Many countries in Europe are struggling with huge deficits. In the past few years Portugal, Ireland, Italy, Greece and Spain (PIIGS) have had severe economic issues with Greece requiring multiple bailouts to avoid a default on its debt. One of the reasons why many of the European countries are suffering with debt problems is that they pay lavish pensions to workers when they retire and also the retirement age is low in most countries. A recent article I read noted that citizens in Western Europe receive the most liberal pension and other social benefits anywhere in the world. Obviously with stagnant to no economic growth these countries cannot sustain paying these public benefits without taking on mountains of debt.

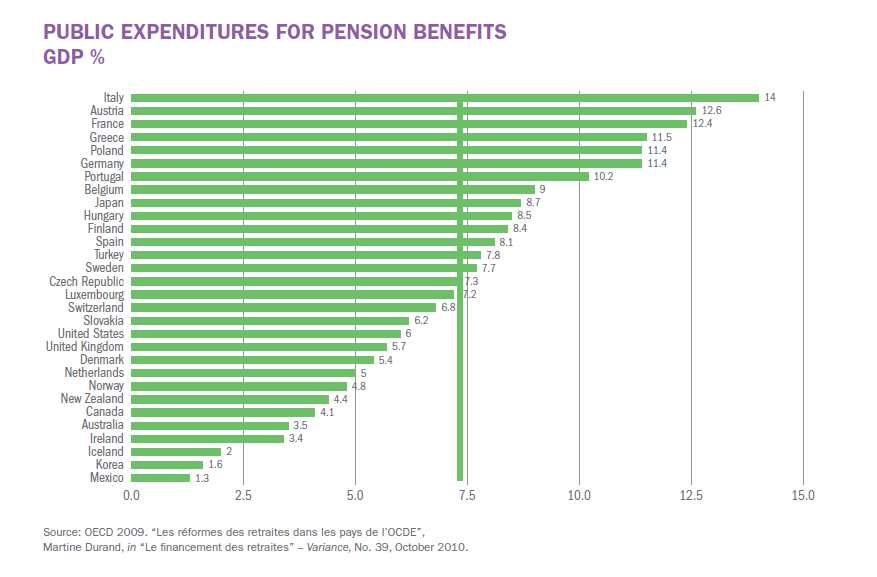

The following chart shows the public expenditures for pension benefits as a % of GDP:

Click to enlarge

Source: Retirement, AXA Financial

Italy ranks the top in this list followed by Austrian and France. Greece, Spain and Portugal also have above average public expenditures on pensions.

Some interesting facts from the AXA report:

The deterioration of the dependency ratio places a direct burden on active workers. Overall, in 1950 there were over seven active workers on average for a single retiree in the OECD (source: OECD 2009). This ratio fell to six to one in 1963 and five to one in 1976. Currently, it stands at four to one. From 2023, for one person over 65 years there will be three active-age people, and only two after 2050. Japan holds a particular record in this regard: since 2005, it has the highest rate of elderly people. Currently, those over 65 represent 22.6% of the population (source: World Population Data Sheet 2010 – Population Reference Bureau). Projections for 2050 show 1.2 active Japanese workers for each retiree, against 1.9 on average in the OECD countries.