I wrote an article last week discussing about the strategy of investing in stocks during a crisis for great returns. This post is a follow up to that article but takes on the benefits of investing in equities for the very long-term. Very long-term can be defined as a time period measured in decades.

From Reasons to Avoid Buying Stocks, and Why You Should Ignore Them in The New York Times:

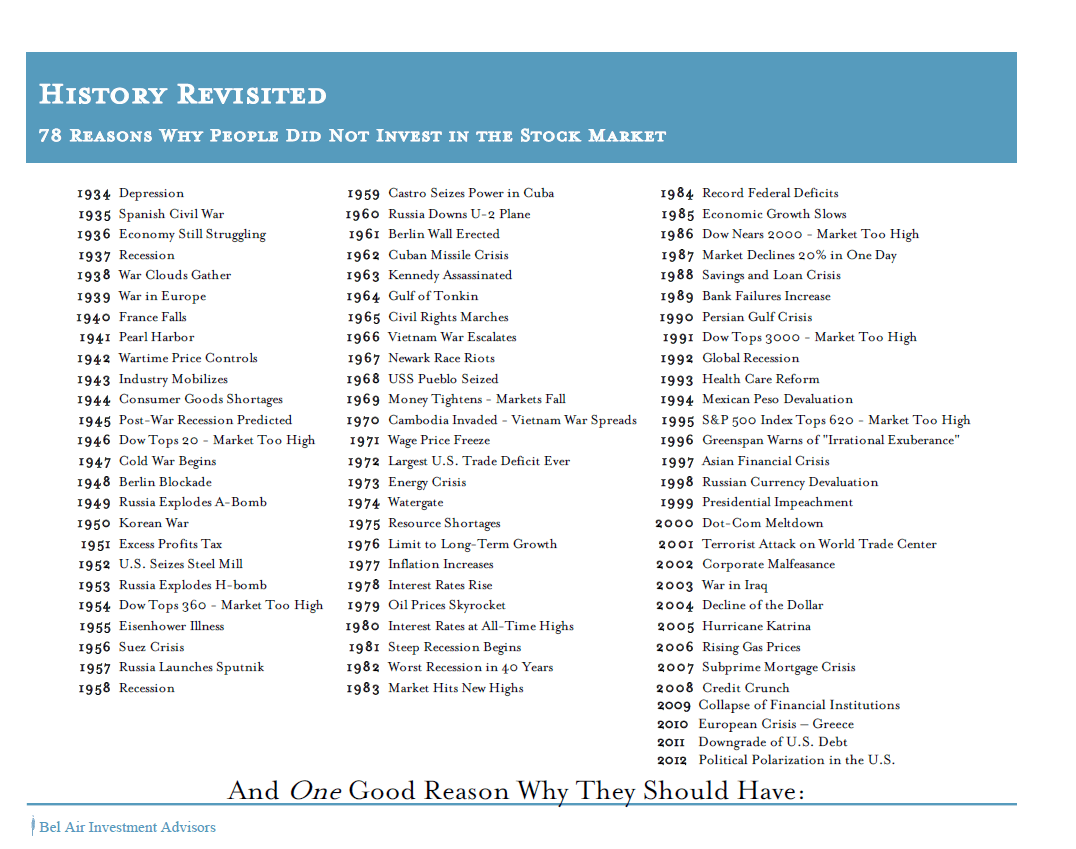

THERE are always reasons not to buy stocks. Investors may think the Dow Jones industrial average is too high, as was the case in 1954 when the index topped 360. In 1941, there was Pearl Harbor. In 1962, the Cuban missile crisis. In 1997, the Asian financial crisis.

