Many retail investors are coming to the realization that stock picking is a losing game. The folks that lost all or most of their investments during the dot-com bubble of the 190s jumped back into the market thinking it was safe only to take a hit again by the great global financial crisis of 2008-09. At the lows of those dark days some investors sold out their holdings and decided to never again invest in equities. Who could blame them since their trust in the market was shattered not once but twice within a decade and they were shocked to see the bankers and others that created the crisis escaped scot-free. They were disgusted with the regulators such as the SEC who were supposed to monitor the workings of the market but slept at the wheel like a drunk driver and even when they took any action they were more of a slap in the wrist or even worse. Hence the idea that market is a rigged game where only the wealthy could play and multiply their wealth started to take hold.9

In general, if retail investors wanted to invest in the stock market should they pick individual stocks or just go with passive funds?

The answer to the above question is it depends on the type of retail investor.For most retail investors individual stock selections will not work due to the time and effort involved in doing research, monitoring their positions, following up with all the earnings reports and so forth. For these people passive funds are the best option.

In my opinion, people who are financially-literate and willing to do hard work and have time to follow the markets can go about building a portfolio made up of their own stock selections and other assets. Even for these folks winning in the equity markets is not a sure thing since any company can blow up regardless of how much time one spends reading all the publicly-available information. The collapse of bank stocks during the financial crisis is an example of this. However diversification is one strategy that can help to reduce volatility and survive a man-made disasters such as a dot-com or a credit crisis.

From a post titled “Keep Investing Simple” by Barry Ritholtz of chief executive of FusionIQ:

1 Go passive. Here is a dirty little secret: Stock-picking is wildly overrated. Sure, it makes for great cocktail party chatter, and what is more fun than delving into a company’s new products? But the truth is that individual stocks are riskier than broad indices. Managing those positions through the ups and downs is complicated and time-consuming, and most investors lack the skills and discipline to do it well.

Consider this: The world’s greatest stock-pickers got creamed in 2008. And the world’s worst stock-pickers made a killing in 2009.

Your solution is index ETFs, vastly preferable to picking individual stocks. Lower cost, reduced turnover, fewer taxes — and much less risk.

Here is Roger Nusbaum, Portfolio Manager of Your Source Financial on this topic from his recent article aptly titled Not All Stock Picking is Wildly Complex:

I wanted to continue on with a concept I brought up recently about stock picking despite the ruckus it raised. In trying to demystify stock picking a little I said that there are some stocks that can serve as reasonable proxies for decades. They may not “beat” the market but they can be great holds and don’t require a degree in forensic accounting to understand and follow.

While researching on the importance of diversification I came across a fascinating article published in 2009 by William J. Bernstein in Money magazine. From Are stocks a loser’s bet?:

In fact, I wouldn’t be surprised if, after seeing the market go straight up for the better part of two decades, you’re now starting to wonder whether stocks are prone to lose money over time.

Well, guess what? Most stocks do lose money over time.

It’s a little-known and depressing fact, but the majority of individual securities tend to post negative returns over the long run.

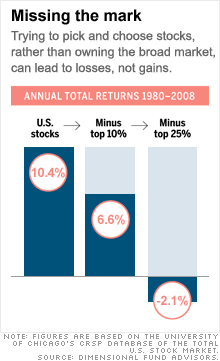

In fact, researchers at the investment management firm Dimensional Fund Advisors found that from 1980 to 2008, the top-performing 25% of stocks were responsible for all the gains in the broad market, as represented by the University of Chicago’s CRSP total equity market database (see the chart at right).

As for the bottom 75% of stocks in the U.S. market, they collectively generated annual losses of around 2% over the past 29 years. (emphasis added)

Source: Are stocks a loser’s bet?, CNN Money

Hence retail investors unable to spend the time and effort needed are better off owning diversified low-cost funds such as ETFs. For investors willing to devote time and continue to learn about equities through market ups and downs stock picking is the best option. Diversification and long-term holding of high quality dividend-paying companies for example can help them attain their goal.

Ten stocks to consider are listed below with their current dividend yields for investors looking to build a portfolio on their own:

1.Company: General Mills Inc (GIS)

Current Dividend Yield: 2.85%

Sector: Food Products

2.Company: The Coca-Cola Co (KO)

Current Dividend Yield: 2.88%

Sector: Beverages

3.Company: Union Pacific Corp (UNP)

Current Dividend Yield: 1.95%

Sector: Railroads

4.Company: Southern Co (SO)

Current Dividend Yield: 4.31%

Sector: Electric Utilities

5.Company: AT&T Inc (T)

Current Dividend Yield: 4.94%

Sector: Telecom

6.Company: Kimberly-Clark Corp (KMB)

Current Dividend Yield: 3.47%

Sector: Household Products

7.Company: Marathon Oil Corp (MRO)

Current Dividend Yield: 1.94%

Sector: Oil, Gas & Consumable Fuels

8.Company: T. Rowe Price Group Inc (TROW)

Current Dividend Yield: 2.01%

Sector: Investment Management

9.Company: Procter & Gamble Co (PG)

Current Dividend Yield: 2.94%

Sector: Household Products

10.Company: Caterpillar Inc (CAT)

Current Dividend Yield: 2.34%

Sector: Machinery

Note: Dividend yields noted are as of Mar 15, 2013

Related ETFs:

- SPDR S&P 500 ETF (SPY)

- Vanguard Dividend Appreciation ETF (VIG)

- SPDR S&P Dividend ETF (SDY)

- iShares Dow Jones U.S. Select Dividend ETF (DVY)

- PowerShares Dividend Achievers ETF (PFM)

- iShares Russell Midcap Index Fund (IWR)

- iShares S&P MidCap 400 Index Fund (IJH)

- iShares Russell Midcap Growth Index Fund (IWP)

- Powershares Dynamic Mid Cap Growth Portfolio Fund (PWJ)

Disclosure: Long GIS