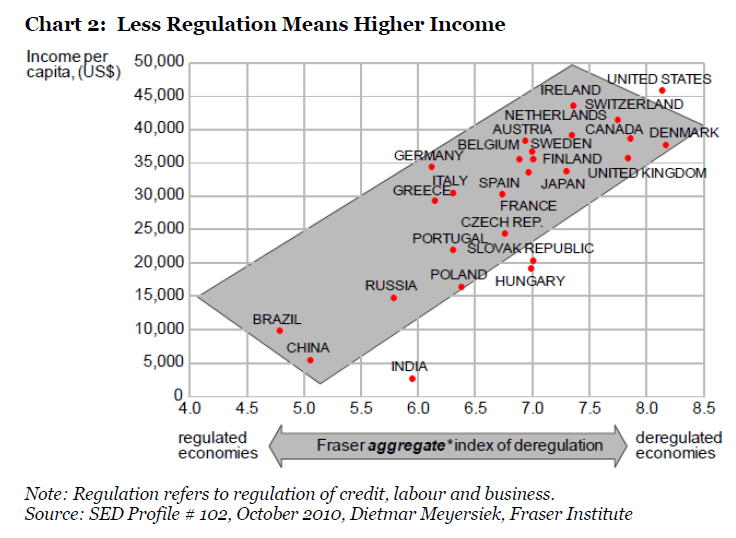

A research study by The Fraser Institute of Canada in 2010 confirmed that a country’s incentive structures which include variables such as labor market flexibility, economic freedom, the quality of the legal system and the intrusiveness of the government into the business sector has a significant impact on wealth and income. More specifically the study found that lower regulation leads to higher income and vice versa.

The following chart shows the relationship between regulation and income:

Click to enlarge

Via The Absolute Return Letter, September 2012, Absolute Return Partners LLP

The highly regulated BRIC countries have lower income.Germany has more regulation than other developed European countries. Portugal, Greece and Italy are just slightly better than BRIC counties in terms of regulations. For example, labor laws in Italy are some of the most restrictive anywhere in the world. From an article in The Wall Street Journal:

Italy’s 1970 labor laws gave legal credence to the idea of the “posto fisso,” or lifetime job, an institution that has been blamed recently for harming productivity growth and discouraging business investment.

The U.S. has the highest income per capita due to the highly de-regulated economy. The government rarely gets involved in the operations of businesses and both the political parties adhere to the belief that less state intervention in the private sector is better. Hence most the regulatory agencies exist to make sure that the markets are operating efficiently and leave the industries to self-regulate themselves through industry-funded groups. This includes some of the major agencies such as the SEC, CTFC and other alphabet soup of government entities at the federal and state levels. Low regulations and the ability to hire and fire workers allow companies to thrive which in turn leads to higher income per capita at the national level. The flexible labor market keeps the economy dynamic in the sense that companies can lay off workers when the economy is in contraction mode and hire them when needed.