The insurance industry in the U.S. is dividend into Property & Casualty (P&C) and Life/Health Insurance companies. In other countries, the industry is split into life and non-life or general insurance companies.The insurance industry employs over 2.2 million or about 2% of the total U.S. workforce in the private sector .There were about 2,689 P&C companies and 1,061 Life&Health companies in 2010 in the U.S. according to the National Association of Insurance Commissioners (NAIC).

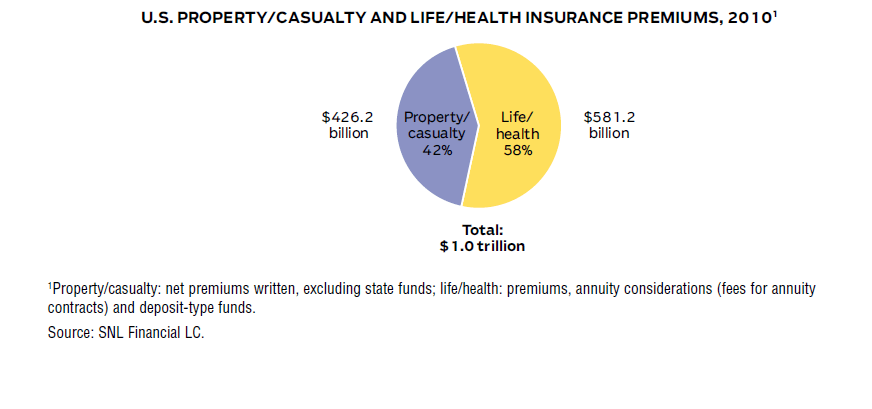

Life and Health insurers employ more workers than P&C insurers. In addition, because health care is expensive and health care costs continue to soar year after year, life and health insurance companies collect more premiums than the P&C companies. In total, Americans pay about a $1.0 Trillion in insurance premiums each year.

The following graph shows the total industry premiums in 2010:

Click to enlarge

Source: 2012 Financial Services Fact Book 2012 by Insurance Information Institute and Financial Services Roundtable.

To put the $1.0 Trillion in perspective, the world insurance premiums (excluding U.S.) stood at $4.34 Trillions in 2010.Life insurance premiums account for a higher portion than non-life premiums worldwide. In fact, in many countries such as France, Germany and Japan people invest a large chunk of their retirement savings in life insurance policies. The U.S. GDP was about $15.0 Trillion in 2011. Since the insurance sector is part of the financial services industry and the financial industry plays a major role in the U.S. economy, the $1.0 Trillion insurance industry premiums is reasonable.