Many major European indices have lagged the performance of the S&P 500 this year. Due to the ongoing fiscal crisis in Spain, Greece, Italy and other countries investors are apprehensive of investing in European stocks. Similar to U.S. companies, European companies are also in strong financial health as earnings reached record-high levels though they have slightly moderated in the recent quarters. This is not surprising since though many of these firms are based in Europe they have a strong presence in other countries especially in emerging countries. Hence their earnings are highly dependent on overseas markets than their domestic markets.

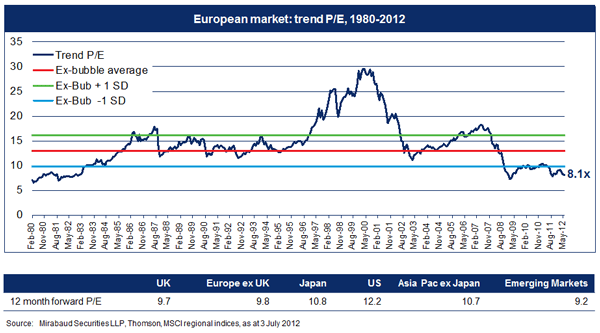

In addition to strong balance sheets, European companies are also attractive now based on P/E ratios according to an article in Citywire. European stocks are trading well below their historical P/E ratios as shown in the chart below. Based on the 12 month forward P/E ratio also Europe is the cheapest compared to the major developed markets. Once the macroeconomic concerns die down there is significant room for growth in multiples.

Despite fear-mongering by the media, the Euro is unlikely to collapse and European companies will continue to remain strong. Mark Mobius, head of emerging markets at Templeton Investments was quoted in an article this week regarding this subject. From the article:

Mobius, who manages the £1.9bn Templeton Emerging Markets fund and has in recent years launched frontier markets and Africa funds – investing in the riskiest economies in the world – says that investors are shooting themselves in the foot with their risk-averse nature.

“The popular press is biased towards Europe and towards the world economy but the numbers don’t warrant that,” he explained.

“We are facing a long process of reform in Europe, but it will take place and Europe will emerge much stronger than it is now.”

Source: 10 reasons to consider investing in Europe: a special report, Citywire, UK

Ten European companies with exposure to countries outside of the continent are listed below together with their current dividend yields:

1. Company: Nestle SA (NSRGY)

Current Dividend Yield: 3.34%

Sector: Beverages (Nonalcoholic)

Country: Switzerland

2. Company: Unilever NV (UN)

Current Dividend Yield: 3.43%

Sector: Food Processing

Country: The Netherlands

3. Company:Danone SA (DANOY)

Current Dividend Yield: 2.93%

Sector: Food Processing

Country: France

4. Company: Diageo PLC (DEO)

Current Dividend Yield: 2.45%

Sector: Beverages (Alcoholic)

Country: The UK

5. Company: Tesco PLC (TSCDY)

Current Dividend Yield: 4.26%

Sector: Retail (Grocery)

Country: The UK

6. Company: Siemens AG (SI)

Current Dividend Yield: 3.89%

Sector: Electronic Instruments & Controls

Country: Germany

7. Company: Novo Nordisk A/S (NVO)

Current Dividend Yield: 1.59%

Sector: Biotechnology & Drugs

Country: Denmark

8. Company: Fresenius Medical Care AG (FMS)

Current Dividend Yield: 1.20%

Sector: Healthcare Facilities

Country: Germany

9. Company: ABB Ltd (ABB)

Current Dividend Yield: N/A

Sector: Electronic Instruments & Controls

Country: Switzerland

10. Company: BASF SE (BASFY)

Current Dividend Yield: 3.91%

Sector: Chemical manufacturing

Country: Germany

Note: Dividend yields noted are as of September 28, 2012

Disclosure: Long ABB