The Economist magazine has published a special report on why France could be the biggest danger for the Euro. French politicians have denounced the report with one minister calling the report “absurd and groundless“. However most people, including myself, would agree with the substance of the Economist report.

From “The time-bomb at the heart of Europe“:

As our special report in this issue explains, France still has many strengths, but its weaknesses have been laid bare by the euro crisis. For years it has been losing competitiveness to Germany and the trend has accelerated as the Germans have cut costs and pushed through big reforms. Without the option of currency devaluation, France has resorted to public spending and debt. Even as other EU countries have curbed the reach of the state, it has grown in France to consume almost 57% of GDP, the highest share in the euro zone. Because of the failure to balance a single budget since 1981, public debt has risen from 22% of GDP then to over 90% now.

The business climate in France has also worsened. French firms are burdened by overly rigid labour- and product-market regulation, exceptionally high taxes and the euro zone’s heaviest social charges on payrolls. Not surprisingly, new companies are rare. France has fewer small and medium-sized enterprises, today’s engines of job growth, than Germany, Italy or Britain. The economy is stagnant, may tip into recession this quarter and will barely grow next year. Over 10% of the workforce, and over 25% of the young, are jobless. The external current-account deficit has swung from a small surplus in 1999 into one of the euro zone’s biggest deficits. In short, too many of France’s firms are uncompetitive and the country’s bloated government is living beyond its means.

After reading the full report I was curious to see how the French equity market has performed over the years and how it compares with the performance of equity market of Sweden.

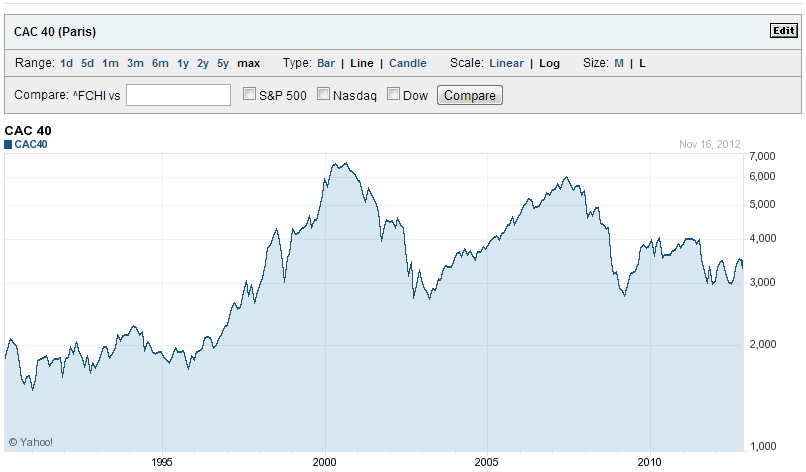

The long-term return of the CAC-40 index is shown below:

Click to enlarge

Source: Yahoo Finance

During the period shown above, the S&P 500 has performed much better than the CAC-40.

The MSCI Index returns for France and Sweden are shown below:

[table “50” not found /]

Source: MSCI

Swedish stocks have have yielded higher returns than French stocks as measured by the respective MSCI indices.

The difference in equity markets’ performance is due to many reasons including the fact that Sweden does not use the Euro as its currency though the country is part of the EU. Hence unlike the French economy, the Sweden was not affected heavily due to the recent European fiscal crisis. However the Euro crisis does not account for the average performance of the French equity market over longer periods such as the 10-year return shown above.

As the Economist reports points out, France has many structural problems that the country’s socialist populist leaders have failed to solve for many years now. The country’s banking system was severely affected during the global financial crisis and French banks have still not recovered to pre-crisis levels. Though Swedish banks were also affected during that crisis, most of them recovered and are in much better shape than their French peers. It should also be noted that Sweden did a complete overhaul and rebuilt its banking system after the banking crisis in early 1990s. Sweden took bold and intelligent steps to rescue the industry as opposed to simply handing out billions to the bankers. The so-called “Swedish Model” has been praised by many economists include Nobel Laureate Paul Krugman.

From the September 2008 New York Times article Stopping a Financial Crisis, the Swedish Way:

Sweden did not just bail out its financial institutions by having the government take over the bad debts. It extracted pounds of flesh from bank shareholders before writing checks. Banks had to write down losses and issue warrants to the government.

That strategy held banks responsible and turned the government into an owner. When distressed assets were sold, the profits flowed to taxpayers, and the government was able to recoup more money later by selling its shares in the companies as well.

Sweden offers betters prospects for equity investments than France. With a diverse economy, Sweden offers plenty of companies to invest in especially in the banking and industrial sectors.

How to invest in Swedish Stocks?

Ten Swedish ADRs trading on the US markets are listed below with their current dividend yields:

1.Company: Nordea Bank AB (NRBAY)

Current Dividend Yield: 4.11%

Sector: Banking

2.Company: Swedbank (SWDBY)

Current Dividend Yield: 4.48%

Sector: Banking

3.Company: Electrolux (ELUXY)

Current Dividend Yield: 3.95%

Sector: Household Goods

4.Company: Volvo (VOLVY)

Current Dividend Yield: 3.38%

Sector: Industrial Engineering

5.Company: SKF (SKFRY)

Current Dividend Yield: 3.57%

Sector: Industrial Engineering

6.Company: Svenska Handelsbanken (SVNLY)

Current Dividend Yield: 4.29%

Sector: Banking

7.Company: Swedish Match (SWMAY)

Current Dividend Yield: 2.88%

Sector:Tobacco

8.Company: Teliasonera AB (TLSNY)

Current Dividend Yield: 6.52%

Sector: Mobile Telecom

9.Company: H&M Hennes & Mauritz (HNNMY)

Current Dividend Yield: 4.40%

Sector: General Retailer

10.Company: Scania Aktiebolag (SVKBY)

Current Dividend Yield: 3.92%

Sector:Industrail Transports

Note: Dividend yields noted are as of November 16, 2012

Svenska Handelsbanken(SVNLY) is the world’s greatest stock in term of returns.

Since most of the Swedish companies trade on the OTC markets in the U.S., the iShares Sweden ETF (EWD) offers a simpler way to access the Swedish market. Most of the companies noted above are in the fund’s portfolio and the fund has an annual dividend yield of 3.45%. The 10-year market return of the ETF as of 10/31/2012 is 14.40%.

Disclosure: Long SWDBY