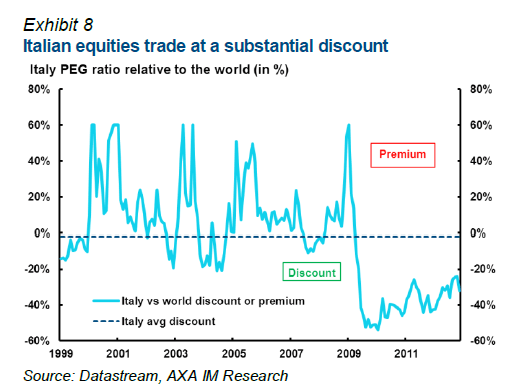

Italy’s benchmark FTSE MIB Index rose 9.04% in 2011. This is lower then other European indices such as Germany’s DAX which had an excellent run. According to a research report by AXA Investment Managers, Italian stocks are trading at a substantial discount relative to their global peers. Though the discount has decreased since the depth of the financial crisis it is still below the average discount.

Click to enlarge

Source: Special 2013 Outlook, AXA Investment Managers

Italy has a lower P/E relative to most PIIGS countries. Italian stocks’ P/E ratio stood at 13.9 on Dec 28, 2011. Portugal, Ireland, Greece and Spain’s P/E ratios were 17.7, 10.4, 14.8 and 12.5 respectively per FT market data.

Italian politics is a mess with the Prime Minister Mario Monti resigning recently and elections due to be held this year. Former Prime Minister billionaire Silvio Berlusconi is planning to run again for office. The economy is in a poor shape as well. From a news report in CNN:

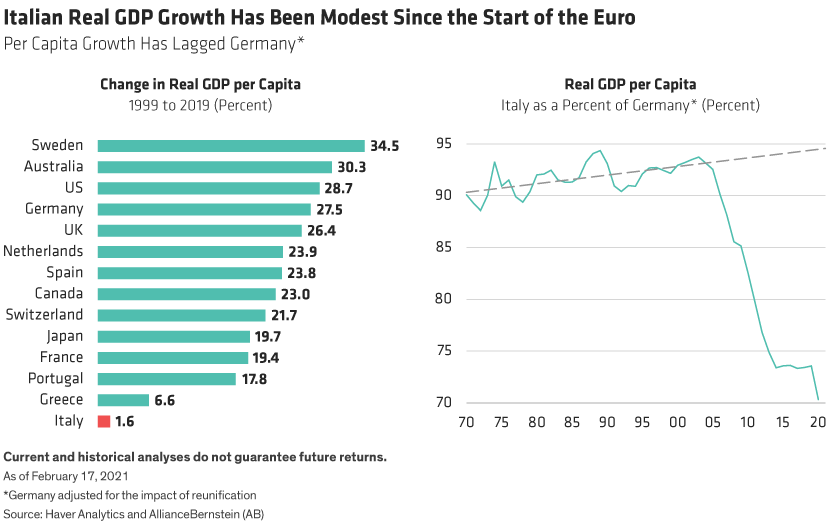

Italy is in a recession, and further belt-tightening will be unpopular with its citizens.

The unemployment rate in Italy rose to 11.1% in October, marking a 13-year high, and the Italian economy has contracted for five consecutive quarters. As of the third quarter, its economic growth was down 2.4% from a year earlier.

