The S&P 500 is up 12.4% year-to-date based on price returns. With dividends reinvested the return jumps to 14.89%. The current dividend yield for the index is 2.23%. Despite rising corporate profits U.S. firms prefer to retain earnings than increase payouts.

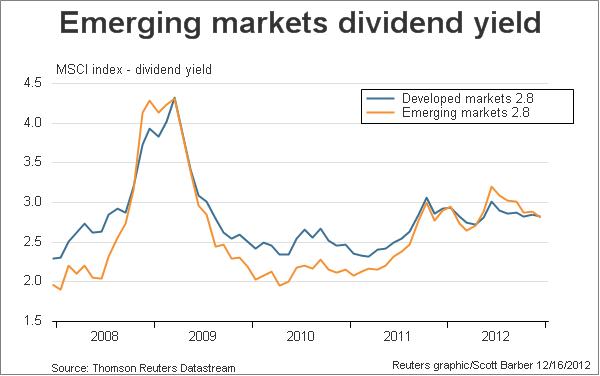

Compared to this paltry yield, many foreign markets pay much higher yields. While in the past other developed markets have had higher dividend yields, currently many emerging markets also have dividend yields comparable to that of the U.S. market.In some emerging countries dividend yields are actually higher than in the U.S. market. Naturally investors looking for better income on their investments are increasingly venturing into emerging stocks.

Some of the reasons for investing in emerging equities for income are below:

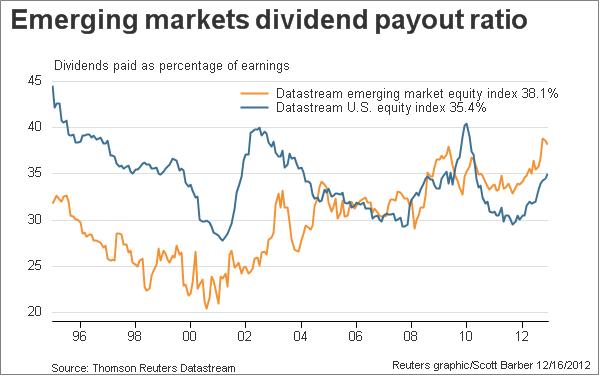

- Emerging market firms have changed their dividend policies in recent years. This year they were projected to pay 35% of their retained earnings according to a Reuters article earlier this year.

- In some countries such as South Africa and Taiwan the payout ratio is as high as 45-50%.

- The dividend culture in Brazil and Taiwan is almost similar to the dividend yield in developed markets.

- The gap in Yields and Payout ratios between developed and emerging markets is shrinking as shown in the charts below:

Source: Emerging markets join the dividend race, Reuters

- Governments in Russia and India are asking state-owned enterprises to payout a larger portion of their profits as dividends as the state stands to earn much-needed funds.

- Of the more than 800 stocks in the MSCI Emerging Markets Index, over 700 currently pay a dividend. 500 of these companies have increased dividends annually for the past five years.

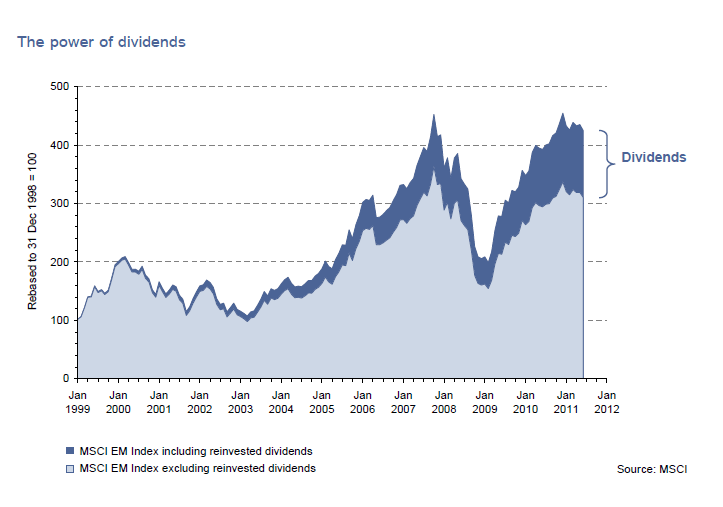

- Emerging market dividends have grown at an annual compounded rate of 14% over the last 10 years, much faster than developed markets.

- The following chart shows the growing significance of dividends in emerging market total returns:

Source: Charlemagne Capital, UK

- The current dividend yields of select emerging markets are listed below:

Brazil – 3.8%

China – 3.7%

Chile – 3.1%

Malaysia – 3.2%

Russia – 4.2%

South Africa – 3.5%

Taiwan – 3.3%

- Among emerging countries, India and South Korea are poor dividend payers.

How to invest in emerging market dividend equities?

Most of the emerging dividend stocks do not trade on the US markets.Hence the easiest way to gain exposure to these equities is to invest via ETFs.

The iShares Emerging Markets Dividend ETF (DVYE) and SPDR® S&P Emerging Markets Dividend ETF (EDIV) are two of the options. Investors’ attraction towards emerging dividend stocks is confirmed by the strong growth in asset sizes of these ETFs since the beginning of the year. The 30-Day SEC Yields are 5.37% and 6.79% respectively.Taiwan and South Africa are among the top countries in the funds.

For investors looking to invest in emerging dividend stocks directly ten options are listed below:

1.Company: PetroChina Co Ltd (PTR)

Current Dividend Yield: 3.58%

Sector:Oil & Gas Operations

Country: China

2.Company: CPFL Energy INC (CPL)

Current Dividend Yield: 6.96%

Sector: Electric Utilities

Country: Brazil

3.Company: Malayan Banking Bhd (MLYBY)

Current Dividend Yield: 7.21%

Sector: Banking

Country: Malaysia

4.Company: Sasol Ltd (SSL)

Current Dividend Yield: 4.91%

Sector:Chemical Manufacturing

Country: South Africa

5.Company:Banco Bradesco SA (BBD)

Current Dividend Yield: 3.44%

Sector: Banking

Country: Brazil

6.Company: Corpbanca (BCA)

Current Dividend Yield: 7.52%

Sector: Banking

Country: Chile

7.Company: Taiwan Semiconductor Manufacturing Co Ltd (TSM)

Current Dividend Yield: 2.93%

Sector:Semiconductors

Country: Taiwan

8.Company: Philippine Long Distance Telephone Co (PHI)

Current Dividend Yield: 4.71%

Sector:Telecom

Country: Philippines

9.Company:Companhia Energetica de Minas Gerais Cemig (CPL)

Current Dividend Yield: 14.09%

Sector: Electric Utilities

Country: Brazil

10.Company:Banco do Brasil SA (BDORY)

Current Dividend Yield: 7.72%

Sector: Banking

Country: Brazil

Note: Dividend Yields noted are as of Dec 14, 2012

Disclosure: Long BCA, BBD