Equity investors often wonder if stocks are better performers than bonds. This question takes on higher importance especially during times of high volatility in equity markets or when the return on equities is negligible or negative. For the decade ending in 2010, U.S. stocks were basically flat as measured by the S&P 500 while bonds yielded decent returns.

I recently came an interesting research report titled “Will Bonds Outperform Stocks over the Long Run? Not Likely” by Peng Chen, CFA of MorningStar Investment Management and Roger Ibbotson, Ph.D. of Yale School of Management and Ibbotson Associates

The following are some of the key takeaways from the report:

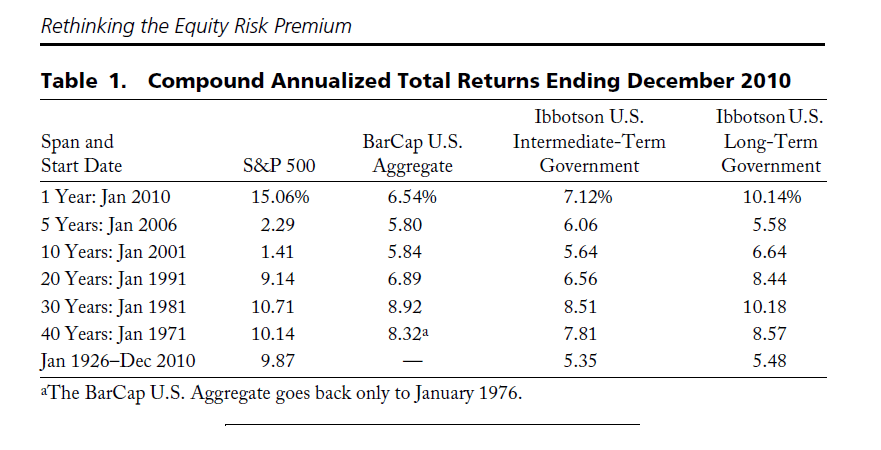

1.The table below shows the performance of the S&P 500 Index, the Barclays Capital U.S. Aggregate Bond Index, the Ibbotson U.S. Intermediate-Term Government Bond Index, and the Ibbotson U.S. Long-Term Government Bond Index over various time periods:

Click to enlarge

The average annual stock returns have been poor relative to bonds for the past 10 years and mediocre for the past 20, 30, and even 40 years relative to bonds.

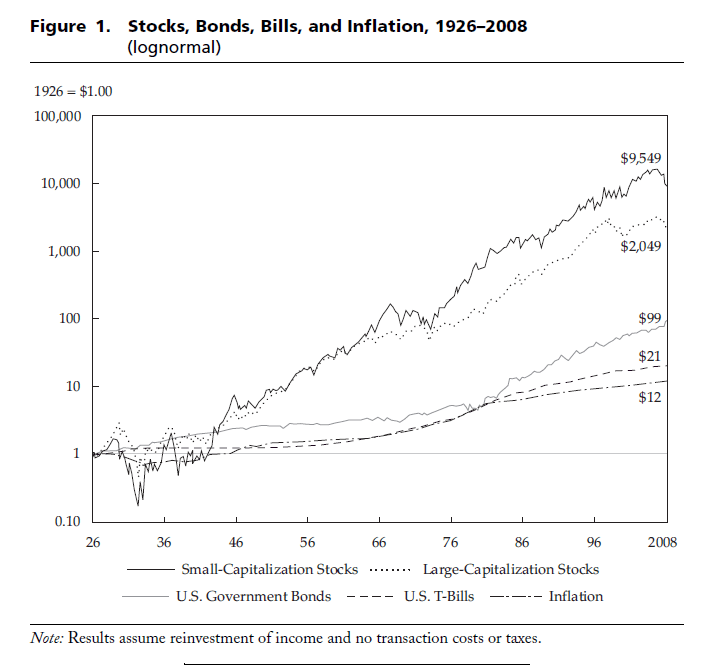

2.Over the very long term however, stocks easily beat bonds. The chart below shows the return of various asset classes over the 85-year period since 1926:

Click to enlarge

3.U.S. stocks’ compounded total returns over other long periods are shown below:

January 1825–December 19251 7.3%

January 1926–December 2010 9.9%

January 1825–December 2010 8.5%

With relatively high returns stocks outperform bonds over long periods.

4.For the 40-yer period from 1971 thru 2010, the majority of the bond returns came from yields and only a small portion from capital gains. In contrast, stocks generated the most return from capital gains and only some of the returns from dividend yields.

5.Given the current low-yield environment projected to continue into the future, it would be almost impossible for bonds to generate the same amount of capital gains as they did in the past.

6.In 2010, the dividend yield on the S&P 500 was 2.03%. If stocks produce an average of even 2% in capital gains per year then the total return of stocks per year will be 4.03%. So one can expect stocks to beat bonds going forward.

7.Stocks tend to outperform bonds over long periods. However stocks are riskier assets compared to bonds even when held for very long time periods.

Source: Will Bonds Outperform Stocks over the Long Run? Not Likely” by Peng Chen, CFA of MorningStar Investment Management and Roger Ibbotson, Ph.D. of Yale School of Management and Ibbotson Associates

Related ETFs:

iShares Lehman TIPS Bond Fund (TIP)

iShares Barclays 20+Year Treasury Bond Fund (TLT)

SPDR S&P 500 ETF (SPY)

Disclosure: No Positions