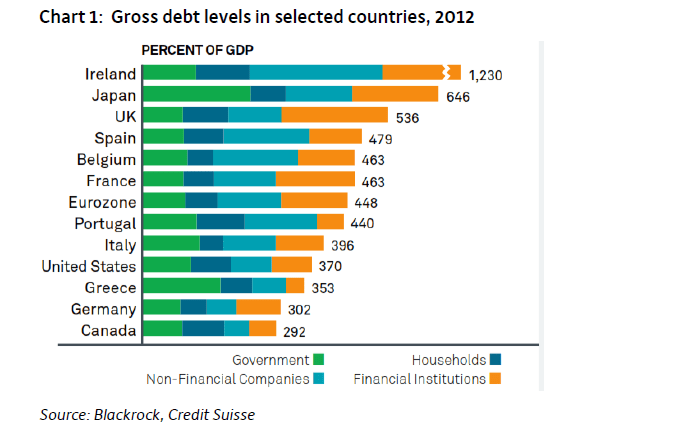

The global financial crisis exposed the big flaw in debt-led growth in most developed countries. The U.S. became the poster child for the world see the harmful effects of how unsustainable debt levels held by individuals, companies and governments alike. Even after the credit crisis debt levels remain still high in many countries. For example, at the end of last year U.S. gross debt stood at 370% of the GDP.This figure includes all the four types of debt shown in the chart below.

The U.S. economy was about $14.0 Trillion in 2011. To put the U.S. Federal government debt in perspective, the total outstanding U.S. public debt is $16,701,250,641,109.6 as of March 7, 2013. Out of this figure, $11.8 Trillion is held by the public and the rest are intra-governmental holdings according data by the U.S. Treasury Department. The U.S. is the largest debtor country in the country and China holds the largest amount of U.S. debt. Nobody knows if this debt will ever be paid to Chinese. The only thing that everyone seem to focus is on for the time being is the interest paid out to the Chinese and other countries every year. Since this interest is only a few billion dollars the U.S. is easily able to pay it without any worries about the principal amount of the loans.

As a result of the sovereign debt crisis in European countries such as Spain, Italy, Portugal and Greece, temporary solutions have been implemented in the past few years to avoid the collapse of the Euro. However debt held by private individuals and corporations have not been reduced much. For example, Spanish households and financial institutions continue to hold high levels of debt from their exposures to the once-vibrant real estate industry.

Niels Jensen of Absolute Return Partners LLP of UK shared some of his thoughts on the debt levels in developed countries in their latest report. From the article:

Overall debt levels remain excruciatingly high (chart 1) and I note with some trepidation that Greece is not even close to being the most indebted nation in the world today. In chart 1 debt from all the four main sectors of the economy have been added together. As experience has taught us, it is total debt that matters. Focusing on government debt alone will lead to bad investment decisions.

Click to enlarge

Without a healthy level of economic growth there is no way that all this debt can ever be repaid, hence the growing focus on nominal GDP growth, so, in that respect, economic growth still matters.

Source: Expect the Unexpected by Niels C. Jensen, The Absolute Return Letter, March 2013

Absolute Return Partners LLP, UK