The long-term capital gains tax rate is currently at 15%. This rate was implemented as part of the tax cuts package during the Bush administration and is set to expire on Dec 31, 2012. The long-term capital gains rate is applied on gains realized from stocks held for over one year 60 days.

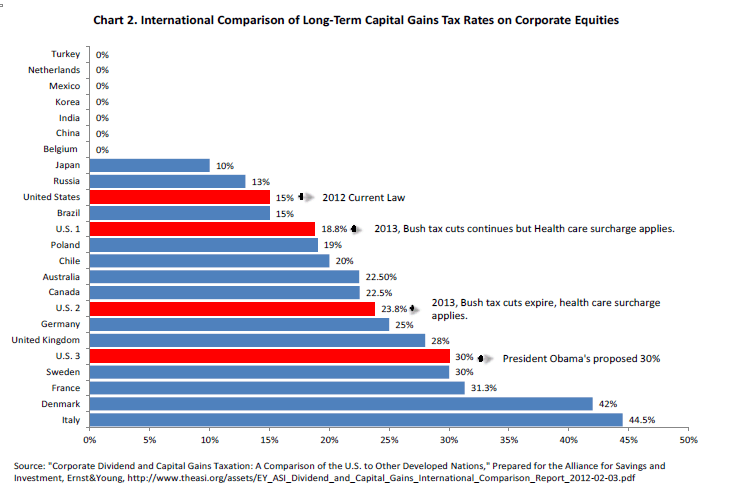

Though the 15% rate seems low, it is unfavorable when compared with that of other major countries according to a testimony by Pınar Çebi Wilber, Ph.D., Economist of the American Council for Capital Formation to the Joint Hearing House Committee on Ways and Means and Senate Committee on Finance. Changes to the long-term capital gains tax rate can potentially take three different ways as indicated by U.S. 1, U.S. 2 and U.S. 3 in the chart below:

Click to enlarge

Source: The Impact of Raising Tax Rates on Individual Capital Gains by Pınar Çebi Wilber, Ph.D.Economist, American Council for Capital Formation

- In the scenario 1, the Bush tax cut rate will continue at 15% but an investment surtax of 3.8% will be added for all boosting the rate to 18.8%.

- In the second scenario, the Bush tax cuts expire and the capital gains tax rate will jump to 20%. This is the same rate that was in effect during President Bill Clinton. With the addition of 3.8% surcharge for Obamacare, the final tax rate will be 23.8%. During his election campaign, Mr.Obama proposed to increase the long-term capital gains tax rate to 20% for high income earners. This group represents people earning $200,000 or $250,000 for married couples.

- The third scenario is the worst case possible. Under this scenario, Mr.Obama proposed to raise the capital gains tax rate to 30% for many taxpayers using the “Buffett rule”. This rule would apply to people making more than $1 million.

Dr. Wilber testified that the 30% tax rate would make the U.S.the fifth highest after Italy, Denmark, France and Sweden. Higher capital gains tax rate would adversely affect the competitiveness of the U.S. and make the country less attractive to foreign investors.

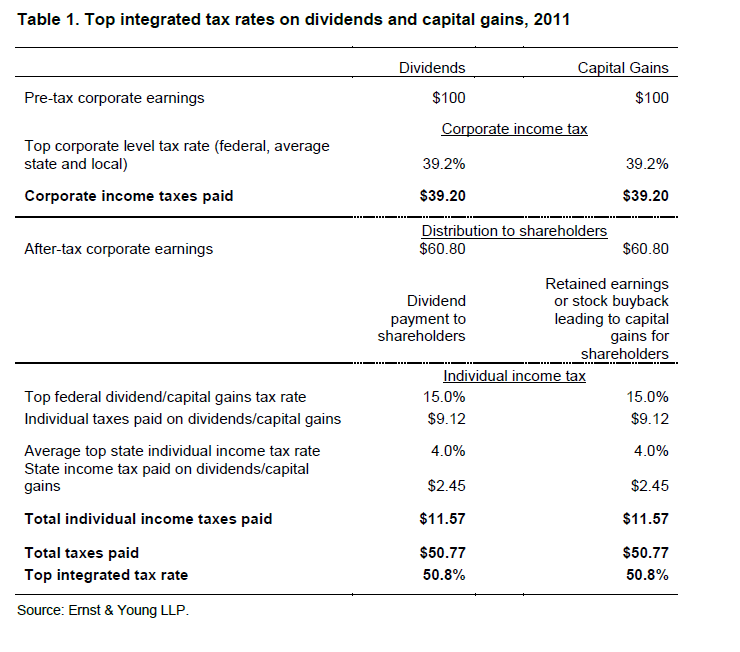

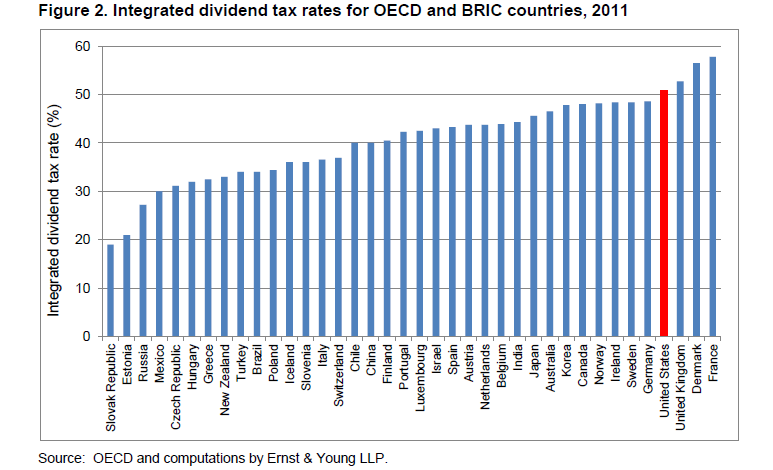

The top dividend tax rate on qualified dividends is now at 15.0%. This rate is also much higher when it is bench-marked against the rate of other countries according to a research study by Ernst & Young. Instead of using the qualified dividend tax rate they have used a rate called the “integrated dividend tax rate”. The calculations for this new rate of tax measurement is shown in the table below:

The U.S. integrated dividend tax rate at 50.0% ranks the country at number four with only France, Denmark and UK having higher rates.

Click to enlarge

Source: Corporate Dividend and Capital Gains Taxation: A comparison of the United States to other developed nations, Drs. Robert Carroll and Gerald Prante, Ernst & Young LLP, February 2012