There are many reasons to invest in foreign stocks. In addition to emerging and frontier markets, U.S. investors should have exposure to other developed markets. This is is because companies in other developed countries operate differently with respect to management and other factors and their sales territory is not only limited to their home markets but may also include other markets. For example, many European multinationals such as Nestle(NSRGY), BP Plc (BP), BASF AG(BASFY), Unilever (UL, UN), Honda Motor Co (HMC), etc. have presence in many foreign countries in addition to their home markets. By investing in companies located in other developed countries U.S. investors can gain from their performance which can vary from the performance of their U.S. peers.

Another that should be noted is each developed country has its own unique advantages and disadvantages. Though most European countries struggled in recent years, Germany performed very well since the country’s economy is export-oriented and many German companies excel in their respective fields. For instance. German firms hold leadership positions in the global chemical industry. Though Singapore is a tiny city state, the country benefits strongly from its world-class trade, banking and tourism industries.Hence the economy of Singapore has different characteristics than the U.S. or European economies. Similarly Australia and Canada are mostly resource-based economies compared to the U.S. economy which is highly diversified. So companies in these two countries may perform differently than U.S. companies.

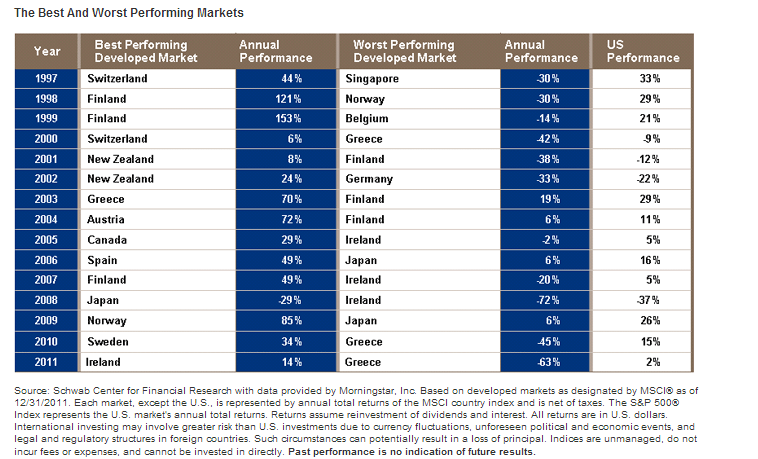

The following table shows the U.S. equity performance against the performance of the best and worst developed markets from 1997 to 2011:

Click to enlarge

Source: Why Invest Internationally?, July 24, 2012, Charles Schwab

During the dot-com boom of the late 90s, U.S. stocks yielded double digit returns in 1997, 1998 and 1999 which was good. However Switzerland returned 44% in 1997 outperforming the U.S. Finland returned an astonishing 121% and 153% in 1998 and 1999 which is much higher than the U.S. returns in the same years.

More recently in 2009 U.S. equities recovered from the global financial crisis lows to yield 26%. But Norway’s performance was even better with returns of 85%.

In 2012, the U.S. S&P 500 was up 13% while Germany’s DAX and Hong Kong’s Hang Seng rose by 22.5% and 20.2% respectively.

Related ETFs:

SPDR S&P 500 ETF (SPY)

iShares MSCI Germany Index Fund (EWG)

iShares MSCI Canada Index Fund (EWC)

iShares MSCI Australia Index Fund (EWA)

iShares MSCI United Kingdom Index (EWU)

iShares MSCI Singapore Index (EWS)

Disclosure: No Positions