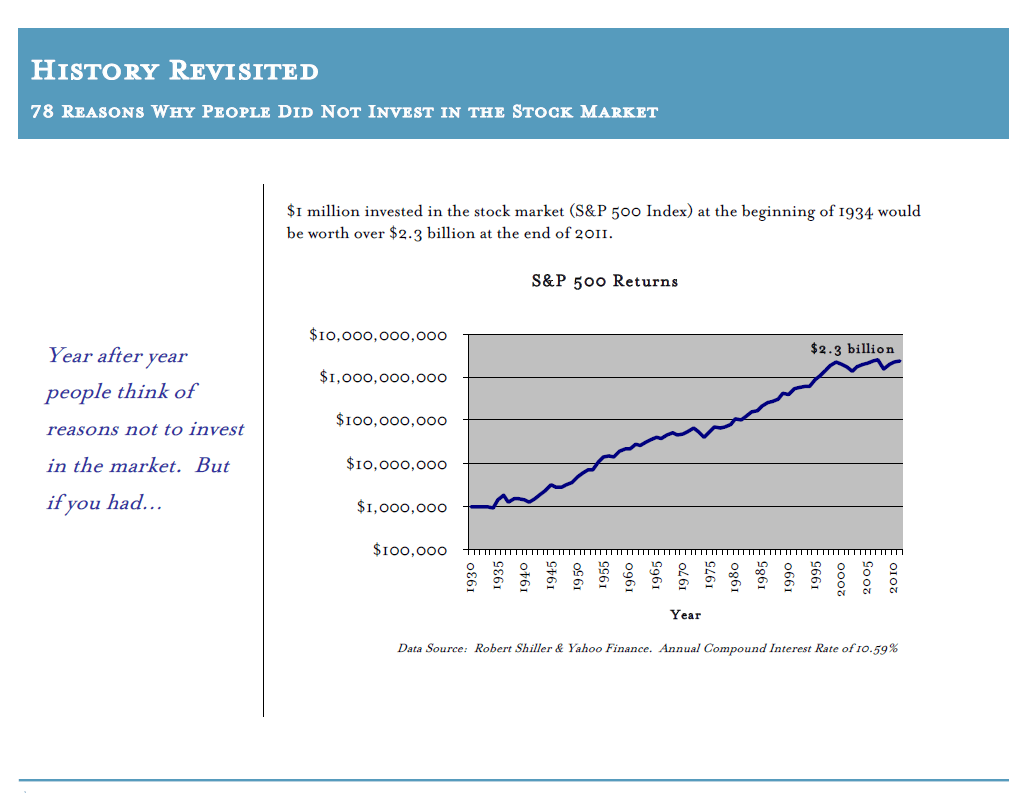

The list, adding up to 78 for each of the years from 1934 to 2012, was compiled by Bel Air Investment Advisors.

But the punch line to this list was that stocks went up by an annual compounded rate of 10.59 percent over those 78 years, with occasional plateaus, and that $1 million invested in 1934 was worth $2.4 billion in 2012.

Click to Enlarge

Source: Reasons to Avoid Buying Stocks, and Why You Should Ignore Them, The New York Times

Data Source: Bel Air Investment advisors

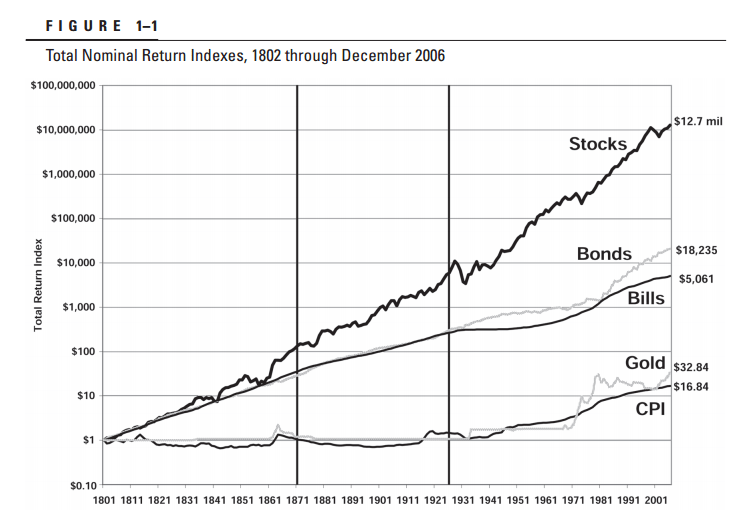

The return calculated in this study based on the S&P 500 is indeed astonishing. Similar studies in the past have shown great returns as well. Here is one chart from the fourth edition of famous book Stocks for the Long Run by Professor Jeremy Siegel of The Wharton School.

A $1 invested in 1801 would have been worth $12.7 million according to his analysis. So investing in equities for the very long-term will yield spectacular returns.

However for most investors this strategy will not work for many reasons. For example, most investors do not hold stocks for many decades. Since very few of us live past the age 100, the idea of investing for centuries is ruled out. Despite these flaws, reviews of the benefits of long-term investing are interesting to follow. While investing for the very long-term is not feasible for most investors, it is a wise idea to hold equity investments for at least five years. One way to do this would be to build a diversified portfolio of dividend-paying well-established companies and reinvesting dividends and other earnings to take advantage of compounding.

Related ETFs:

iShares MSCI Emerging Markets Index (EEM)

Vanguard Emerging Markets ETF (VWO)

SPDR S&P 500 ETF (SPY)

SPDR STOXX Europe 50 ETF (FEU)

SPDR DJ Euro STOXX 50 ETF (FEZ)

Disclosure: No Positions