Australian bank stocks are indeed in bubble territory according to an analyst and an investment industry executive. An article in the Australian Financial Review last week quoted Emilio Gonzalez, chief executive of BT Investment Management as saying that Australian banks may face corrections due to soaring asset prices.

Here is an UBS analyst’s take on Aussie banks:

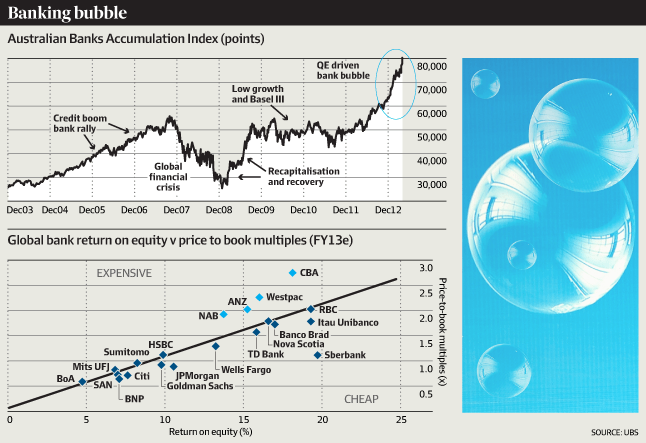

In a research note titled Welcome to the great bank bubble of 2013 sent on Wednesday, UBS analyst Jonathan Mott said banks were low growth companies, heavily exposed to a housing market downturn and unemployment.

“As with all asset bubbles, they can go higher and for longer than many expect,” Mr Mott said. “As Chuck Prince [former chief executive of Citigroup] famously said ‘As long as the music is playing, you’ve got to get up and dance’. All we can say is buyer beware.”

It was “fundamentally flawed” for investors chasing yield to compare dividends from more risky bank stocks to lower rates on much safer term deposits and government bonds, he said.

The share prices of Australia’s banks have reached a record high at an average of 14.9 times earnings, despite subdued demand for lending.

The market capitalisation of Commonwealth Bank of Australia and Westpac have surpassed $100 billion and the big four are ranked among the world’s top-11 by market capitalisation.

Click to enlarge

Quantitative easing by central banks around the world, where their bond buying has pushed global interest rates down, have led investors to select alternative assets offering higher yields.

Combined with falling term-deposit rates and the tax advantage of franking credits in Australia, investors have jumped into banks because of their track record of producing excellent earnings, high dividends, sound management and prudent regulatory structure. Bad debts remain benign, housing markets stable and the unemployment rate of 5.6 per cent is relatively low although edging up slowly.

Australia is also leveraged to the fastest growing region in the world, Asia.

Source: Banks enter bubble zone: analysts, Australian Financial Review

Hat Tip: The great Aussie bank share price bubble, FT Alphaville

Related ETFs and Stocks:

- iShares MSCI Australia EFT (EWA)

- Australia and New Zealand Banking Group Ltd (ANZBY)

- Westpac Banking Corp (WBK)

- National Australia Bank Ltd (NABZY)

- Commonwealth Bank of Australia (CMWAY)

Disclosure: No Positions