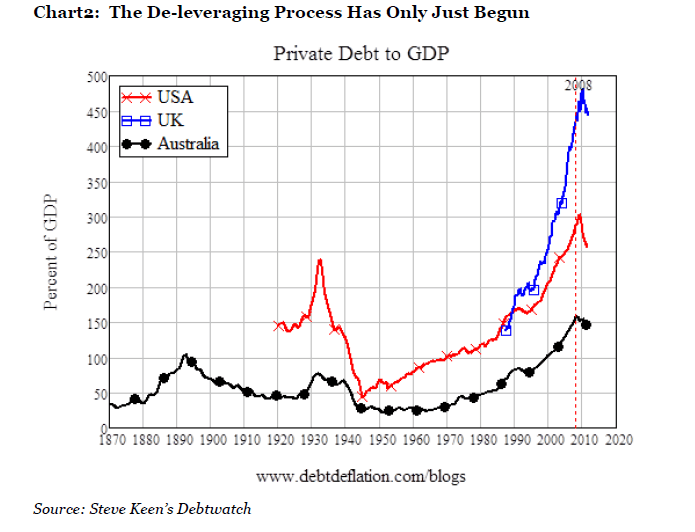

The chart below shows the private debt to GDP in the US, UK and Australia:

Click to enlarge

Source: The Absolute Return Letter February 2012, The Unlikely Bull Market

Absolute Return Partners, LLP

British households are more leveraged than households in the U.S. Private debt peaked at over 450% of GDP in 2008 in UK compared to over 300% and 150% in US and Australia respectively. While households have started the de-leveraging process after the credit crisis they still have a long way to go before reaching manageable debt levels. As consumers reduce debt consumption of goods and services is bound to suffer. Hence any recovery in the consumer-driven economies of US and UK will be modest. Accordingly investors may want to be cautious of the recent rally in global equity markets.

Related ETFs:

Disclosure: No Positions