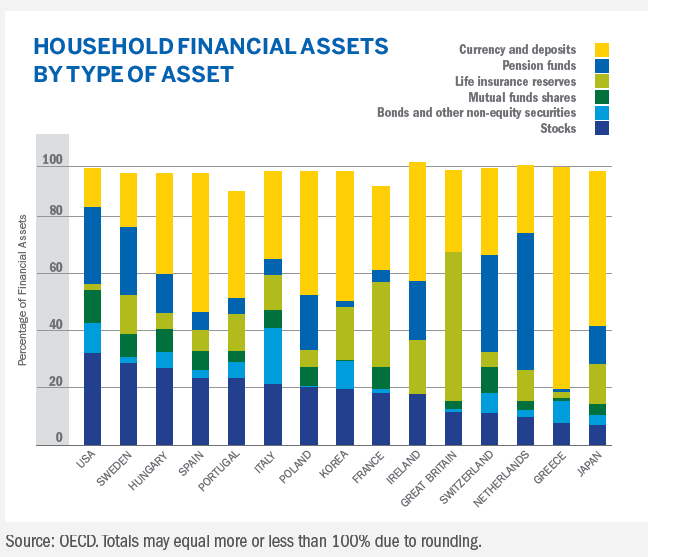

Financial assets held by households vary widely across countries. In the developed world, households hold a higher portion of their financial assets in equities compared to the emerging world where equities are not as popular for a variety of reasons. Among developed countries, the percentage of households’ financial assets held in various asset classes such as stocks, bonds, insurance, bank deposits, etc. varies from one country to another.

The following chart shows the household financial assets by type of assets held in select OECD countries:

Click to enlarge

Source: The Influence of Demographics on Stock Markets of Alejandra Grindal, Ned Davis Research, Inc. in onInvesting, Summer 2013, Charles Schwab

U.S. households hold the highest portion of their financial assets in individual stocks followed by Sweden. Japan has the lowest number of households invested in individual stocks. This is not surprising since ordinary Japanese have pretty much ignored their stock markets since the asset bubble collapse of the early 90s. Even today Japanese have one of the lowest stock market participation rates in the world despite a big run in the Nikkei due to Abenomics introduced the Prime Minister Shinzo Abe.

Since stocks are also present in mutual fund shares, life insurance reserves, and pension funds, Alejandra Grindal, Senior International Economist at Ned Davis Research, Inc estimates that equities make up about 50% of total household financial assets in the U.S. Americans also hold the lowest percentage of their financial assets in cash relative to Japan at 54%, Germany at 40% (not shown in chart) and the UK at 28%. German, French and British households invest a high portion of their financial assets in life insurance policies. Hence it may be wise to invest in life insurers such as Legal & General Group Plc (LGGNY), AXA Group (AXAHY) and Allianz SE (AZSEY).

For more details on stock market participation rates globally you can checkout my article earlier this year.

Disclosure: Long AXAHY