Effective January 1st of this year the rates on many different types of taxes increased as part of the fiscal cliff deal. However the most of these increases affect only high earners. The majority of the working population are not impacted by most these increases especially taxes related to investments such as capital gains and dividends. In anticipation of higher tax rates in 2013, many companies paid out special dividends or moved the dividend pay dates from first quarter 2013 to late 2012. These payouts primarily benefited insiders and big investors.

However were the actions of such companies justified? Should company highly-paid executives panic like pimple-faced high-school teenagers every time there is a possibility of a tax increase? Or put another way, is there a strong correlation between tax rates and equity returns?

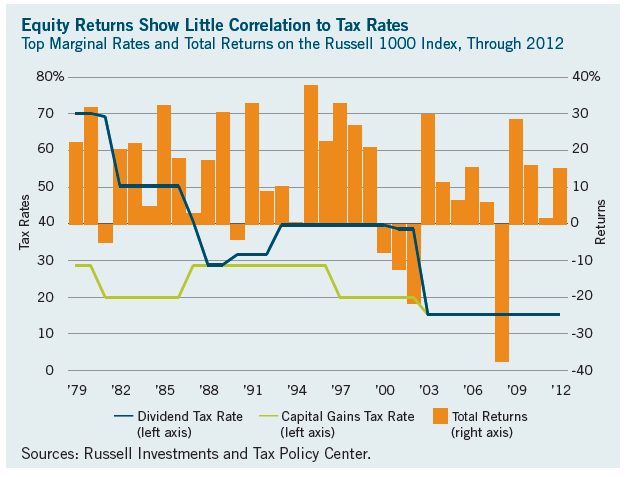

Research shows that the correlation between tax rates and stock returns is very low. While in the short-term there may be a strong correlation, the correlation is pretty much insignificant in the long-term.

From a research report by T.Rowe Price:

While some analysts warn that equity prices, and particularly relatively riskier assets such as small-cap stocks, may be pressured by the boost in the capital gains rate, T. Rowe Price managers say that the past three decades of market history suggest that tax rate changes have had relatively modest effects on equity valuations and dividend policies.

Moreover, investors are encouraged not to focus on any short-term effects as markets adjust over time. In the long run, stock prices are more driven by such fundamental factors as earnings, interest rates, and economic growth than tax changes.

Sudhir Nanda, head of T. Rowe Price’s quantitative equity research, says that since 1980 there have been eight changes in the top tax rate on dividends (including the pre-2003 changes when dividends were taxed at the same rate as ordinary income) and four changes to the top long-term capital gains rate. The overall impact of these changes on equity returns and valuations appears to have been modest.

Click to enlarge

In fact, the S&P 500 soared 27.7% in the 12 months following the 1990 increase in the maximum dividend tax rate (from 28% to 31%), and it gained 5.3% in the 12 months after the 1993 dividend hike (from 31.0% to 39.6%), according to Strategas.

Mr. Nanda also notes that it is “inherently difficult” to measure the impact of tax rate changes as markets react to many different factors, such as the 1990s technology bubble and the recovery from the 2000–2002 and 2007–2009 bear markets. Indeed, the capital gains rate in August 1981 was reduced from 28% to 20%, yet the S&P 500 declined 14% in the following six months amid double-digit interest rates and a double-dip recession.

Source: T.Rowe Price Report, Issue No 118, Winter 2013 , T.Rowe Price

Related ETFs:

SPDR S&P 500 ETF (SPY)

Vanguard Dividend Appreciation ETF (VIG)

SPDR S&P Dividend ETF (SDY)

iShares Dow Jones U.S. Select Dividend ETF (DVY)

PowerShares Dividend Achievers ETF (PFM)

Disclosure: No Positions