The U.S. has the world’s largest economy with a GDP of about $15.0 Trillion in 2011.Finance, Insurance and Real Estate collectively known as the FIRE sector are the some of the major industries in the country.During 2008-2009 the financial and real estate sectors triggered the financial crisis bringing the global economy almost to its knees.

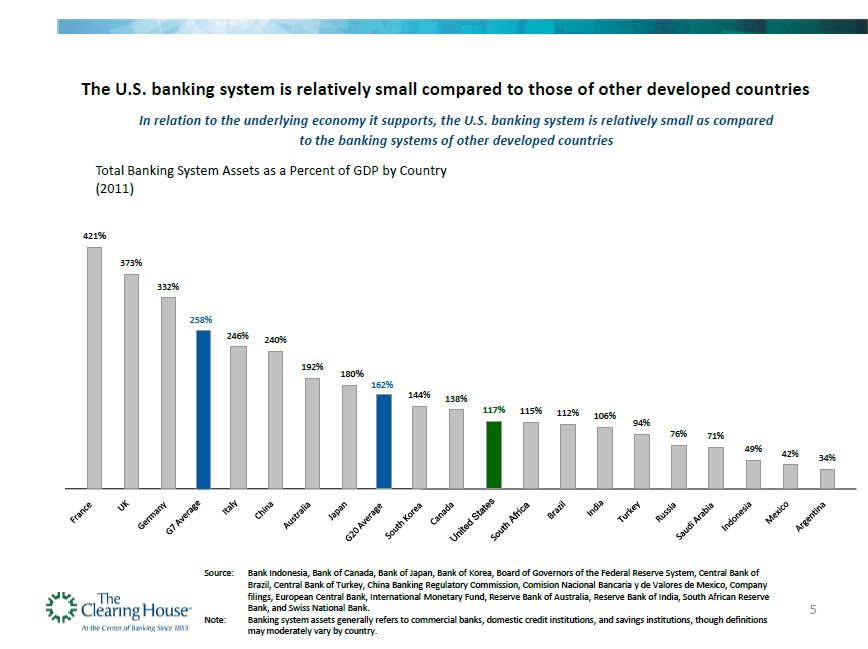

Though many banks failed and many are still struggling to survive, the U.S. banking system as whole has stabilized and is in a better position relative to the banking system of peer countries. Specifically, the banking system in the U.S. is less concentrated than those of other developed countries according to a research report by The Clearing House. For example, the U.S. banking system is small at 117% of the GDP compared to 332% for Germany, 373% for UK and 421% for France. In terms of assets as a percentage of GDP, the U.S. is the lowest among the G-7 countries as shown in the chart below:

The U.S. banking system is also less concentrated than the banking systems of peer countries. Based on assets held, the top five banks held 56% of the country’s total banking assets which is the least among the G-7 countries.When the largest five banks’ assets are compared as a percent of GDP, they are relatively small as well.

Source: SCALED TO SERVE: THE ROLE OF COMMERCIAL BANKS IN THE U.S. ECONOMY, July 2012, The Clearing House

Another interesting fact noted in the report is that the banking system is also less concentrated relative to other industries such as telecom and auto makers.

After the crisis, the Dodd-Frank Act and scores of other regulations implemented have made the US banking system more stable and strong.On the other hand, the banking system in Europe is not only concentrated but also still fragile since banks failed to raise enough capital after the crisis and earnings have not rebounded strongly. The ongoing European crisis is also not helping the banks. Hence U.S. banks offer better investment opportunities than many banks in Europe.

Since hundreds of bank stocks trade on the markets, investors have to be very selective in picking potential winners. From a Zacks Investment Research research report this week:

Though the improving performance of banks seems already priced in and there remains substantial concerns, the sector’s performance in the upcoming quarters should not disappoint investors.

Specific banks that we like with a Zacks #1 Rank (short-term Strong Buy rating) include ViewPoint Financial Group (VPFG), BofI Holding(BOFI), Preferred Bank (PFBC), TriCo Bancshares (TCBK), Cardinal Financial Corp. (CFNL), M&T Bank Corporation (MTB), Macatawa Bank Corp. (MCBC) and Tompkins Financial Corporation (TMP).

Stocks in the U.S. banking universe with a Zacks #2 Rank (short-term Buy rating) currently include BOK Financial Corporation (BOKF), Texas Capital BancShares (TCBI), Central Pacific Financial (CPF), Fidelity Southern Corporation (LION), BankUnited, Inc. (BKU), First Business Financial Services (FBIZ) and Washington Trust Bancorp (WASH)

Investors may want to avoid developed European banks and instead focus their attention on banks in the Scandinavian countries.They can also consider the five Canadian banks trading on the US markets.

Disclosure: Long MCBC