The current U.S. corporate tax rate at approximately 40% is among the highest in the world. This figure includes the marginal federal corporate income tax rate of 35% and state and local taxes according to KPMG. As many U.S. companies are multinationals with strong presence in overseas markets, some of them earn more profits abroad than in the US. According to one estimate, just 70 U.S. firms hold $1.2 trillion in profits in foreign countries.Companies have stashed such huge amount of funds abroad because if they are repatriated back to the U.S., Uncle Sam will charge the same high corporate tax rate on them. Hence for many years now companies have been reluctant to repatriate profits firm abroad. Since the great recession U.S multinationals have lobbied for a tax holiday on profits earned abroad. But Congress has not yet embraced the proposal so far.

In addition to the high corporate tax rate, the U.S. is one of the few OECD nations that does not follow the territorial tax

system. Under this system,corporations pay a very law tax on repatriated profits. 27 of the 34 OECD countries follow this

system with tax deductions of 95% to 100% on foreign source dividends.Hence a reduction in the taxes on repatriated

profits would put the U.S. closer to the territorial tax system.

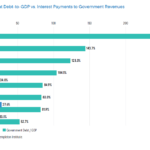

Click to enlarge

Source: The Need for Pro-Growth Corporate Tax Reform, Repatriation and Other Steps to Enhance Short-and Long-Term Economic Growth. Prepared for the U.S. Chamber of Commerce, by Douglas Holtz-Eakin, August 2011

For individuals, the U.S. is one of the only seven OECD countries that levies taxes on worldwide income and not just income earned in the U.S. As shown in the chart above, the U.S. also has the highest tax rate among the seven OECD countries that levy taxes on worldwide income.

From the IRS site:

If you are a U.S. citizen or resident alien, the rules for filing income, estate, and gift tax returns and paying estimated tax are generally the same whether you are in the United States or abroad. Your worldwide income is subject to U.S. income tax, regardless of where you reside.

Hence a U.S. citizen working in Dubai or Timbuktu or Sao Paulo is required by law to file income and pay taxes. However a tax credit is allowed in order to prevent to double taxation. Currently the US has tax treaties with 65 countries to help reduce the burden of double taxation.

So the U.S. tax system has to be amended to bring the tax rates inline with other developed countries for both individuals and corporations.

For more details on US Tax Treaties, please go to the following IRS web sites:

Publication 901 (04/2012), U.S. Tax Treaties

United States Income Tax Treaties – A to Z