Financials are the pillars of most major economies. The finance sector is also the key barometer of equity markets.A strong and sustained growth in equity prices is unlikely without the participation of the financials. This is especially true in developed markets where credit plays an important role in the economy.

UK-based Fund manager Sanjeev Shah of Fidelity Special Situations Fund believes equity markets are in the early stages of a bull market. From an article in Trustnet:

The manager believes financials will help to sustain the rally in the short-term, although in the long-run he points to more sustainable themes.

“I think we are in the early stages of a new bull market in equities, and in the short-term I believe financials have the opportunity to continue to provide leadership,” he said.

“However over the longer term it will be themes such as the emerging market consumer, the digital economy and internet which could provide leadership. I believe the commodity bull market is over.”

The manager thinks that fears surrounding financials prior to the crash of 2008 were just; however he adds that times have changed and the unloved sector will continue to strengthen.

“As a result of the financial and eurozone crisis, there has been a lot of concern regarding financials. This was justified given high levels of leverage and the need to write down assets,” he said.

“This led to financials becoming extremely disliked by investors and very cheap in a historical context. Crisis brings opportunity and there will be winners and losers in the new environment. HSBC is a potential winner given its strong capital and funding position.”

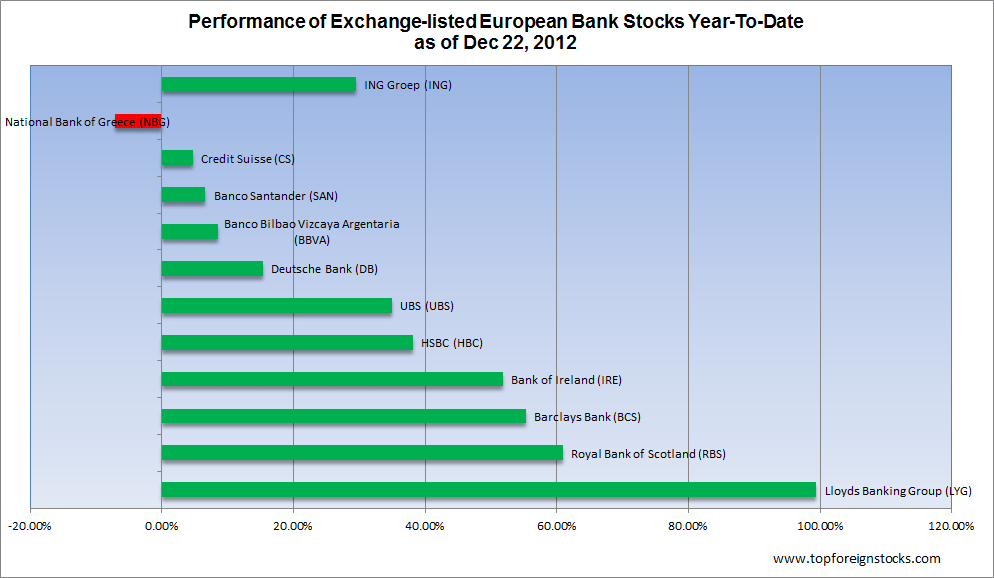

A quick check of European bank stocks trading on the US exchanges shows that financials have indeed recovered and most are up by double-digit percentage this year.

Unlike their US peers, European banks have not yet built a solid capital position and are still in the process of writing off bad assets from their books. However compared to last year most of these banks are showing signs of improvement which is reflected the run in their stock profits. For example, ING Group(ING) has been getting rid of non-core business units in many countries to raise capital. In the U.S. it sold the ING Direct unit to Capital One Financial (COF) last year and in Scotiabank(BNS) acquired its ING Direct Canada unit.

It should be noted that some of the sharp increases in stock prices shown in the chart above are misleading since these stocks jumped from a very base. Llyods Bank (LYG) closed at $3.13 on Friday which is nowhere near where it used to trade before the global financial crisis. Generally stocks under $10 are highly volatile and can easily be moved around even with light volumes.The same can be said of some of the other banks shown as well. In addition, many of these banks currently pay much reduced dividends than before the crisis and some banks such as ING have still not reinstated their dividend payments which were suspended before. Hence from an investment perspective, it is not clear if the recovery in financials is indicative of a start of a bull market in Europe.

Disclosure: Long ING, SAN, BBVA, LYG