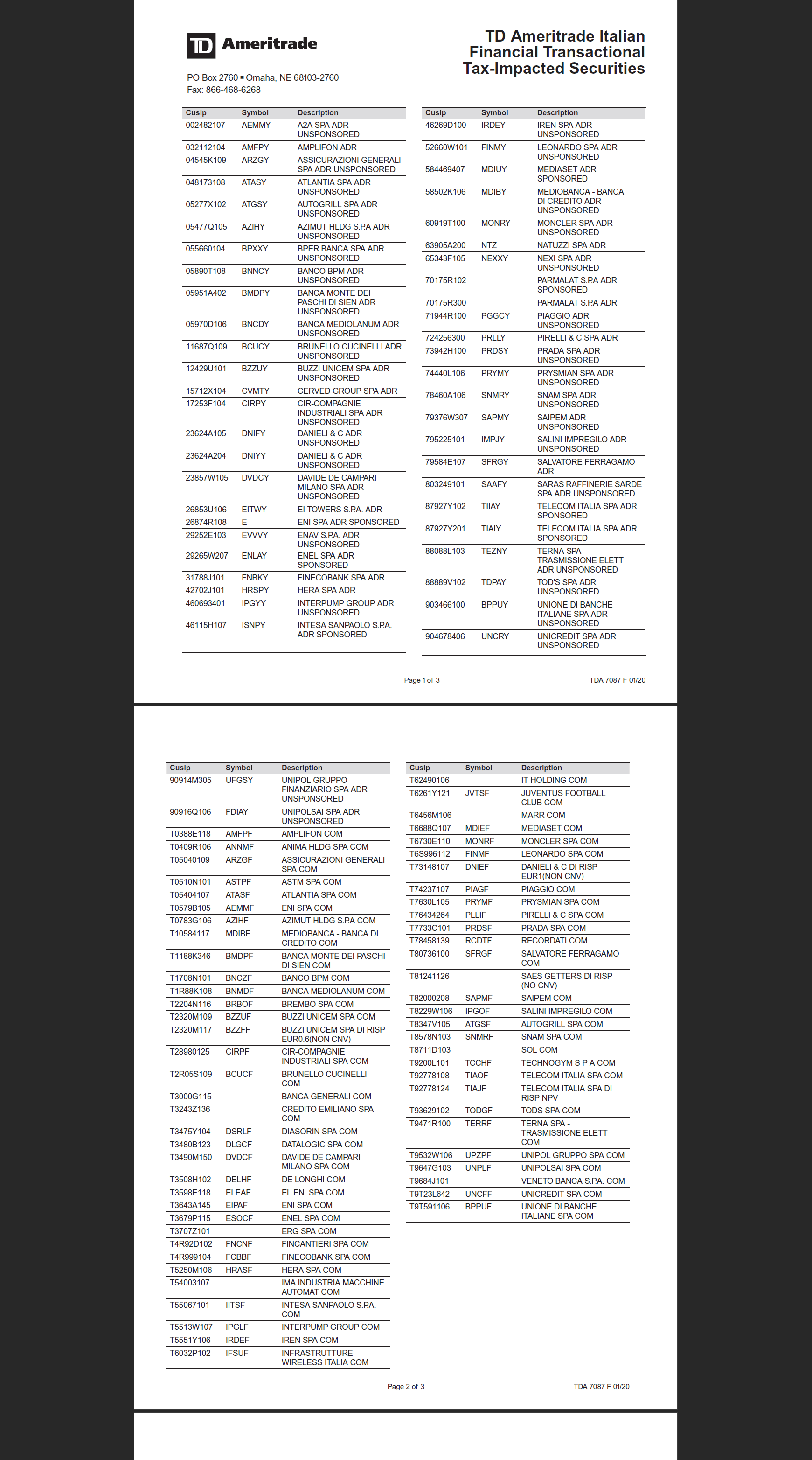

Nine Italian firms that made it to the Fortune Global 500 list in 2012 are listed below with their tickers if available and current dividend yields:

1.Company: ENI Spa(E)

Current Dividend Yield: 5.46%

2.Company: EXOR Group

3.Company: Assicurazioni Generali (ARZGY)

Current Dividend Yield: 1.74%

4.Company: Enel (ENLAY)

Current Dividend Yield: 8.05%

5.Company:UniCredit Group (UNCFY)

Current Dividend Yield: N/A

6.Company: Intesa Sanpaolo (ISNPY)

Current Dividend Yield: 3.54%

7.Company: Telecom Italia (TI)

Current Dividend Yield: 5.96%

8.Company: Poste Italiane

9.Company: Finmeccanica (FINMY)

Current Dividend Yield: N/A

Note:Dividends noted are as of Dec 31, 2012

The iShares MSCI Italy ETF(EWI) has most of the companies noted above in the top 10 holdings. The fund has total assets of $370 Mil. and a distribution yield of 3.28%. As with many country specific ETFs, financials account for over one-fourth of the portfolio.

To answer my title question, I would say that while the whole market is trading at a discount based on technical investors have to be still very selective if willing commit new money on Italian stocks. For example, the integrated utility Enel appears to be strong among European utilities to continue paying dividends this year without cutting payouts or borrowing funds as per a report in The Wall Street Journal.

Disclosure: Long EWI