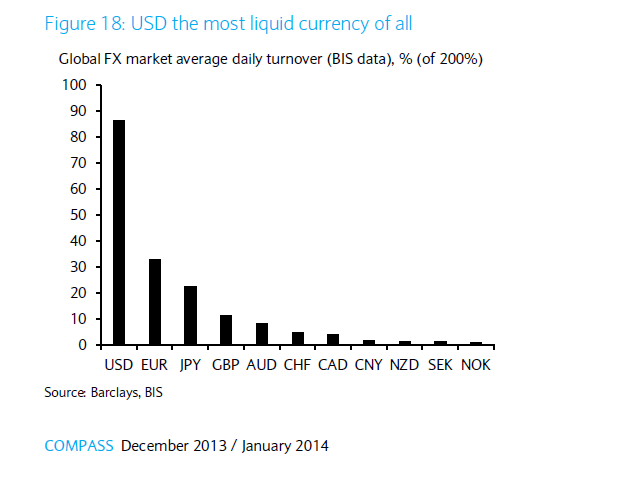

a) Liquidity

The US dollar is the most liquid currency by a wide margin. The nearest competitor Euro has a daily turnover of only about one-third in the forex market relative to the dollar.

Click to enlarge

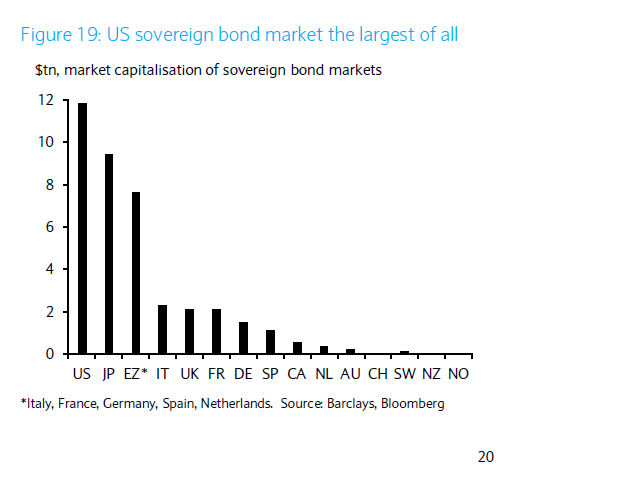

b) Depth of local capital markets

The U.S. sovereign bond market is the largest in the world. Hence it is highly liquid for investors and prices are not easily distorted when someone winds up even a smaller position.

c) Investor faith

The dollar and its underlying assets still retain investors’ faith even during times of great stress. For example, during the global financial crisis the dollar and treasuries benefited greatly as investors piled into them seeking safe heavens.It is ironic that investors put their faith in the same country that started the financial crisis causing the loss of billions of dollars.

Serious competition to the domination of the US dollar as the top reserve currency is non-existent. Norway has strong fiscal balances, runs a strong current account surplus and enjoys the AAA rating. However the Norwegian Kroner(NOK) cannot compete vigorously against the dollar since the local capital market is shallow, the currency is illliquid and underperforms during times of stress.

The Japanese Yen and Euro are two of the other possible substitutes for the dollar. But Japan’s fiscal position and Europe’s internal fights among member countries make it unappealing to investors.

The next contender for the reserve currency status is China’s Renminbi. However it is unlikely to attain that position anytime soon since China’s capital markets are immature and its currency is illliquid. China’s capital controls and managed nature of the currency also does not help.

In summary, the US dollar will remain the top reserve currency for the foreseeable future.

Source: Compass, December 2013/January 2014, Barclays