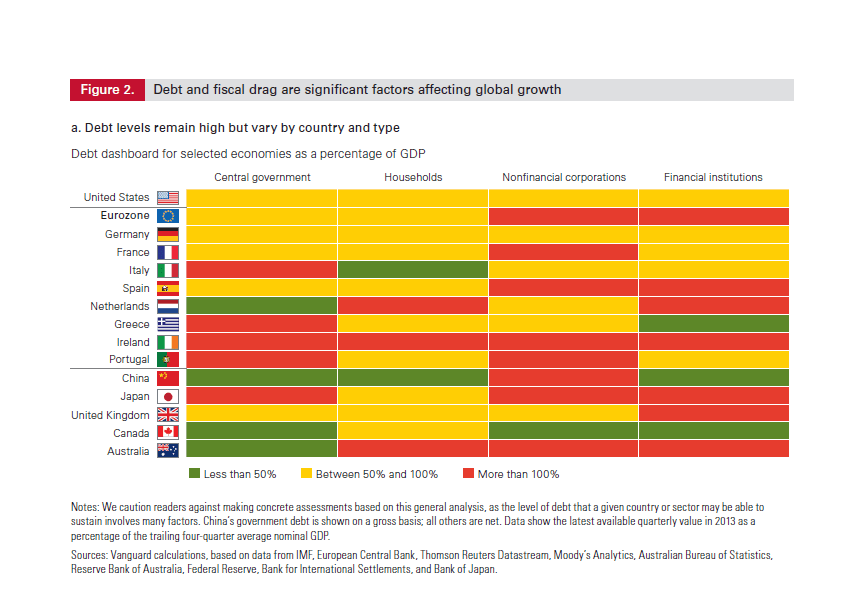

Debt levels remain high across the world especially in the developed countries.However debt levels vary by type and country as shown in the following chart:

Click to enlarge

Source:Vanguard’s economic and investment outlook, Jan 2014, Vanguard

Debt held by the Federal government, households, non-financial and financial firms in the U.S. and Germany is moderate(between 50% and 100%) as a percentage of GDP. The UK is similar shape except the financial institutions there are still in a mess. While the U.S. took swift action after the financial crisis and financial firms especially the banks cleaned up their books and raised capital, British banks failed to take proper actions. The painfully slow British political and regulatory system did not help to speed things up either.In Japan households are in much better shape than corporations and the federal government in terms of debt levels. Similarly Chinese households have low debt levels.

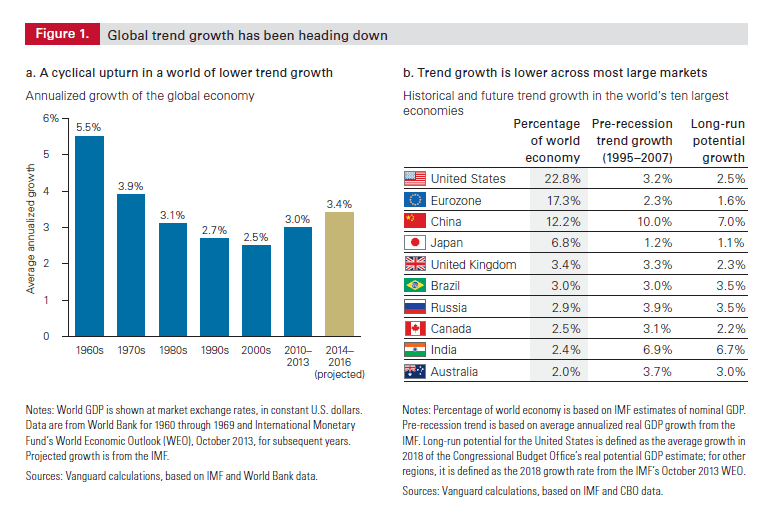

Vanguard predicts the global economic recovery to be modest over the next compared to the previous two decades.The chart below shows the potential growth rates for the world’s major economies:

The long-run economic growth potential of BRIC countries is higher than that of the developed countries including the U.S. However it should be noted that high economic growth does not necessarily mean higher equity market returns.

Related ETFs:

- iShares MSCI Brazil ETF(EWZ)

- Market Vectors Russia ETF (RSX)

- iShares FTSE/Xinhua China 25 Index Fund (FXI)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard Emerging Markets ETF (VWO)

- SPDR S&P 500 ETF (SPY)

- SPDR STOXX Europe 50 ETF (FEU)

Disclosure: No Positions